This Analyst Sees XRP Potentially Moving to $15: Futures Volume Hits Record $235M on CME

XRP has been trading near the psychological level of $3. Recent movements suggest the cryptocurrency is undergoing a bullish correction. A sustained push above this level may lead to further gains, depending on market conditions.

Meanwhile, daily trading volume of XRP futures on the Chicago Mercantile Exchange reached a record $235 million. This marks the highest level since the launch of the product in May. Combined notional volume for standard and micro contracts has now exceeded $1.6 billion.

Price Forecasts and Risks

Analyst Austin Hilton has projected that if XRP breaks through $3, it may target its previous all-time high of $3.84. He suggests the price could reach $5 by the end of 2025. Some outlooks include even higher targets, such as $10 or $15, though these depend on broader market momentum. At the same time, a pullback to the $2.55–$2.60 range remains possible.

XRP Price Prediction!

— Austin Hilton (@austinahilton) July 13, 2025

What Is Going To Happen To XRP This Week?

Where Will XRP End Up In Price By The End Of 2025?! pic.twitter.com/xpa0xST2Fb

Growing Institutional Interest

The increase in volume reflects rising institutional interest in regulated crypto derivatives. CME’s XRP futures allow investors to gain exposure to XRP price movements without holding the asset directly. This structure suits firms that face restrictions on owning cryptocurrencies.

BREAKING 🚨

— Fabio Zuccara (@ZuccaraFabio) July 16, 2025

XRP Futures Smash $235M in One Day on CME—$1.6B Volume Signals Escalating Demand

Read more 👇🏼 pic.twitter.com/ZTEP1HWayE

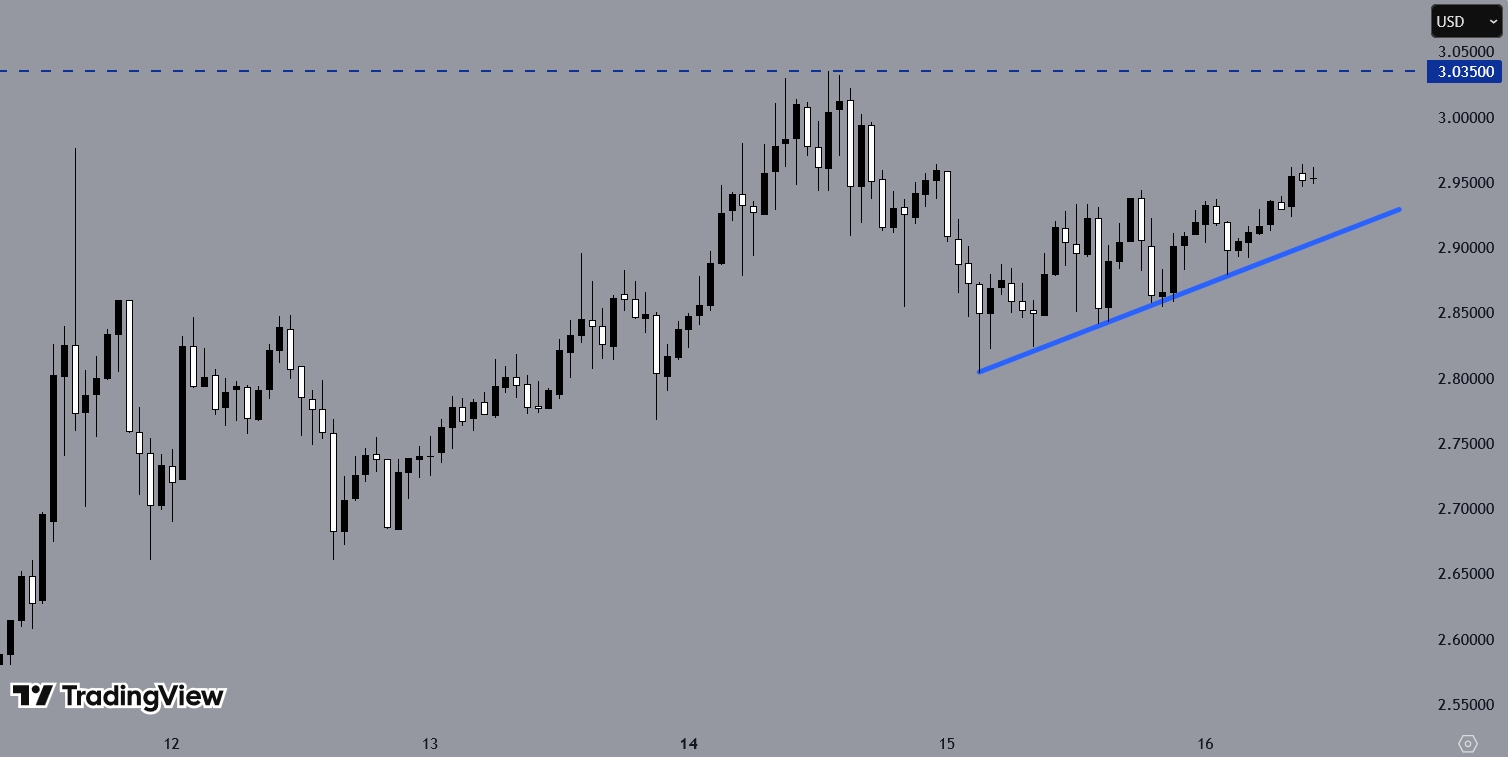

Price Tracks Trend Line on H1 Chart

The XRPUSD H1 chart shows a gradual upward movement following a clear trend line. The recent high of 3.03500 may serve as a resistance level.

A breakout above this point could attract more buyers and drive the price higher with strong momentum. Conversely, if the price falls below the trend line, it may enter a consolidation phase and trade within a range for some time.

You may find it interesting at FinanceMagnates.com: XRP Nears $3: Grayscale Challenges SEC Over Paused Multi-Crypto ETF.

Ripple Seeks National Trust Charter Approval

Ripple has applied for a national trust charter from the U.S. Office of the Comptroller of the Currency, seeking to expand its services under federal regulation. This move aligns with a broader industry trend, as other crypto firms like Circle pursue similar applications for national oversight.

If approved, Ripple would operate under both state and federal supervision, which would help streamline compliance and service delivery across the country. The firm currently offers RLUSD, a $470 million stablecoin regulated by the New York Department of Financial Services.