XTB Advances 4% to All-Time High After 10 Million Zlotys Share Buyback Announcement

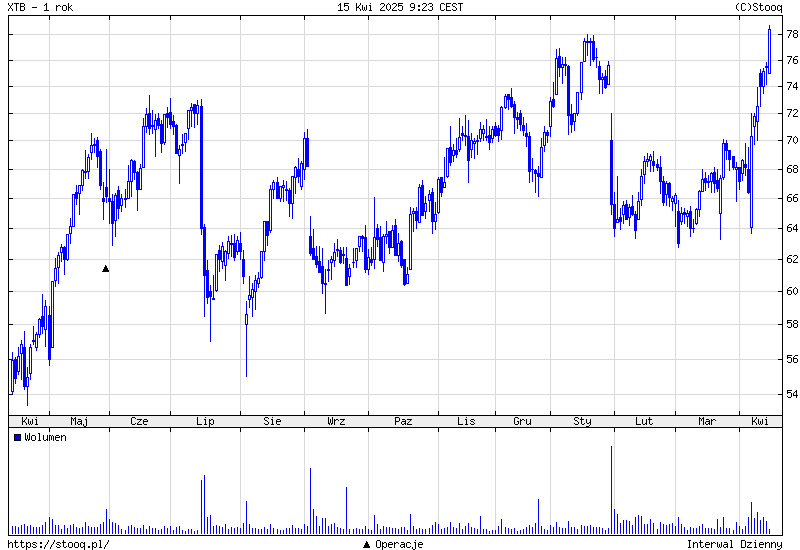

XTB shares climbed to an all-time high today (Tuesday), surging more than 4% as investors responded positively to the company's 10 million zlotys share buyback program launched the previous evening.

XTB Shares Hit Record High Following Share Buyback Announcement

The Poland-based fintech broker saw its stock price reach 78.74 PLN during morning trading on the Warsaw Stock Exchange (WSE: XTB), surpassing its previous record of 78 PLN set in January. The latest rally represents a significant 25% rebound from the 2025 low recorded in March.

The price jump follows Monday's announcement that XTB's Management Board has initiated an almost 10 million PLN share repurchase program authorized by shareholders at the company's Extraordinary General Meeting last November. The buyback, which began on April 14, will continue until September 30, 2025, unless the allocated funds are depleted earlier.

XTB plans to acquire up to 95,248 of its own shares at prices ranging between 35.00 PLN and 104.30 PLN per share, with a total budget not exceeding 9.93 million PLN. The purchases will be conducted on the WSE through broker orders, including block trades.

The Management Board has committed to providing regular updates on the progress of the share repurchase program.

According to the company's statement, the repurchase program aims to fulfill obligations under XTB's incentive plan. The company has engaged Trigon Dom Maklerski S.A. to execute the buyback in accordance with European Union regulations and Polish national legislation.

Bucking the Trend in Volatile Markets

XTB's recent performance stands in contrast to its industry peers, who have struggled amid the market volatility triggered by President Trump's aggressive tariff policies. While London-listed brokers saw significant declines last week, XTB has demonstrated resilience.

The ongoing trade tensions between the United States and China have intensified in recent days. Last week, Trump threatened to impose 50% tariffs on China starting April 9 if China did not withdraw its 32% retaliatory tariffs. This escalation pushed the VIX volatility index to around 32 points, reflecting heightened market uncertainty.

However, some relief came on Sunday when Trump announced tariff reductions on electronic equipment. Consumer electronics such as smartphones and laptops will now face a 20% rate instead of the previously announced higher tariffs. Reports also suggest that Trump may adjust semiconductor tariff rates later this week.

Moving back to XTB, the company also announced a new crypto institutional offering this week, reducing spreads by up to 60% and increasing exposure from 1 to 10 million EUR.