Tom Lee Called Bitcoin's Peak In 2024 And Just Made Another Bold 2,400% BTC Price Prediction

Bitcoin (BTC) analysis reveals a market poised for explosive growth, with Wall Street's most accurate crypto forecaster backing astronomical targets that dwarf previous BTC price predictions.

Tom Lee of Fundstrat is confident that Bitcoin's price will double by the end of this year, and in the long term, he believes it could surpass $1 million, potentially reaching as high as $3 million

Bitcoin Price Today: Digital Gold Narrative Strengthens

Bitcoin price today reflects growing institutional confidence, with the world's largest cryptocurrency maintaining near the all-time high around $120,000. The digital asset has demonstrated remarkable resilience during the current consolidation, building a solid foundation for the next explosive move higher.

As of today, Wednesday, July 23, 2025, Bitcoin is trading at $118,500, down a modest 1.2%.

Recent market dynamics show Bitcoin responding favorably to global liquidity expansion and dovish Federal Reserve expectations. During a recent interview on CNBC’s Squawk Box, Lee emphasizes that Bitcoin is "responding to global liquidity, which is currently moving up" as markets anticipate rate cuts in the coming months.

The cryptocurrency's performance continues outpacing traditional assets, with institutional investors increasingly viewing Bitcoin as digital gold that deserves premium valuations compared to physical precious metals.

Tom Lee's Revolutionary $3M Bitcoin Price Prediction

The Supply-Demand Mathematics Behind $3 Million

Fundstrat's Tom Lee unveiled his most aggressive Bitcoin prediction during a recent CNBC appearance, suggesting the cryptocurrency could reach $2.5 million to $3 million in the long term. His reasoning centers on a fundamental supply-demand imbalance that creates unprecedented upside potential.

"I think, at a minimum, it should have the same network value as gold... But I think Bitcoin is more valuable than gold. Bitcoin could be $2 million, $3 million long term, I mean even higher," Lee stated during the interview.

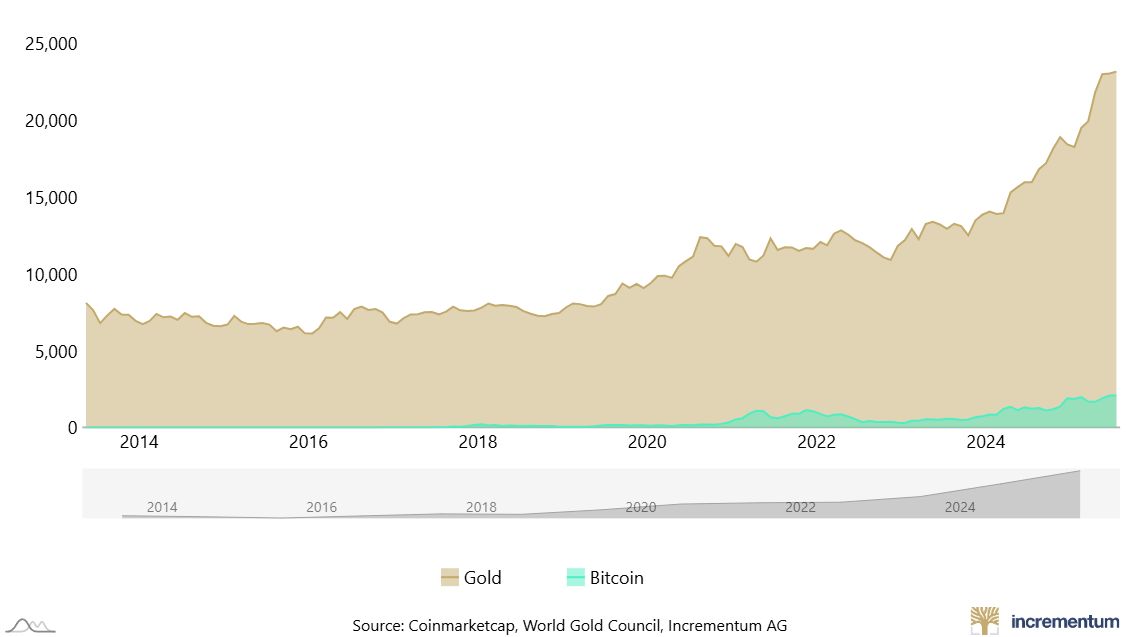

The mathematics supporting Lee's projection are compelling. Gold currently represents approximately $20 trillion in above-ground value, while Bitcoin's market capitalization sits at roughly $2 trillion. If Bitcoin captures even a fraction of gold's market share, the price implications become staggering.

I recently wrote about extremely bullish forecasts from Mike Novogratz, who predicts that Bitcoin could climb to $1 million. Around the same time, popular author Ric Edelman suggested that BTC may soon reach $500,000.

95% Mined, 95% Unowned: The Perfect Storm

Lee's bullish thesis relies heavily on Bitwise research highlighting a critical supply-demand imbalance. While 95% of all Bitcoin has already been mined, only approximately 5% of the global population actually owns the cryptocurrency.

"So, I just think that there's still a huge demand versus supply imbalance, meaning there's a lot more potential buyers of Bitcoin over the next ten years," Lee explained.

JUST IN: 🇺🇸 $12 billion Bitwise CEO Hunter Horsley says, “#Bitcoin is by far the scarcest store of value in the world today.” 🙌 pic.twitter.com/A65VNrOfSK

— Bitcoin Magazine (@BitcoinMagazine) May 5, 2025

This scarcity dynamic creates what Lee describes as exponential growth potential as mainstream adoption accelerates. With nearly all Bitcoin already in circulation but minimal global ownership penetration, the stage is set for massive price appreciation as demand outstrips available supply.

$250K Bitcoin Price Target Still Intact for 2025

Short-Term Catalysts Support Aggressive Year-End Targets

Despite his astronomical long-term projections, Lee remains firmly committed to his $250,000 Bitcoin price target for 2025. During the CNBC interview, he confirmed that "the $200,000 to $250,000 for Bitcoin still makes sense" given current market dynamics.

This near-term target would value Bitcoin at approximately 25% of gold's current market size, which Lee considers conservative given Bitcoin's superior monetary properties. The projection implies potential gains of over 100% from current levels before year-end.

🚀 Tom Lee Predicts $250K Bitcoin ( $BTC ): Is It Achievable? 💰https://t.co/2mgxDU8ITx

— WallStreetholic (@WStreetholics) December 12, 2024

Tom Lee of Fundstrat has made waves with his bold prediction of Bitcoin ($BTC) reaching a staggering $250,000. His forecast is rooted in emerging government-friendly initiatives that could…

You may also like: Kiyosaki Predicts Bitcoin at $1 Million by 2030 as Economic Crisis Looms. How High Can BTC Price Go?

Why Lee's Track Record Demands Attention

From $5,000 to Vindication: Lee's Legendary Calls

Tom Lee's Bitcoin predictions carry exceptional weight given his remarkable forecasting accuracy. In 2019, he urged CNBC viewers to allocate 1-2% of portfolios to Bitcoin when it traded near $5,000, only to face ridicule from skeptical hosts.

His conviction proved prophetic as Bitcoin subsequently soared over 2,000% to current levels, vindicating his early institutional adoption thesis. This track record establishes Lee as Wall Street's most credible Bitcoin analyst.

Technical Analysis Supports Bullish Bitcoin Projections

Market Structure Remains Constructive

Bitcoin's current price action supports Lee's optimistic projections, with the cryptocurrency maintaining strong technical momentum above key support levels. The digital asset continues benefiting from institutional ETF inflows and corporate treasury adoption.

Recent consolidation below $120,000 has created a solid foundation for the next leg higher, with technical indicators suggesting underlying accumulation by sophisticated investors. This price behavior aligns with Lee's expectation of sustained upward pressure.

Bitcoin Bullish Flag and Fibo Extensions Suggest New ATH

My technical analysis suggests that Bitcoin has successfully broken out of a flag pattern that formed from the April lows through the first half of July. This breakout indicates that Bitcoin now has room to breach the current resistance at $120,000 and move to significantly higher levels. The current consolidation is finding support around the $116,000 area, and even if that level is broken, there remains strong support near $112,000, reinforced by the 50-day EMA and the previous all-time high from May.

I would only take a bearish view on the Bitcoin chart if the price tests the psychologically important $100,000 level, which now aligns with the 200-day EMA.

Moreover, as I noted in my earlier analyses, Fibonacci extensions measured on the uptrend from April to May, followed by the June correction, suggest that Bitcoin’s price could continue rising toward the 161.8% extension levels, potentially reaching as high as $160,000.

Below you can find also my previous crypto predictions article for other popular tokens:

- Why Is Dogecoin Going Up Today? DOGE Price Predictions Eye Test of 5 Month Highs

- XRP Technical Analysis Points to XRP Price Predictions Surpassing $6 in 2025

- The Newest Ethereum Price Prediction Shows ETH Could Hit $15K in 2025

Why Is Bitcoin Price Going Up?

Federal Reserve Policy Creating Perfect Backdrop

Lee identifies Federal Reserve dovishness as a primary catalyst for Bitcoin's continued ascent. With the federal funds rate currently at 4.25%-4.50% and two rate cuts expected this year, liquidity conditions favor risk assets including Bitcoin.

Market participants are positioning for increased monetary accommodation, which historically benefits Bitcoin as investors seek alternatives to depreciating fiat currencies. Lee's analysis suggests this macroeconomic backdrop supports aggressive Bitcoin targets throughout 2025.

The Stablecoin Revolution Supporting Bitcoin Adoption

Lee identifies the stablecoin boom as a crucial catalyst for Bitcoin adoption, describing it as "the ChatGPT moment for crypto" due to rapid business and consumer adoption. Major financial institutions including JPMorgan and Citibank are entering the stablecoin market, legitimizing the broader cryptocurrency ecosystem.

This institutional validation creates positive spillover effects for Bitcoin, as regulatory clarity and mainstream acceptance reduce barriers to crypto investment. Lee views this trend as exponential growth for the entire digital asset space.

Global Liquidity Trends Favor Risk Assets

Lee emphasizes that Bitcoin's price action reflects broader global liquidity trends, which currently favor risk assets over traditional safe havens. As central banks maintain accommodative policies, capital flows increasingly target assets with finite supply characteristics like Bitcoin.

This macroeconomic environment creates ideal conditions for Lee's aggressive price targets, as investors seek protection against currency debasement and inflation concerns.

Investment Implications of Lee's $3M Target

Strategic Asset Allocation Considerations

Lee's $3 million Bitcoin projection carries profound implications for portfolio construction and strategic asset allocation. If even partially accurate, early positioning in Bitcoin could generate life-changing returns for long-term investors.

The Fundstrat strategist's analysis suggests Bitcoin deserves significant portfolio allocation as digital transformation accelerates and monetary policies remain accommodative globally. His firm conviction in the $250,000 near-term target provides tactical trading opportunities alongside strategic positioning.

Risk Management in Context of Explosive Targets

While Lee's projections appear aggressive, his systematic approach to Bitcoin valuation provides rational justification for extreme price targets. The supply-demand imbalance combined with institutional adoption trends creates conditions for exponential price appreciation.

Investors should consider position sizing appropriate to their risk tolerance while recognizing the asymmetric return potential that Lee's analysis suggests. The combination of limited supply and expanding demand creates unique investment dynamics rarely seen in traditional markets.

Bitcoin price analysis reveals a cryptocurrency positioned for potentially explosive growth as institutional adoption accelerates and supply constraints tighten. Tom Lee's $3 million long-term target, backed by rigorous fundamental analysis and proven forecasting accuracy, represents one of Wall Street's most compelling investment theses.

The convergence of supply scarcity, institutional adoption, accommodative monetary policy, and technical momentum creates conditions that support Lee's aggressive projections. As Bitcoin continues demonstrating its digital gold credentials, investors may witness one of the most remarkable asset price appreciations in financial history.