XRP Trades in Range as Ripple-SEC Case Paused for 60 Days Following Joint Request

The legal dispute between Ripple and the US Securities and Exchange Commission (SEC) has taken another turn. The US Court of Appeals has agreed to pause the case for 60 days following a joint request from both parties.

This development has sparked speculation about possible behind-the-scenes discussions that could lead to a shift in legal strategy. Crypto lawyers suggest the pause may signal significant developments, possibly involving a settlement or a legal ruling that could change Ripple’s ability to operate.

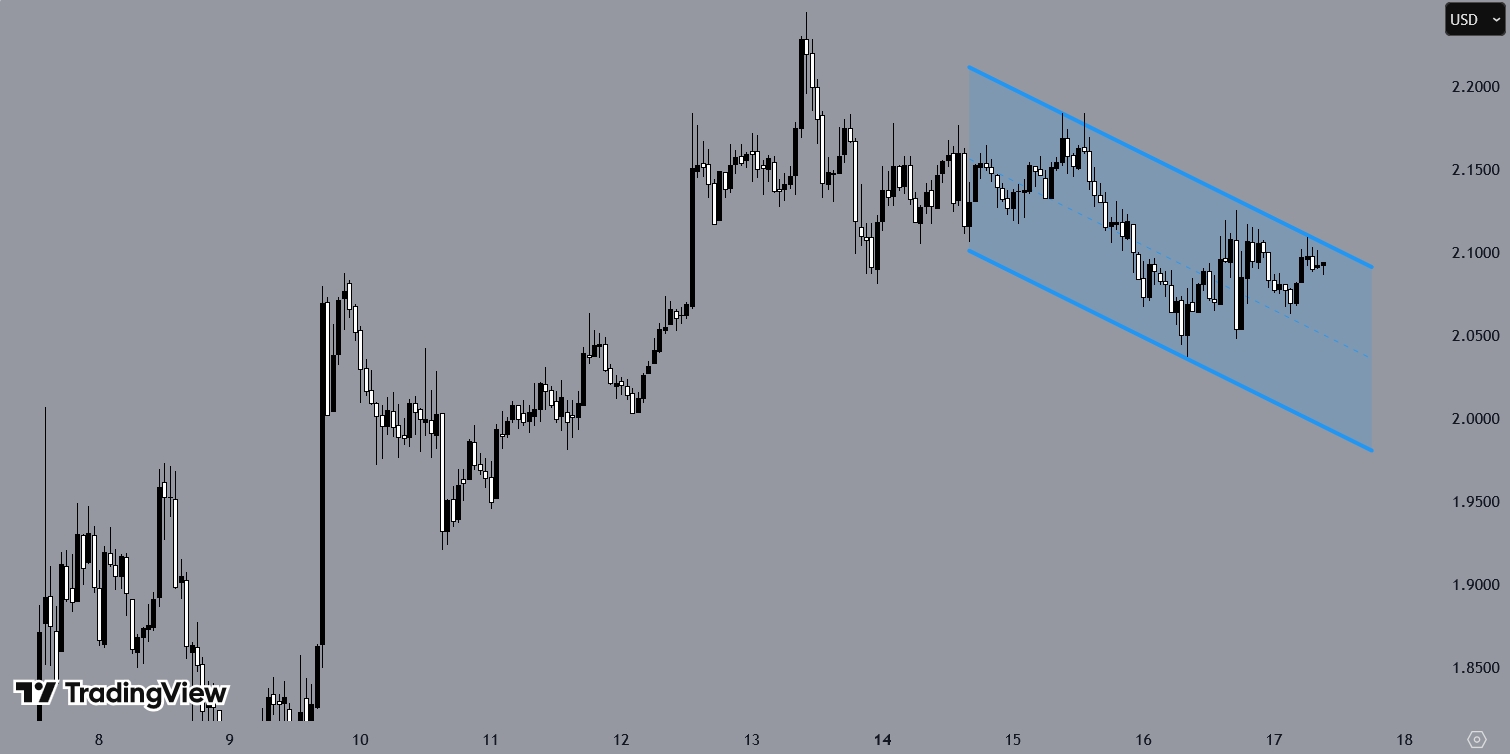

Meanwhile, XRP is trading within a mildly bearish equidistant channel. The price action reflects uncertainty among traders, with no clear directional bias emerging.

Ripple’s IPO Plans Face Legal Delay

The joint request likely indicates that Ripple and the SEC are working together on a resolution. One option could be a settlement, while another could involve an “indicative ruling” from Judge Analisa Torres.

The appeal in the SEC vs. Ripple case is now officially paused (held in abeyance), which directly affects the ongoing legal uncertainty surrounding $XRP.

— ꪑỉᨶꫝꪖꫀꪶ ꪖꪹꪶỉ᭢ (@mrcauliman) April 16, 2025

• Both sides, the SEC and Ripple, jointly requested to pause the appeal.

• The court approved this joint motion.

• The… pic.twitter.com/M97FuVmW4Q

Ripple is currently restricted from selling its tokens in private markets due to earlier legal violations. The company hopes the judge will allow these private sales under certain conditions. If this restriction remains, Ripple may not be able to go public, even as other crypto firms proceed with IPOs. This could delay Ripple’s plans by several years.

You may want to read it at FinanceMagnates.com: Breaking: Ripple Acquires Hidden Road for $1.25 Billion, Becomes First Crypto Company with Multi-Asset Prime Broker.

No Deal Could Extend Ripple Dispute

There are two possible outcomes. In the first, Ripple and the SEC reach a settlement, but the SEC does not support changing the current rules. In this case, Ripple would still need the court’s approval for a rule change, which could take another three to six months with no guarantee of success.

In the second outcome, the SEC agrees to both a settlement and the proposed rule change. The case would then return to Judge Torres, who would decide how to proceed. Even in this scenario, the timeline would depend on how quickly the court acts.

As Coinpedia reported, if a full agreement is reached, the legal appeal could be dismissed as early as next month. However, if Ripple needs to file separately for the rule change, the process could extend further. If no agreement is reached at all, the case might return to the appeals court, potentially prolonging the dispute until 2026 or 2027. The SEC is expected to make its next move by June 15. Until then, the case remains paused.