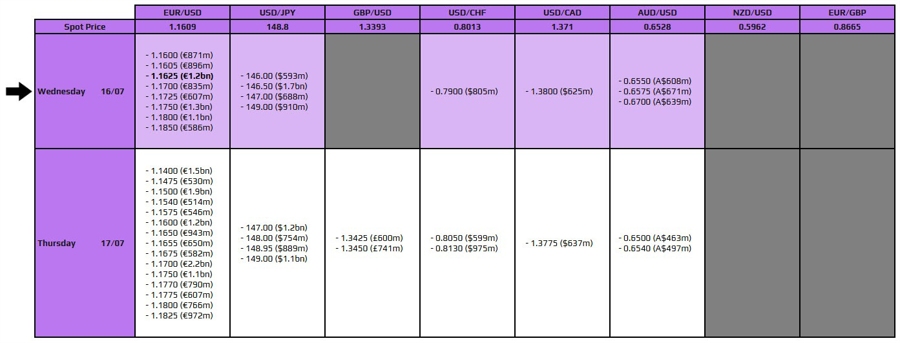

FX option expiries for 16 July 10am New York cut

There is just one to take note of on the day, as highlighted in bold.

The dollar has strengthened after the US CPI report yesterday here. At face value, the numbers appeared softer but there was already anticipation of the risk of undershooting here. Broader markets took a while to digest it but came around to the notion that there are signs of tariffs impact seeping in. And that's keeping the dollar underpinned.

Going back to the expiries, the one today will be for EUR/USD at the 1.1625 level. That doesn't tie to any technical significance and with the dollar looking to squeeze out short players, there might be further room to the downside in the short-term. As such, the expiries may not factor too much into play in the day ahead. That unless we see a slight breather in broader markets i.e. stocks and bonds as well before the next round of US data later today. But for now, the dollar is looking to be in charge just for a while.

For more information on how to use this data, you may refer to this post here.