Why Your Broker Can't Sell You the Next OpenAI? Robinhood CEO Calls It “Tragedy”

Robinhood's boss thinks there's something fundamentally broken about how global capital markets work. Vlad Tenev, the CEO who built his fortune democratizing stock trading, now says it's a "tragedy" that regular investors can't access private markets where the real money gets made.

Robinhood Boss Says Wall Street's Biggest Secret Is Unfair

Speaking on Bloomberg Wealth, Tenev didn't mince words about what he sees as Wall Street's biggest inequity. "A big tragedy is that private markets are where the bulk of the interesting appreciation and exposure is nowadays," Robinhood's Tenev told host David Rubenstein. "It's a shame that it's so difficult to get exposure in the US."

The comments highlight a growing frustration among retail trading platforms as private companies stay private longer and capture more value before going public. Companies like SpaceX, OpenAI, and other tech darlings have generated massive returns for institutional investors while everyday Americans watch from the sidelines.

Robinhood CEO Vlad Tenev said retail investors are largely excluded from the “huge opportunity” available in private markets. https://t.co/BWOA8mL60A

— Bloomberg (@business) July 28, 2025

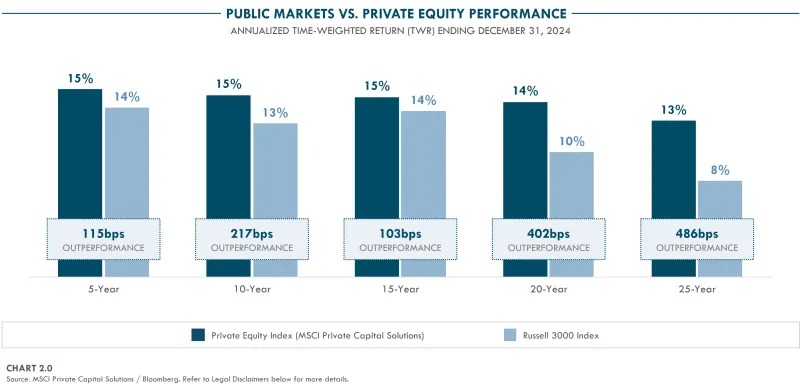

What’s important here, private market investments dramatically outperform public markets over the long term, generating returns that can be 400-500 basis points higher annually. The wealth creation difference is staggering - while public market investors earned 6.6x their money over 25 years, private market investors generated 19.9x returns according to Cambridge Associates' comprehensive data.

The Numbers Don't Lie

Private equity has delivered an average annual return of 13.1% over 25 years, significantly outpacing the S&P 500's 8.6% return during the same period.

Even more compelling data comes from MSCI Private Capital Solutions, which shows that since 2000, private equity has generated a 13% net annualized return compared to the Russell 3000's 8% return. This represents outperformance of 486 basis points annually.

The illiquidity premium alone adds 2-4% annually to private equity returns over the long run. This premium compensates investors for giving up the ability to sell their investments quickly, but the trade-off has proven highly rewarding for those who can afford to wait.

Private equity has outperformed public markets in 97 out of the last 100 quarters when looking at 10-year rolling returns. Even during the three quarters of underperformance, private equity regained its lead in the immediately following quarter.

Robinhood's European Experiment

Tenev isn't just complaining about the problem. His company has already started testing solutions, though not without controversy. Last month, Robinhood rolled out tokenized products to European customers that supposedly give them exposure to private companies like OpenAI without actually owning equity in those firms.

The move raised eyebrows among regulators and industry watchers who questioned how these products are valued and whether retail investors truly understand what they're buying. Critics worry about transparency and whether these complex instruments could blow up in customers' faces.

Robinhood CEO downplays OpenAI concerns on tokenized stock structure https://t.co/6tWzgrtBXa

— CNBC Tech (@CNBCtech) July 8, 2025

But Tenev seems undeterred. "We're obviously working to solve that," he said, suggesting more products could be coming to bridge the gap between retail investors and private markets.

Robinhood is not the only company currently offering such solutions. Several major cryptocurrency exchanges have joined this trend as well, partnering with firms like xStocks, which specializes in asset tokenization.

Why Private Markets May Be Too Risky for Regular Investors

The fundamental mismatch between how private markets operate and what everyday investors need could create dangerous situations for both individuals and the broader financial system.

The UK's Financial Conduct Authority delivered a stark warning about this trend. Deputy Chief Executive Sarah Pritchard emphasized that while some people might benefit from private market exposure "with the right information and support," the reality is that "for others, it will not" be appropriate. The regulator's position acknowledges a harsh truth - these investments simply aren't designed for most people.

The core problem lies in what experts call liquidity mismatch. Unlike stocks that you can sell instantly, private market investments lock up your money for years without any guarantee you can get it back when you need it. Moody's research highlighted this critical flaw: "Retail investors often require quicker access to their capital and have less long-term investment flexibility" compared to the pension funds and endowments that traditionally dominate these markets.

Even more troubling is what might happen if retail money floods into private markets too quickly. Moody's research suggests this could trigger a dangerous race among fund managers to deploy capital, potentially leading them to "compromise on underwriting standards or stretch into riskier assets to keep pace with inflows.”

Wall Street Takes Notice

The private markets boom has caught everyone's attention, not just regulators and fintech upstarts like Robinhood. Earlier this month, banking giants JPMorgan Chase and Citigroup announced they're expanding research coverage to include private companies in hot sectors like artificial intelligence and aerospace.

The numbers explain why. Private company valuations have been surging for years, creating paper fortunes for those lucky enough to get in early. Meanwhile, the traditional initial public offering market has struggled, with many companies choosing to raise money privately rather than face the scrutiny of public markets.

This trend has created what Tenev calls the "greatest remaining iniquity" in American finance. While pension funds, endowments, and wealthy individuals can write checks to private equity firms and venture capital funds, regular investors are largely shut out by regulations designed to protect them from risky investments.

The Access Problem

The irony isn't lost on anyone. Robinhood made its name by eliminating trading commissions and making it easier for millennials to buy stocks and options. But when it comes to the investments that have generated the biggest returns over the past decade, even Robinhood's millions of users are stuck on the outside looking in.

Current regulations require investors to be "accredited" to participate in most private investments, meaning they need either $1 million in net worth or $200,000 in annual income. Those rules were written decades ago to protect unsophisticated investors from losing their shirts on risky deals.

But critics argue these outdated thresholds now serve mainly to protect the wealthy's access to the best investment opportunities. While a middle-class investor can day-trade meme stocks on Robinhood, they can't buy shares in the next big tech startup.

"That's where I would point to as the greatest remaining iniquity and opportunity in our capital markets," Tenev said, making clear he sees this as more than just a business opportunity for his company.

The question now is whether regulators will go along with efforts to democratize private markets, or whether they'll stick with rules designed for a different era of finance.