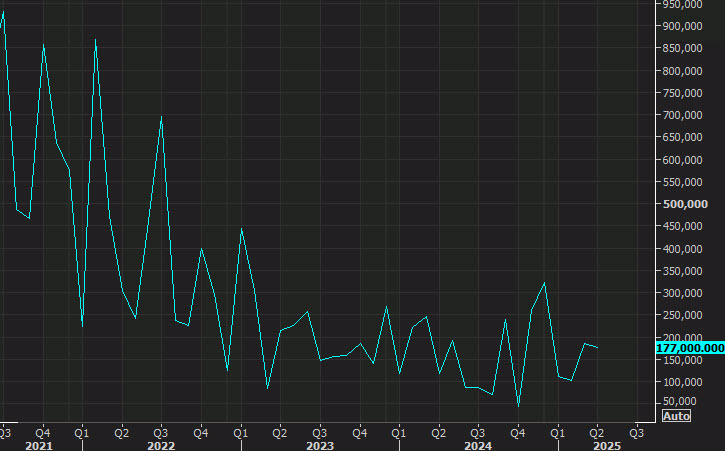

US April non-farm payrolls +139K vs +130K expected

- Prior was +177K (revised to +147K)

- Two-month net revision: -95K versus -58K prior

- Unemployment rate: 4.2% versus 4.2% expected

- Prior unemployment rate: 4.2%

- Unrounded unemployment rate: 4.244% versus 4.1872% prior --highest unrounded print since October 2021

- Participation rate: 62.4% versus 62.6% prior

- Average hourly earnings (m/m): +0.4% versus +0.3% expected and +0.2% prior

- Average hourly earnings (y/y): +3.9% versus +3.7% expected and +3.8% prior

- Average weekly hours: versus 34.3 expected and 34.3 prior

- Change in private payrolls: +140K versus +120K expected and +167K prior (revised to +146K)

- Change in manufacturing payrolls: versus -5K expected and -1K prior

- Government jobs: -1K versus +10K prior

- Full-time jobs: -623K versus +305K prior

- Part-time jobs: versus +33K +56K prior

- Household survey -696K vs +436K prior

USD/JPY was trading at 144.26 just ahead of the data and the market was pricing in 80 bps in easing in the year ahead, which is at 79 bps afterwards.

There was a slight hawkish reaction to the data which I would classify more as a 'sigh of relief' that jobs were better than ADP. With the revisions, it was slightly less than expected and also note falling labor force participation; if not for that the unemployment rate would have risen further. There is also an argument that the revisions tell you more about the economy than the headlines, and the revisions weren't great for the second month, the household survey was also poor (though it's volatile).

Note the composition as well:

Healthcare: +62,000 jobs (hospitals +30,000, ambulatory care +29,000, nursing facilities +6,000).

Leisure & hospitality: +48,000 jobs (mostly food/drinking places +30,000).

Social assistance: +16,000 jobs.

Federal government: -22,000 jobs (down 59,000 since January).

The government job losses are a solid sign that the private sector is doing better but healtcare is government-adjacent and the rest of the jobs aren't high quality.