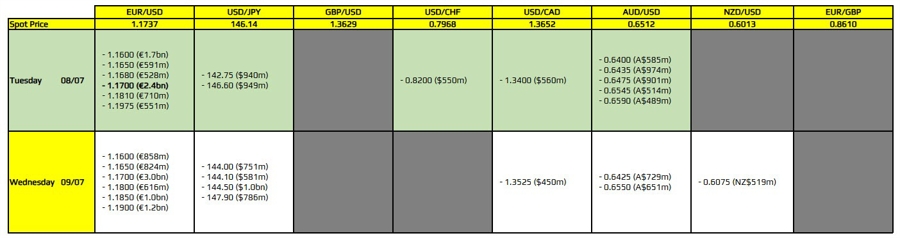

FX option expiries for 8 July 10am New York cut

There is just one to take note of on the day, as highlighted in bold.

That being for EUR/USD at the 1.1700 level. The pair is keeping just below its key hourly moving averages but the expiries here should help to limit further downside for now.

The dollar may have advanced yesterday but EUR/USD is still up over 8.5% since the start of April. So, that puts into context the dollar's state of being since the whole reciprocal tariffs drama. And that is now extending further to 1 August at the very least.

There's also relatively large expiries at the 1.1700 mark all through the week. So, that might also keep price action more interested around the region. Or at least act as some added layer that sellers will have to chew through depending on market developments.

We'll be getting €3.0 billion tomorrow, then €1.4 billion on Thursday, and then €1.5 billion on Friday - based on the current snapshot. The sizes should change as we move closer to the respective expiry dates above.

For more information on how to use this data, you may refer to this post here.