XRP Trades in Range as Analysts Predict $6 by 2025 Amid SWIFT Transaction Decline

XRPUSD has been trading within a range, showing signs of market indecision. After a recent upward move, the price encountered selling pressure and pulled back. A key support level remained intact, prompting another upward push.

The cryptocurrency market has shown notable momentum, with XRP leading major digital assets. Its recent price increase is attributed to regulatory progress, rising institutional interest, and technical developments. These factors have brought XRP close to previous highs. Technical analysis suggests the price could continue rising, potentially surpassing six dollars by this year.

SWIFT Volumes Drop 15%, Structural Shift

Recently, SWIFT reported a 15% decline in transaction volumes. Official statements link this drop to broader macroeconomic and geopolitical factors. However, some analysts suggest deeper structural changes may be contributing. Legal measures such as the Genius Act and Clarity Act are cited as facilitating a gradual shift away from traditional financial systems.

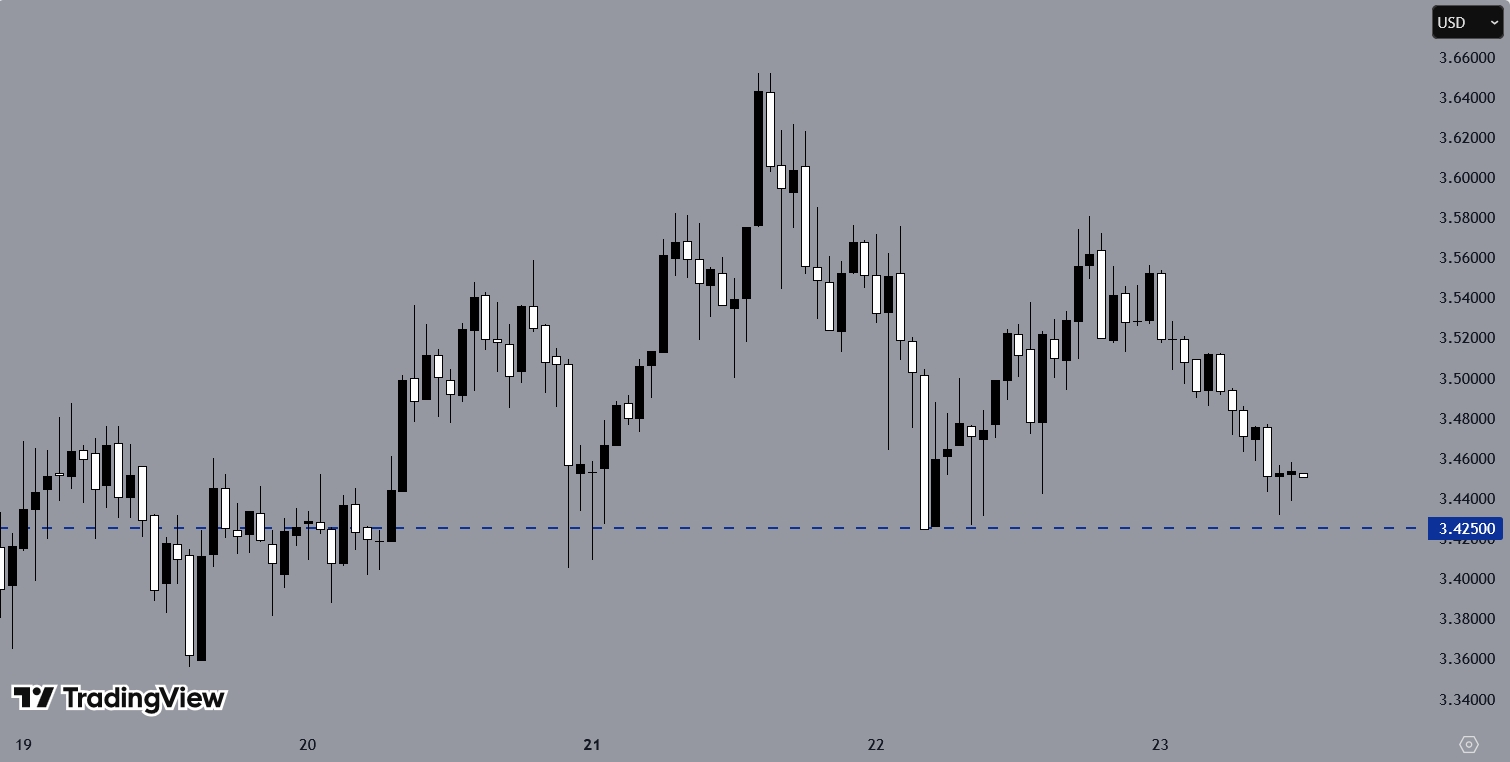

XRP Faces Resistance Near 3.65

From a technical perspective, XRPUSD reached resistance near 3.65000 before experiencing a bearish pullback. Support at 3.42500 held firm, triggering a rebound to the upside. The price then faced rejection around 3.57000 and is currently undergoing another bearish correction. Traders are closely watching price action around this resistance level to determine the next direction, whether a breakout or further consolidation.

🚨BREAKING: SWIFT Sees 15% Drop in Transactions as #XRP Ledger Activity Surges!

— JackTheRippler ©️ (@RippleXrpie) July 19, 2025

💥The Outdated System Is Coming To An End💥 pic.twitter.com/XSZ8CbQ5b5

You may find it interesting at FinanceMagnates.com: XRP and Ether Lead Crypto Rally as Market Cap Hits $4 Trillion After GENIUS Act Approval.

XRPL Gains Institutional Interest, $118M Assets

Meanwhile, the XRP Ledger (XRPL) continues to attract institutional interest, with over $118 million in tokenized real-world assets recorded on the network. Observers highlight XRP’s neutral status and technical efficiency as factors appealing to institutions seeking alternatives for cross-border payments. Rather than being fully replaced, SWIFT may integrate blockchain-based technologies, including Ripple’s protocols, over time.

Although no official confirmation exists, regulatory alignment and an increase in pilot projects suggest blockchain infrastructure could play a growing role in future international financial settlements.