What are the main events for today?

In the European session we don't have much on the agenda other than a couple of low tier releases. As it's usually the case, most of the action will be in the American session when we get the US Retail Sales, the US import prices and the US Industrial Production and Capacity Utilization data.

13:30 GMT/08:30 ET - US January Retail Sales

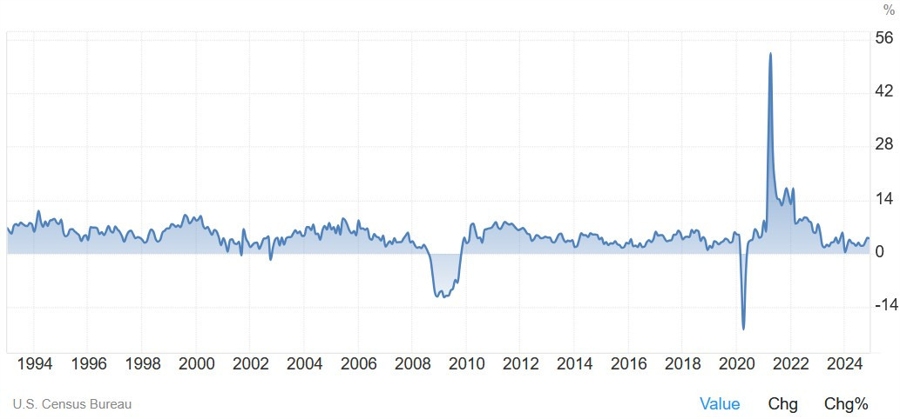

The US Retail Sales M/M is expected at -0.1% vs. 0.4% prior, while the ex-Autos figure is seen at 0.3% vs. 0.4% prior. The focus will be on the Control Group figure which is expected at 0.3% vs. 0.7% prior.

Consumer spending has been stable which is something you would expect given the positive real wage growth and resilient labour market. More recently, we’ve been seeing some easing in consumer sentiment though which might also lead to some softening in consumer spending.

If the data indeed softens, it shouldn’t be worrying just yet but should help alleviate further some inflation worries and keep the market pricing around two rate cuts in 2025.

Central bank speakers:

- 20:00 GMT/15:00 ET - Fed's Logan (neutral - non voter)