Bitcoin Futures Analysis Now with orderFlow Intel at investingLive.com

Trader Update: Bitcoin Futures OrderFlow Intel

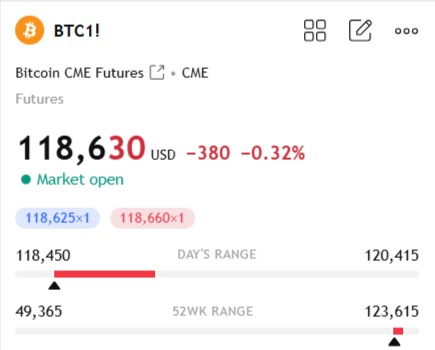

Market Snapshot (July 28–29, 2025):

Bitcoin futures have demonstrated dynamic swings, establishing a clear trading range between approximately $118,500 (support) and $120,300 (resistance). Here is the latest assessment based on recent price action and detailed OrderFlow analysis.

Key Observations for Bitcoin Futures in the past 20 hours:

Bullish Momentum (July 29 Mid-Morning):

The session experienced strong bullish interest with significant buying volume and positive Delta around 09:46.

Buyers briefly pushed price upwards to test higher resistance levels, peaking around $120,305.

Afternoon Bearish Reversal (12:48–16:06):

A clear reversal occurred around midday, with sellers stepping in more aggressively.

Volumetric data showed an important shift from buyer to seller dominance, confirmed by rising sell volumes and increasingly negative Delta.

By 16:06, sellers had taken temporary control, turning cumulative Delta negative, indicating sellers successfully overcame earlier bullish momentum.

Bitcoin Order Flow Dynamics (Balanced View):

Buyers: Demonstrated clear strength earlier, yet the momentum was not sustained into the afternoon. Their ability to defend the lower boundary (~$118,500) is now crucial.

Sellers: Gained significant ground from midday onwards. The recent increase in selling pressure suggests growing bearish sentiment, though further confirmation is required before confidently declaring sustained downside.

Bitcoin Futures Price Levels to Watch Closely:

Resistance: $120,300–$120,500

Immediate Support: $118,900–$119,100

Critical Support Zone: $118,500 (key area tested multiple times)

Current Bitcoin Price Prediction & Confidence Score:

OrderFlow Intel Score: -5 (Moderate Bearish Bias, Awaiting Confirmation)

Sellers have an advantage in the short term, but caution is advised until price clearly breaks below the critical support at $118,500 with continued strong negative Delta.

Conversely, a reclaiming of levels above $119,500–$120,000, supported by renewed positive Delta, would signal a potential bullish resurgence.

Bitcoin Trader Decision Support Summary:

Bearish Scenario (Short-Term Advantage):

Watch closely for clear bearish confirmation through sustained negative Delta and volume increases below $118,900. This would signal a higher probability of continued downside.

Bullish Scenario (Still Possible):

If buyers strongly return and successfully defend the current support zone with aggressive positive Delta and robust buy volumes, a retest of $120,000+ levels remains viable.

The market has tilted slightly bearish following a significant shift in OrderFlow sentiment from buyers to sellers during the afternoon. However, it remains prudent to await further confirmation before fully committing to a directional stance.

Trade carefully, manage risk effectively, and stay tuned for further updates.