Why Is Bitcoin Going Down? BTC Price Closes Its Worst Quarter in 7 Years

The Bitcoin (BTC) price has been on a downward trend, trading at approximately $81,481 as of Monday, March 31, 2025. This decline marks four consecutive days of losses, with the price testing monthly lows, raising concerns among investors. The Bitcoin price chart reflects this volatility, showing a 5.45% drop over the past week, aligning with broader market unease.

Bitcoin Price Is Down Today

As of this writing, one Bitcoin on the Bitstamp exchange is priced at $81,481, down 1.2% from the previous session, breaching local support levels and marking the fourth consecutive day in its depreciation streak.

The declines align with the broader sentiment currently observed in the cryptocurrency market, with other assets losing value alongside Bitcoin.

The table summarizes recent Bitcoin price movements:

Date | Price (USD) | 24h Change (%) |

March 28 | 84,379 | -3,3% |

March 29 | 82,608 | -2,1% |

March 30 | 82,359 | -0,3% |

March 31 | 81,401 | -1,2% |

Let’s examine what’s driving Bitcoin price declines.

Why Is Bitcoin Price Going Down?

A significant driver of Bitcoin's decline appears to be macroeconomic uncertainty, particularly surrounding US trade tariffs. President Donald Trump's administration has announced tariffs set to begin on April 2, 2025, targeting imports from Canada, Mexico, and China.

These tariffs, including 25% on Canadian and Mexican goods and 10% on Chinese imports, effective from February 4, 2025, with potential increases, have sparked fears of a trade war. This uncertainty has led to a risk-off sentiment, with investors shifting to safe-haven assets like gold, which has hit all-time highs.

This shift is mirrored in Bitcoin's performance, with Cointelegraph noting on March 28, 2025, that "BTC’s ongoing price drop mirrors similar declines in the broader risk-on market due to unfavorable macroeconomic conditions," particularly citing Trump's tariff announcements. The anticipation of these tariffs, dubbed "Liberation Day" by Trump, has weighed on Bitcoin, contributing to why Bitcoin is going down.

You may also like: Will Bitcoin Reach $100K Again? Latest BTC Price Prediction for 2025 Says Yes

Bitcoin Technical Indicators and Market Sentiment

Technical analysis provides further insight into Bitcoin's decline. The market value to realized value (MVRV) ratio, has converged toward its long-term average, indicating the market has exited an overheated zone. However, Yonsei Dent from CryptoQuant noted, "no definitive bottom signal has emerged yet," suggesting potential for further downside, aligning with a bearish sentiment observed in CoinCodex with a Fear & Greed Index of 26 (Fear).

Based on my technical analysis, Bitcoin failed to overcome local resistance and has entered a series of consecutive bearish days. Over the past four declining sessions, Bitcoin’s price has dropped by more than $6,000 (7%) and is testing a level of $81,287 on Monday, March 31, 2025—the lowest since March 14, marking over two weeks of decline.

The BTC price couldn’t break through $87,500, slipping not only below the 200 EMA but also below the next local support level, defined by the February 26 low of just under $82,100. As a result, Bitcoin’s price has paved the way for a potential drop below $80,000, heading toward the $78,300 level tested earlier this month.

It’s worth noting that both $78,300 (the current support) and $87,500 (the resistance Bitcoin failed to breach) align with the lower and upper boundaries of a descending regression channel, drawn from the all-time high in January. This structure, which I’ve marked in red on the chart, appears to be technically significant and could influence how BTC’s price behaves moving forward.

While I don’t currently expect a strong rebound, it’s part of my analytical duty to also mention key resistance levels. In addition to those already noted, the $92,000 level—representing lows from late 2024 that repeatedly saved the bulls from further drops—is also significant. The ultimate resistance lies around $108,000, Bitcoin’s all-time high from December 2024.

Readers also like: Will XRP Reach $10? Latest XRP Price Prediction for 2025 Says Yes

BTC's Worst Quarter Since 2018

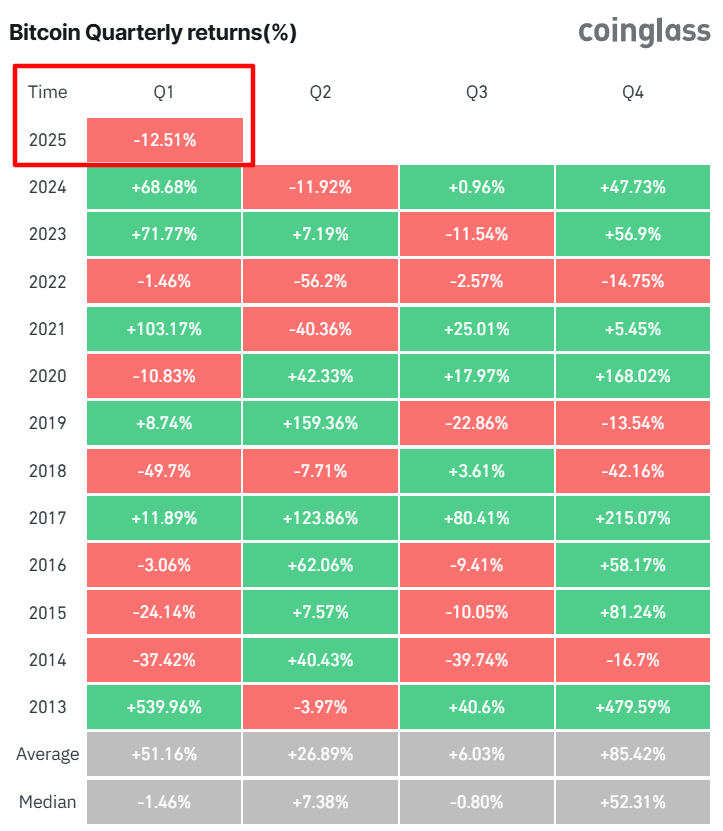

Bitcoin's Q1 2025 performance is notably weak, with a 12.5% loss, as per CoinGlass data, marking the worst first quarter since 2018.

Despite this, the correction is mild compared to historical bull market drawdowns exceeding 60%, as noted in Glassnode analysis, with this cycle being the least volatile.

This cycle continues to be the least volatile of all:

— glassnode (@glassnode) February 26, 2025

🔹2011-2013: Avg. -19.19%, Max. -49.45%

🔹2015-2017: Avg. -11.49%, Max. -36.01%

🔹2018-2021: Avg. -20.41%, Max. -62.62%https://t.co/isZhpa3caS pic.twitter.com/JfhMa5J3kv

In conclusion, Bitcoin's recent price decline is driven by macroeconomic uncertainty from US trade tariffs, technical indicators signaling correction, and a challenging Q1 2025, with a 12.7% loss. While short-term risks persist, historical resilience and upcoming events like Fed rate cuts offer potential for recovery. Investors should monitor key levels and economic developments closely.

Bitcoin News, FAQ

Why Is Bitcoin Falling Down?

A key factor is the looming uncertainty from new US trade tariffs set to take effect on April 2, 2025, which are rattling risk assets like cryptocurrencies. Investors are shifting toward safe-haven options such as gold, which has reached all-time highs, leaving Bitcoin vulnerable. Additionally, technical indicators show the price slipping below critical support levels, like the $82,100 mark from late February, and failing to break resistance at $87,500.

Will Bitcoin Rise Again?

Yes, Bitcoin has a history of rebounding from significant dips. Its resilience stems from its decentralized nature and growing adoption as a store of value, often compared to "digital gold." The current decline, driven by short-term macroeconomic fears, doesn’t erase its long-term potential. Analysts point to cycles where Bitcoin has weathered corrections—like the over 60% drawdowns in past bull markets—only to climb to new highs.

Will Bitcoin Ever Recover?

Yes. Despite closing its worst first quarter since 2018 with a 12.7% loss in Q1 2025, this correction is relatively mild compared to previous cycles. On-chain data, such as the market value to realized value (MVRV) ratio trending toward its long-term average, suggests the market is cooling off rather than collapsing. Institutional interest, though tempered by recent panic selling, remains a supportive factor, as seen in the neutral Coinbase Premium.

What Will Be the Price of Bitcoin in 2025?

Some technical forecasts, like those based on the descending channel from January’s peak, indicate a near-term test of $78,300, with resistance at $92,000 as a key hurdle. Optimistic outlooks from sources like Forbes hint at long-term growth driven by institutional adoption, potentially pushing prices higher. Conversely, prolonged economic uncertainty could keep Bitcoin suppressed below $80,000. Given these variables, a wide range—anywhere from $78,000 to over $100,000—remains plausible by the end of 2025.