New Ethereum Price Prediction Targets $17K by 2026. Could ETH Gain as Much as 350%?

Ethereum (ETH) price action has crypto analysts buzzing as technical patterns and institutional demand align to suggest a massive upward breakout. With ETH currently trading at $3,858, multiple indicators point toward a potential rally that could see the world's second-largest cryptocurrency jump by 350% from current levels.

The convergence of technical analysis, institutional adoption, and supply-demand dynamics has created what many consider the perfect storm for Ethereum price prediction models targeting five-digit valuations.

Let’s check how high the Ethereum price can go and what the most up-to-date ETH price forecasts are.

Current Ethereum Price Analysis and Market Performance

Ethereum price has demonstrated remarkable resilience despite macro headwinds that typically suppress risk appetite. Trading 23% below its November 2021 all-time high of $5,000, ETH has established a crucial resistance level at $4,000 that serves as the gateway to new price discovery territory.

According to the latest data from CoinMarketCap, one Ethereum is currently priced at $3,865, with a 2% increase over the past 24 hours.

Ray Youssef, CEO of NoOnes, observes that Ethereum's symbolic rebound above $3,850 during its 10th anniversary celebration showcases unusual strength. "Despite conditions that would typically fuel a broad risk-off environment, Ethereum has demonstrated unusual resilience, reflecting its growing role as digital infrastructure rather than just a speculative asset," Youssef explains.

The cryptocurrency has already surged over 300% since establishing a cycle low of approximately $880 in June 2022, painting compelling chart patterns that suggest continued upward momentum.

Why Is Ethereum Going Up? Key Factors Driving Ethereum Price Movement Today

High Demand for Ether

Multiple catalysts are converging to support ETH price appreciation in the current market environment. Exchange balances have reached their lowest levels in nearly a decade, creating a supply squeeze that historically precedes explosive price movements.

Youssef emphasizes this dynamic: "The demand for Ether is growing rapidly, and the circulating supply to meet this demand is steadily evaporating. This rare combination of factors has been known to historically precede explosive upside movement."

Corporate treasury accumulation continues at an aggressive pace, with companies like SharpLink Gaming acquiring 438,000 ETH worth over $1.69 billion. This institutional buying pressure, combined with consistent ETF inflows, creates a demand-supply imbalance that supports bullish price trajectories.

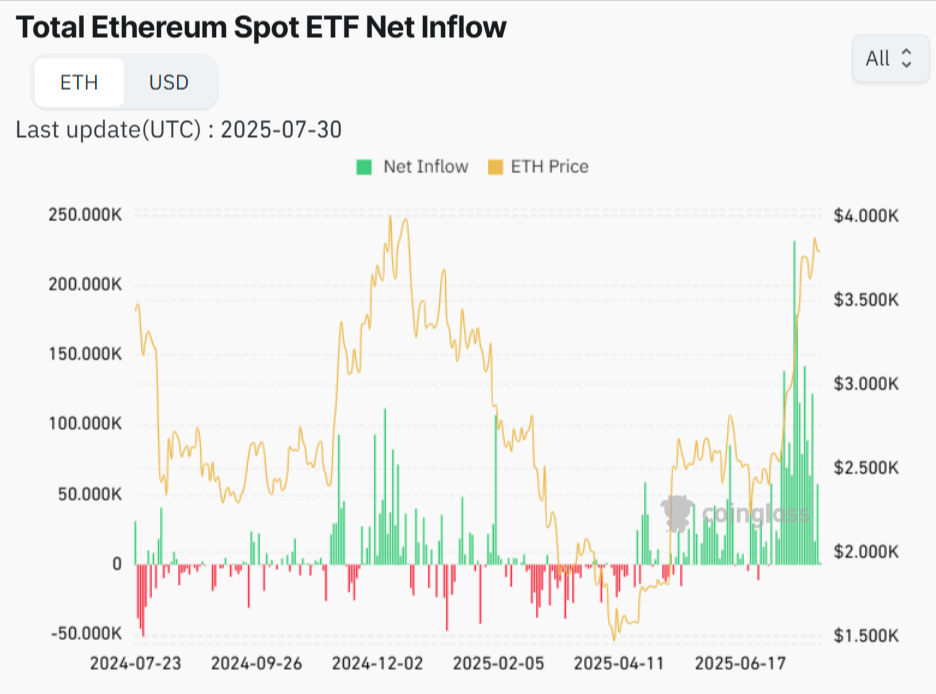

Ethereum ETF Impact on Price Trajectory

Spot Ether ETFs have recorded an impressive 18-day streak of positive inflows, with Tuesday's $218 million net inflow contributing to over $5.3 billion in total inflows since July 2. Cumulative net inflows now exceed $9.6 billion since the July 2024 launch of these investment products.

This institutional adoption represents more than speculative interest, it reflects growing recognition of Ethereum's fundamental value as digital infrastructure. Bitwise CIO Matt Hougan projects $20 billion in annual demand against Ethereum's network issuance of only 800,000 ETH annually, highlighting the structural supply deficit supporting price appreciation.

Paul Howard, Director at Wicent, sees Ethereum's recent price surge as a long-overdue correction driven by institutional adoption. "The move in ETH prices of late signifies more of an overdue directional move as the institutional market looks for alpha opportunities," he explains, pointing to key catalysts including Ethereum's transition to proof-of-stake, the launch of ETFs, corporate treasury adoption, and improved regulatory clarity from US authorities.

Howard believes the cryptocurrency was significantly undervalued for an extended period. "ETH was heavily undervalued for a long time, and its ascension back to $4K and beyond likely gives scope for continued price appreciation," though he anticipates "more modest" gains in Q3 compared to Q2's explosive growth.

Institutional Adoption and Market Sentiment

The institutional narrative surrounding Ethereum price has evolved significantly, with corporate treasuries and traditional finance recognizing ETH as legitimate digital infrastructure. This shift from speculative interest to strategic allocation represents a fundamental change in market dynamics.

Youssef notes: "Ethereum is not just surviving the chaos; it's building through it." This resilience in challenging macro conditions demonstrates the network's maturation and institutional confidence in its long-term value proposition.

Technical Analysis: ETH Price Patterns

According to my technical analysis, Ethereum is currently testing a local resistance zone around the $3,850 mark. This level coincides with the year’s highs and has proven to be a tough barrier. Since the June lows, Ether has gained about 80%. And if we go back to the April bottom, when one token cost just $1,400, the price has surged by nearly 180%.

Looking ahead, I believe a pullback may be on the horizon. However, I would consider it a technical correction rather than a trend reversal. Any decline, in my view, would be a potential buying opportunity. The area around $3,000 stands out as particularly interesting: it aligns with the 50-day EMA, a psychological support level, and the 61.8 percent Fibonacci retracement.

That’s where I’d expect a potential pullback to land, offering a chance to reassess profits and consider re-entry. Of course, this scenario is not set in stone. Ethereum could just as well break through the current resistance and push past the $4,000 level, which also aligns with the December 2023 high. If that happens, we might enter a new price discovery phase, possibly aiming again for the all-time highs of November 2021, when Ether was trading near $5,000.

While these price levels might seem lofty from today’s standpoint, they don’t look so far-fetched when you consider the latest Ethereum price predictions from several well-followed crypto analysts. In fact, compared to those forecasts, my outlook might even be considered conservative.

Related: The Newest Ethereum Price Prediction Shows ETH Could Hit $15K in 2025

Ethereum Price Prediction Shows ETH Can Hit Almost $17K

Popular crypto investor Ivan On Tech identifies a symmetrical triangle formation with a measured target of $7,709, representing a 105% increase from current levels.

ETHEREUM BREAKING OUT ON THE MONTHLY!!!!!!!!!!!!

— Ivan on Tech 🍳📈💰 (@IvanOnTech) July 20, 2025

TARGET $7,700

YES

OOOH YES GUYS pic.twitter.com/z0sZvKxOYW

More aggressively, analyst Mikycrypto Bull highlights an ascending triangle pattern spanning five years, with a breakout target reaching approximately $16,700, a staggering 350% increase from current price levels.

ETHEREUM IS SET FOR A MACRO BREAKOUT

— Mikybull 🐂Crypto (@MikybullCrypto) July 30, 2025

IT WILL SPARK OFF A HUGE ALTSZN IF IT HAPPENS

A VERY CRITICAL MOMENT FOR ETHEREUM pic.twitter.com/IoZX77DvmR

The moving average convergence divergence (MACD) indicator has produced a bullish crossover on the monthly chart, historically associated with significant price rallies. Previous instances generated 2,000% gains during the 2020-2021 cycle and 130% in Q4/2023.

Short-term Ethereum Price Prediction (Next 30 Days)

Youssef provides tactical insight for near-term price action: "By holding above the $3,750 breakout zone, Ether is showing that bulls are not in a hurry to take profits and believe that there is still significant room for another phase of price discovery."

The immediate resistance target sits at $4,100, where a clean break would open doors toward new highs at $4,300. As long as ETH maintains support above $3,700, the cryptocurrency remains well-positioned for continued upward momentum.

Merlijn The Trader also emphasizes the significance of current technical setups: "Ethereum is setting up for a monster move, with a massive bullish monthly candle and fresh MACD crossover. Break $4,200 and $ETH will rip like in 2021."

ETHEREUM IS SETTING UP FOR A MONSTER MOVE!!

— Merlijn The Trader (@MerlijnTrader) July 27, 2025

Massive bullish monthly candle

Fresh MACD crossover

3-year squeeze reaching its apex

Break $4,200 and $ETH will rip like 2021.

Those who didn’t reload… will remember this moment.

DON’T SAY WE DIDN’T SIGNAL IT. pic.twitter.com/FqA0LPj1OL

However, geopolitical tensions and macro headwinds could trigger volatility, potentially testing the $3,500 support zone in a risk-off environment.

You may also like: This Bitcoin Price Prediction Suggests BTC Will Hit $200K in 2025

Long-term Ethereum Price Forecast (2025-2030)

Long-term ETH price prediction models suggest extraordinary upside potential as Ethereum transitions from speculative asset to foundational digital infrastructure. The ascending triangle breakout target of $16,700 represents the primary bull case for this cycle.

Some analysts project even higher valuations, with pseudonymous trader DeFi Dad suggesting Ethereum could reach $30,000 based on recent performance metrics and adoption trends.

I’ve completely readjusted my expectations for $ETH this run to top out between $15k-$30k.

— DeFi Dad ⟠ defidad.eth (@DeFi_Dad) July 15, 2025

I am buying and holding ETH believing we can run at minimum to $15k-$18k (20x from its low in 2022, 5-6x from here).

This is the worst case atm.

When you add in all the tailwinds of… https://t.co/P7YaNfbuX4

These projections assume continued institutional adoption, successful scaling solutions, and Ethereum's growing role in decentralized finance and Web3 applications.

Ethereum Price Prediction Table 2025, 2026

Analyst Name | Prediction Type | Price Target | Percentage Gain | Timeframe | Technical Basis |

Ivan On Tech | Conservative Target | $7,709 | +105% | This Cycle | Symmetrical Triangle Formation |

Mikycrypto Bull | Primary Bull Case | $16,700 | +350% | 2025-2026 | Ascending Triangle (5-year pattern) |

Ray Youssef | Short-term Resistance | $4,100 | +6% | Next 30 Days | Breakout Zone Analysis |

Ray Youssef | Extended Target | $4,300 | +11% | Near-term | Clean Break Scenario |

Merlijn The Trader | Breakout Level | $4,200 | +9% | Short-term | MACD Crossover + Monthly Candle |

DeFi Dad | Aggressive Scenario | $30,000 | +680% | Cycle Peak | Performance Metrics & Adoption |

Risk Factors and Market Volatility Considerations

Despite bullish Ethereum price prediction scenarios, several risk factors warrant consideration. Regulatory uncertainty, particularly regarding cryptocurrency taxation and oversight, could impact institutional adoption rates.

Youssef acknowledges potential downside risks: "If geopolitical tensions and macro headwinds intensify, ETH might retest the $3,500 support zone, and breaking below $3,500 could lead to a deeper pullback towards $3,100."

Howard's most compelling observation positions Ethereum within the broader digital asset landscape: "If BTC is digital gold, ETH is the digital oil of the digital economy" - a metaphor that captures Ethereum's role as the fundamental infrastructure powering decentralized applications and smart contracts across the blockchain ecosystem.

Market volatility remains elevated, and investors should prepare for significant price swings even within bullish long-term trends.

Ethereum News FAQ

How Much Will Ethereum Be Worth in 2025?

Ethereum price prediction models for 2025 show significant bullish potential. According to Mikycrypto Bull's ascending triangle analysis, ETH could reach approximately $16,700 by 2025-2026, representing a massive 350% increase from current levels of $3,858.

More conservative estimates from Ivan On Tech suggest a symmetrical triangle target of $7,709, which would still deliver impressive 105% gains. The convergence of institutional adoption through spot Ether ETFs and corporate treasury accumulation creates strong fundamental support for these ambitious targets.

What Will 1 Eth Be Worth in 2030?

Long-term Ethereum price forecasts for 2030 venture into even more speculative territory, with some analysts projecting extraordinary valuations. DeFi Dad suggests ETH could reach $30,000 based on performance metrics and adoption trends, though this represents the most aggressive scenario.

Will Ethereum Hit $10,000?

Ethereum reaching $10,000 appears increasingly plausible given current technical patterns and institutional momentum. This milestone represents approximately 160% upside from current prices and falls well within the range of analyst predictions.

The ascending triangle breakout identified by multiple analysts targets $16,700, making $10,000 a conservative intermediate milestone rather than an aggressive projection. MACD bullish crossovers have historically generated substantial gains, with previous cycles delivering 2,000% and 130% returns respectively.

Will Ethereum Reach $50,000?

Ethereum hitting $50,000 would require extraordinary circumstances and represents the most speculative end of price prediction models. This target implies roughly 1,200% gains from current levels and would establish ETH as a genuine store-of-value competitor to Bitcoin.

Check also my previous article from last month about Ethereum price predictions, answering the question of how high the Ether price can go.