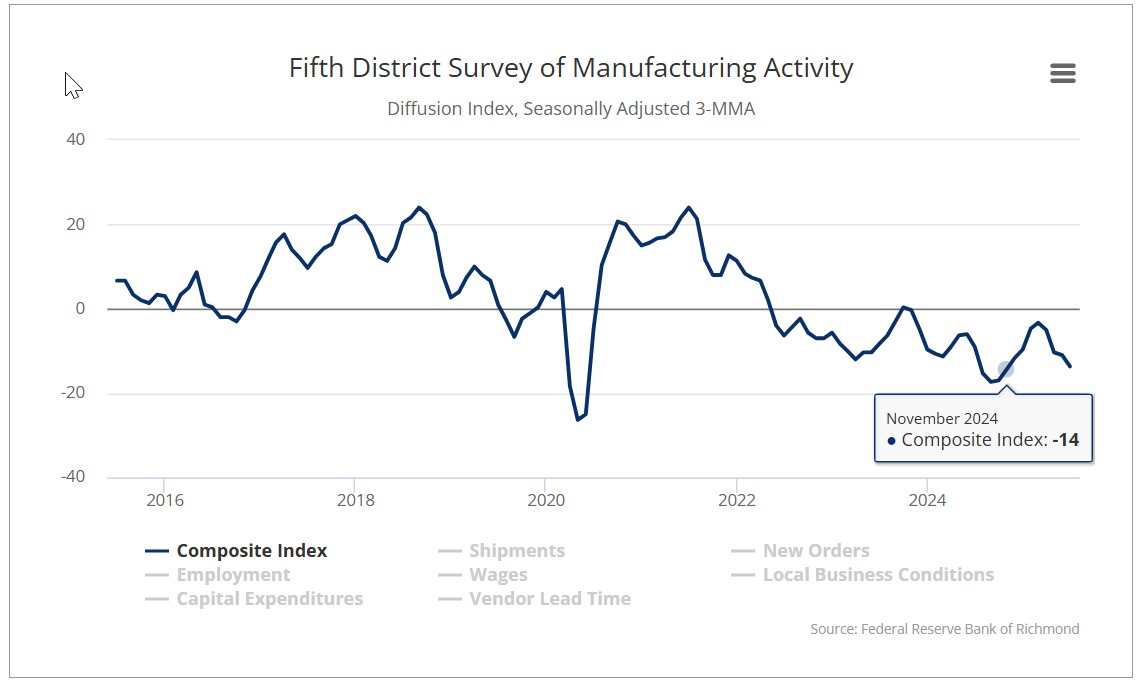

Richmond Fed manufacturing index -20 versus -8 in June

- Prior month -8 revised from -7

- Richmond Fed composite index -20 index versus -8 last month

- Services index +2 versus -1 last month (revised from -4 previously reported)

- Manufacturing shipments -18 versus -5 last month (revised from -3).

The index is in contrast to the Philadelphia Fed index which was released last week. That index showed a surprise gain of 15.9 versus -1.2 estimate. Good news is that the price trend did move lower from last month's spike to the upside. However, the price is still remain above the May levels.

Details:

Composite manufacturing index: -20 → ↓ vs -8 last month

Shipments: -18 → ↓ vs -5 last month

New orders: -25 → ↓ vs -12 last month

Employment: -16 → ↓ vs -6 last month

Local business conditions index: -11 → ↑ vs 17 prior month

Vendor lead time: 7 → ↓ vs prior month

Backlog of orders: -30 → ↓ vs -18 last month

Prices paid 5.65% ↓ 6.10% prior month. In May the price is paid was 5.35%.

Prices received: 3.16% ↓ vs 3.57% prior month. In May the price received was 2.73.

12-month outlook: Firms expect prices paid to stay steady → and prices received to increase ↑

Future expectations:

Future local business conditions: -2 → ↑ vs -7 last month

Future shipments: 11 → ↑ vs 6 last month

Future new orders: 9 → ↑ vs 6 last month

Future employment: -10 → ↓ vs -4 last month