XRP Trades Above $3 as Analyst Sees Support but Warns of Short-Term Pullback

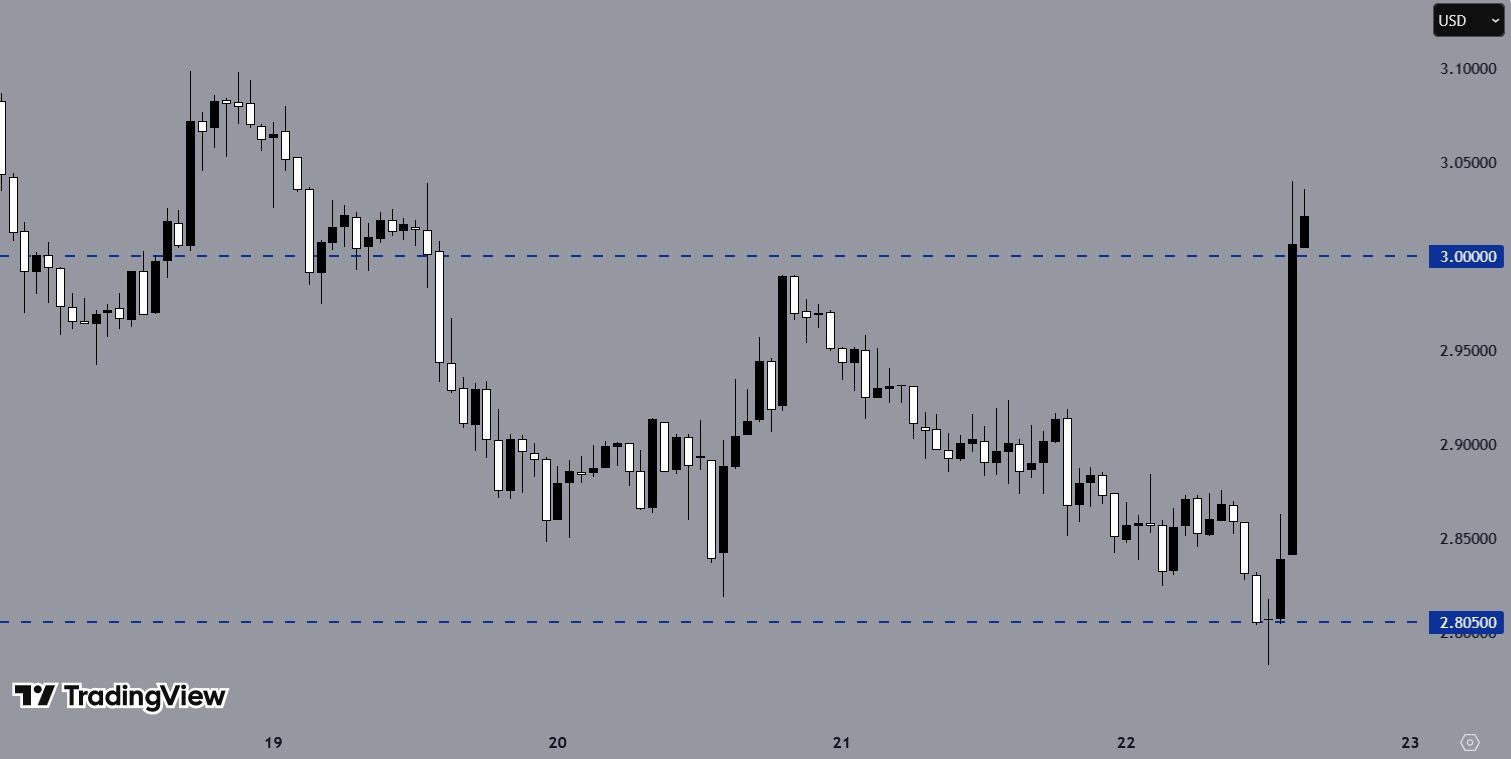

XRP recently failed to break a key resistance level, with analysts pointing to possible short-term weakness under broader market pressures. Despite this, the asset is holding firm support, suggesting medium-term stability. On the hourly chart, XRPUSD has rebounded from support and is trading above $3, showing signs of further upside.

Analyst Update

According to a recent technical analysis on the YouTube channel Cilinix Crypto, XRP is expected to move within the $2.50 to $3.40 range. The token tested resistance between $3.30 and $3.40 but failed to break higher. Momentum into the level was strong but insufficient to confirm a breakout.

Short-Term Outlook

The analyst highlighted broader market fundamentals, including expected remarks from Federal Reserve Chair Jerome Powell, as potential pressure points.

You may find it interesting at FinanceMagnates.com: BTC and ETH “Likely to Trade in Ranges,” Analyst Says as Futures Leverage Remains High.

XRP could test support around $2.70, with a deeper drop to $2.50–$2.60 possible in a worst-case scenario.

Medium-Term View

Despite short-term risks, XRP is holding major support levels on higher timeframes, indicating potential stability. A dovish signal from the Federal Reserve could lift sentiment and trigger a rebound toward $3.15.

After short-term volatility, XRP is expected to enter a period of consolidation, maintaining stability in the medium term.

SEC Extends Review of XRP ETFs

Meanwhile, the US Securities and Exchange Commission has extended its review of several proposed XRP exchange-traded funds, including applications from CoinShares, 21Shares, Canary Capital, and Grayscale.

The SEC had previously postponed these filings, citing the need for additional assessment. The delays follow a broader pattern affecting digital asset ETFs, including Solana and Litecoin.

Market reactions are mixed, with some traders expressing frustration while others view the extensions as part of the normal review process. Analysts remain optimistic, pointing to the conclusion of the SEC’s Ripple case and prediction markets indicating a strong likelihood of approval before year-end.