Bitcoin Dips From $123K Peak amid Dormant Satoshi Era Whale Moving 80K BTC to Galaxy Digital

Bitcoin experienced moderate volatility this week. The price briefly dipped before recovering. Analysts say the market absorbed large transactions without major disruption. They view this as a sign of deeper liquidity and stronger institutional involvement.

Meanwhile, a long-dormant Bitcoin wallet, inactive since 2011 and considered a Satoshi-era whale, moved a significant amount of coins. The wallet held about 80,000 BTC, mined over a decade ago. The full amount has now been transferred to wallets linked to Galaxy Digital, Bitcoin.com reported.

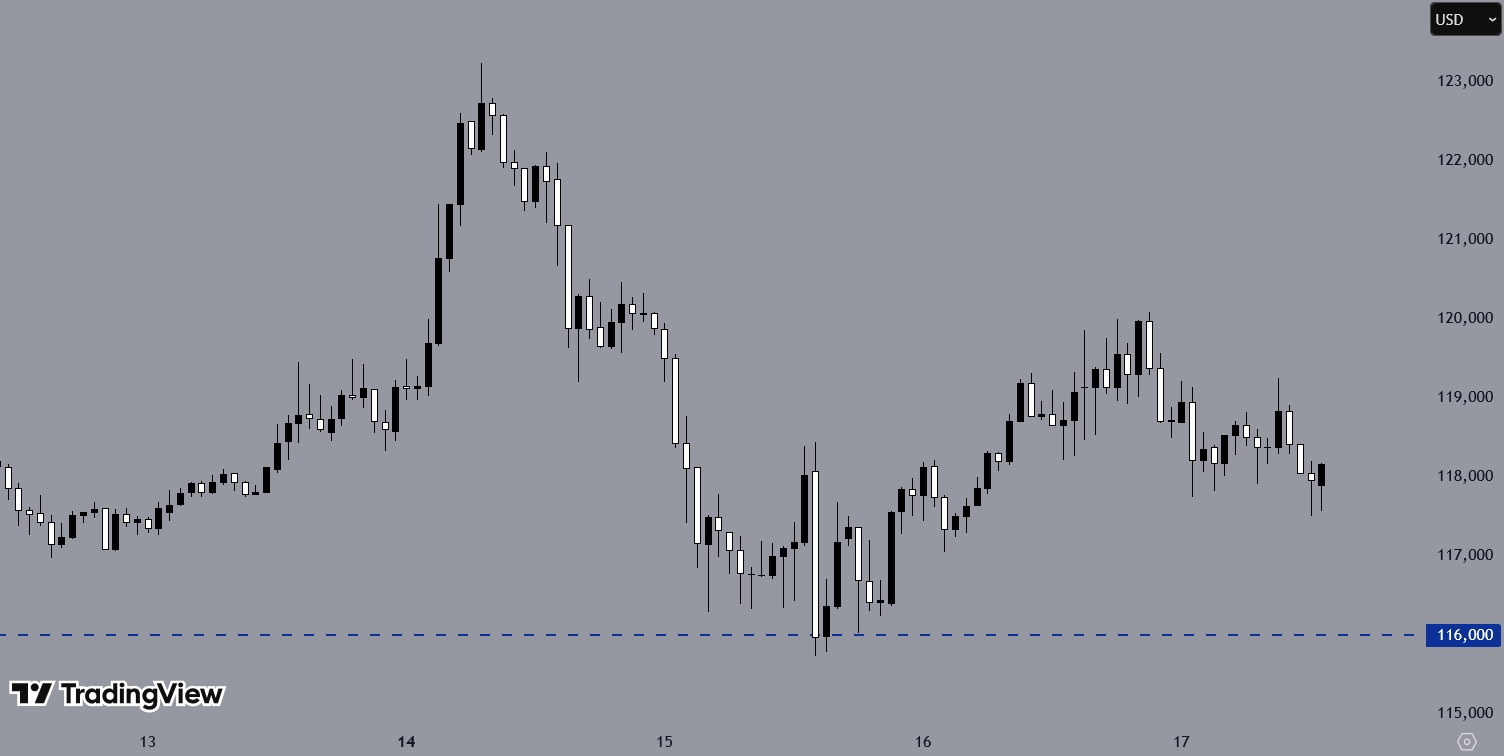

Bitcoin Eyes Support Near $116K

After reaching an all-time high of $123,000, Bitcoin began a bearish correction. The price found support around $116,000 and rebounded, moving upward. However, current momentum suggests the cryptocurrency may struggle to sustain a continued bullish trend. At the time of writing, Bitcoin is trading near $118,000.

The price could revisit the recent swing low at $116,000. If a bullish reversal pattern forms, it may attract intraday buyers and push the price back toward the $123,000 high.

You may find it interesting at FinanceMagnates.com: Bitcoin Smashes Through $120,000 Barrier Today as Bitwise’s BTC Price Prediction Eyes $200,000.

Dormant Satoshi-Era Whale Moves 80,000 BTC Quietly

The transfers began on July 4, when the whale divided the holdings into several new wallets. Ten days later, the coins were moved again in two large batches to Galaxy Digital.

🚨Big Whale, who holds 80K #Bitcoin, split 40K #BTC into two separate wallets yesterday, each holding 20K BTC. The sale of all 40K Bitcoin to #GalaxyDigital was completed immediately. There's still a remaining 40K BTC in four separate wallets, totaling 10K. I'll share it if… pic.twitter.com/Iy2gcx1c3J

— The Crypto GEMs (@CryptoGemsCom) July 15, 2025

Some early transactions included small amounts. After the initial transfers, the rest of the coins were sent in transactions of varying sizes. Only a small amount remains unspent. On-chain data confirms that the full 80,000 BTC has been moved.

Observers believe the transfers were planned and targeted. The structure and timing suggest the funds were not sold on open markets. Instead, they may have been moved for custody, lending, or over-the-counter purposes. The high Bitcoin price and growing institutional demand may have influenced this decision.