Canadian inflation surprised to the upside in January

Canada’s inflation rate advanced slightly in January, according to the latest data from Statistics Canada. The Consumer Price Index (CPI)—which measures the cost of everyday goods and services—rose by 1.9% over the last twelve months, up from December’s 1.8% and matching analysts’ expectations. On a monthly basis, prices rose 0.1%, reversing a 0.4% drop in December.

Meanwhile, the Bank of Canada’s Core CPI—which strips out volatile categories like food and energy—showed more strength. It climbed to 2.1% YoY in the first month of 2025 (up from 1.8% the month before), although on a monthly basis it gained 0.4%, also reversing December’s 0.3% decline.

According to the press release: “In January, increased energy prices, notably for gasoline and natural gas, contributed the most to the acceleration. These price increases were partly offset by continued downward pressure on prices for products affected by the goods and services tax (GST)/harmonized sales tax (HST) break introduced in December. Prices for the food component fell 0.6% on a year-over-year basis in January, the first yearly decrease since May 2017, driven by a record decline in prices for food purchased from restaurants (-5.1%).”

Market reaction

The Canadian Dollar (CAD) remains on the defensive, prompting USD/CAD to regain some upside traction, reverse three consecutive days of losses, and reclaim the 1.4200 barrier and beyond so far on Tuesday.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.33% | 0.25% | 0.18% | 0.13% | 0.27% | 0.72% | 0.09% | |

| EUR | -0.33% | -0.09% | -0.14% | -0.20% | -0.07% | 0.39% | -0.24% | |

| GBP | -0.25% | 0.09% | -0.06% | -0.11% | 0.02% | 0.47% | -0.16% | |

| JPY | -0.18% | 0.14% | 0.06% | -0.06% | 0.07% | 0.51% | -0.11% | |

| CAD | -0.13% | 0.20% | 0.11% | 0.06% | 0.13% | 0.59% | -0.04% | |

| AUD | -0.27% | 0.07% | -0.02% | -0.07% | -0.13% | 0.45% | -0.19% | |

| NZD | -0.72% | -0.39% | -0.47% | -0.51% | -0.59% | -0.45% | -0.62% | |

| CHF | -0.09% | 0.24% | 0.16% | 0.11% | 0.04% | 0.19% | 0.62% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

This section below was published as a preview of the Canadian inflation report for January at 09:00 GMT.

- The Canadian Consumer Price Index is seen increasing 1.8% YoY in January.

- The Bank of Canada reduced its interest rate by 25 basis points in January.

- The Canadian Dollar maintains the area of yearly highs vs. the US Dollar.

This Tuesday, Statistics Canada will unveil its latest inflation report for January, based on data from the Consumer Price Index (CPI). Early forecasts suggest that headline inflation held steady at 1.8% compared with January of last year.

In addition, the Bank of Canada (BoC) is also stepping into the spotlight with its core CPI data, which cuts out the more unpredictable items like food and energy. For a bit of context: December’s core CPI dipped by 0.3% from the previous month, though it still marked a 1.8% rise from a year earlier, while headline inflation was up by 1.8% annually and dropped 0.4% on a monthly basis.

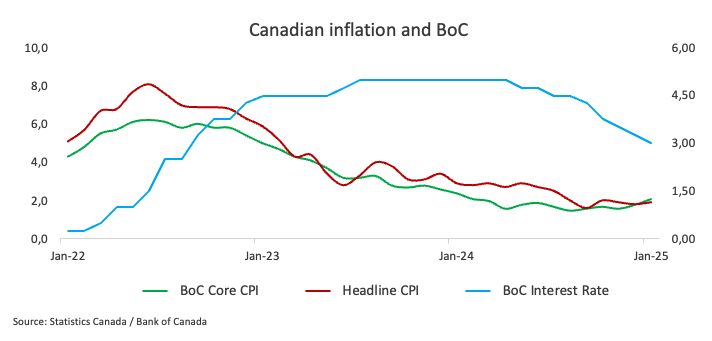

These numbers carry the potential to impact the Canadian Dollar (CAD). The BoC's approach to interest rates is key here. Since easing began in June 2024, the central bank has slashed its policy rate by 200 basis points, lowering it to 3.00% as of January 29.

Meanwhile, the CAD has been on a positive ride, steadily regaining value in the last couple of weeks. In fact, USD/CAD has dropped to two-month lows during last week, revisiting the 1.4150 region and extending its rejection from yearly peaks around the 1.4800 barrier recorded at the beginning of the month.

What can we expect from Canada’s inflation rate?

According to the meeting Minutes published on February 12, the rate cut of 25 basis points was driven by both concerns over tariff threats and a desire to bolster growth. Last month, the Bank of Canada noted that the persistent threat of tariffs was obscuring its forecasts with members admitting that predicting US trade policy was impossible.

Following the latest BoC gathering on January 29, Governor Tiff Macklem said that a significant increase in tariffs would initially push prices — and consequently inflation — up, noting that the lags in monetary policy meant there was little that could be done about that immediate effect. He explained that the key concern was to prevent that initial price surge from spreading to other prices and wages, which could lead to persistent inflation. He emphasised that while inflation was expected to rise, the focus would be on ensuring it eventually returned to 2%, as allowing a sustained increase would not be good for Canadians.

Previewing the data release, analysts at BBH note: “Canada highlight will be January CPI data Tuesday. Headline is expected at 1.9% y/y vs. 1.8% in December, core median is expected to remain steady at 2.4% y/y, and core trim is expected at 2.6% y/y vs. 2.5% in December. The GST/HST holiday (from December 14, 2024 to February 15, 2025) will pull down inflation in January, particularly in categories such as food services and semi-durable goods. The Bank of Canada projects headline and core CPI inflation to average 2.1% and 2.5% over Q1, respectively. The BoC has room to ease further, though at a more gradual pace because inflation has been around 2% since August. The market is pricing in 50 bp of easing over the next 12 months that would see the policy rate bottom at 2.50%”.

When is the Canada CPI data due and how could it affect USD/CAD?

Canada's January inflation report will be published on Tuesday at 13:30 GMT, and all eyes will be on whether the data throws any curveballs. If the numbers stick to expectations, the Bank of Canada’s current rate outlook will likely stay on track.

Meanwhile, USD/CAD has been trading in a bearish trend since the beginning of the month, dropping as low as the 1.4150 zone on February 14 — the lowest level in the last couple of months. In addition, the pair retreated for the second week in a row, shedding nearly 7 cents from year-to-date highs of around 1.4800 recorded earlier in the month.

Pablo Piovano, Senior Analyst at FXStreet, believes that despite the ongoing recovery, the Canadian Dollar should remain under pressure from US Dollar dynamics and the tariffs narrative in the medium term.

“Bullish attempts should lead USD/CAD to a potential visit to the interim 55-day SMA at 1.4305, prior to the 2025 high of 1.4792 reached on February 3,” Piovano explains.

On the downside, there’s initial support around the 2025 bottom of 1.4150 (recorded on February 14), followed by the provisional 100-day SMA at 1.4090 and the key psychological threshold of 1.4000. A breach of the latter could trigger additional selling pressure. Targets would move toward the significant 200-day SMA at 1.3816, then the November low of 1.3823, and finally the September low of 1.3418, according to Piovano.

Economic Indicator

BoC Consumer Price Index Core (YoY)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Last release: Tue Feb 18, 2025 13:30

Frequency: Monthly

Actual: 2.1%

Consensus: -

Previous: 1.8%

Source: Statistics Canada

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.