Will XRP’s Path to $10 Be Too Late as Trump’s Tariff Warning Fuel Market Volatility?

Crypto assets, including bitcoin, XRP, and solana, saw renewed volatility after former US President Donald Trump warned of more tariffs. He said these would be imposed if countries collaborated to harm the U.S. economy.

Trump posted on Truth Social early Thursday, stating that if the European Union coordinated with Canada for economic harm, the US would impose “large-scale tariffs.” He added that these tariffs would be higher than those already planned, Coindesk reported.

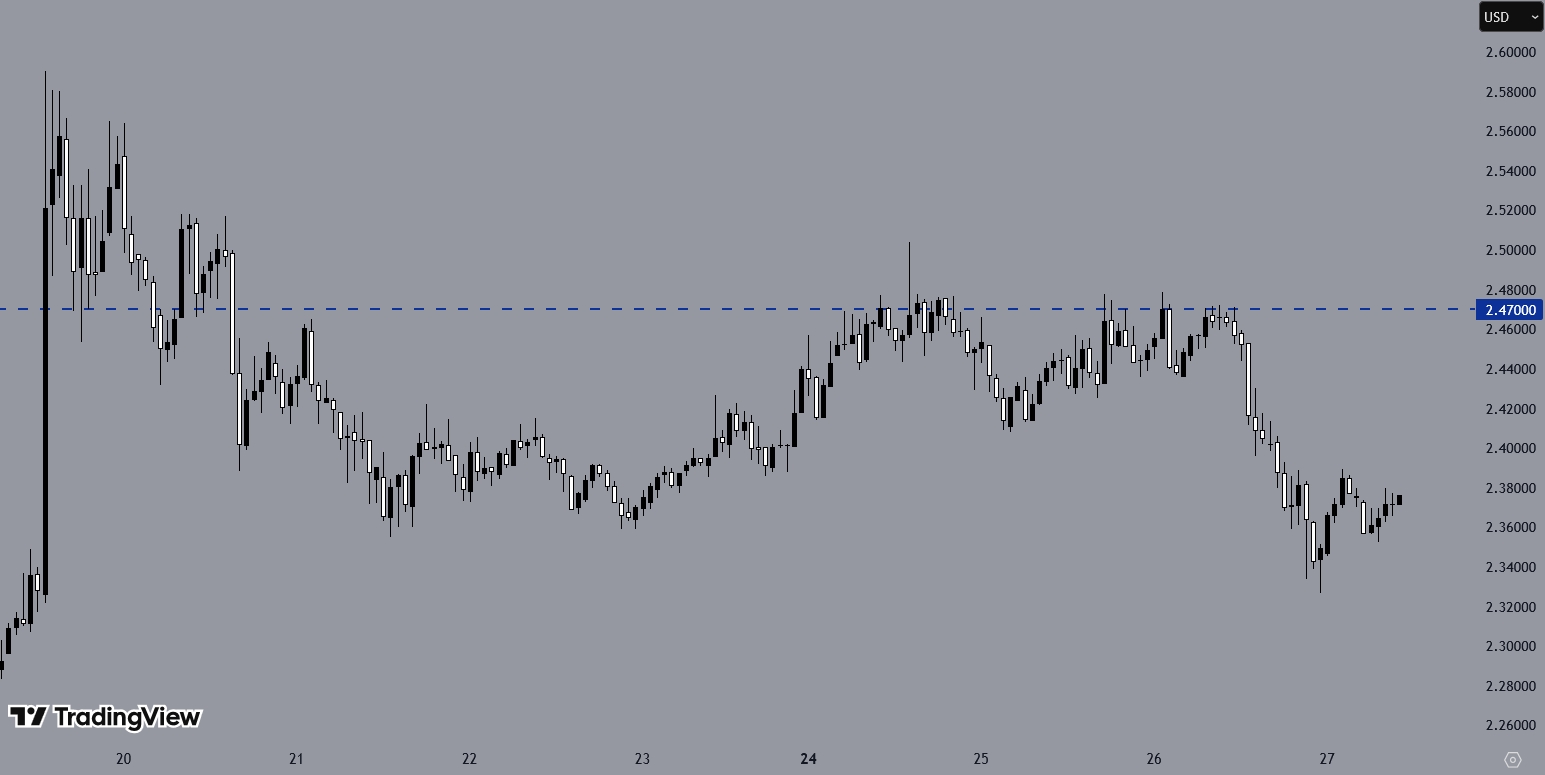

The broader market uncertainty has affected individual cryptocurrencies. Investors are assessing whether XRP’s price could reach $10, particularly following the SEC’s decision to drop its lawsuit against Ripple Labs and the growing adoption of Ripple’s RLUSD stablecoin. However, XRP has declined since yesterday, possibly in response to concerns over new tariffs and their potential market impact.

Trump Defends Tariffs Amid Economic Concerns

In another post, Trump wrote that the US had been “ripped off” by many countries for years but that those days were ending. He emphasized an "America First" stance.

His comments followed reports suggesting that concerns over tariffs were exaggerated and their impact would be more moderate than expected.

Earlier in the month, Trump had implemented 25% tariffs on imports from Canada and Mexico. He also imposed a 20% tariff on Chinese goods. He justified these measures by citing national security concerns related to immigration and fentanyl trafficking.

New Tariffs Could Disrupt Global Supply Chains

The latest warning suggests further economic tensions with the EU and Canada. Markets could react with caution as new trade barriers could affect global supply chains. Tariffs tend to raise import costs, push inflation higher, and influence central bank decisions. The Federal Reserve could face more pressure to tighten monetary policy.

Crypto Market Declines Amid Tariff Uncertainty

For cryptocurrencies, increased trade uncertainty may pose short-term risks. Crypto markets often follow equities, which tend to decline in uncertain economic conditions. A stronger US dollar, supported by capital inflows due to tariffs, could further weigh on BTC and other tokens as investors shift to safer assets.

Following Trump’s statements, the crypto market saw a brief downturn during Asian trading hours. XRP and SOL fell by 2%, while ether (ETH) and BNB Chain’s BNB remained mostly unchanged. Dogecoin (DOGE) lost earlier gains from a 3.5% increase over the past 24 hours.