Robinhood, S&P 500, Nasdaq 100: Bitstamp Deal, Record Closes, and JPMorgan's Bold Forecast

JPMorgan has raised its price target for Robinhood Markets Inc. (HOOD) to $98 by 2026, doubling its previous forecast of $47 for 2025. The upward revision reflects expectations of long-term growth from the trading platform’s recent moves in crypto and tokenized finance.

The new price target comes ahead of Robinhood’s second-quarter earnings report, which is due Wednesday after the market close. Analysts expect the firm to post earnings per share of $0.31, up from $0.21 a year earlier, according to FactSet. Transaction-based revenue is projected to hit $515 million.

Crypto Revenue Expected to Double Year-Over-Year

Crypto trading revenue is forecast to reach $169.3 million for the quarter, more than double the $81 million recorded in the same period last year, Coindesk reported. However, the figure is well below the $247 million seen in Q1, underscoring the company’s exposure to fluctuations in digital asset trading volumes.

In its forecast, JPMorgan highlighted Robinhood’s $200 million acquisition of Bitstamp, finalized in June, as a key driver of future growth. The deal provides the company with a fully licensed European crypto exchange and supports its expansion into the EU market.

Bitstamp is now part of @RobinhoodApp

— Bitstamp by Robinhood (@Bitstamp) June 2, 2025

Together, we’re combining 14 years of trusted crypto expertise with Robinhood’s global vision - expanding access and building the future of crypto, together.

More here 👇https://t.co/Po2NxE971C

Robinhood began offering tokenized stock trading in the European Union earlier this month under the region’s new MiCA regulations. Users can now trade more than 200 tokenized stocks and ETFs, with plans for 24/7 trading once Bitstamp’s order book is integrated.

Private Market Access and U.S. Regulatory Shifts in Focus

Robinhood also plans to give EU users tokenized exposure to private companies such as OpenAI and SpaceX. The firm said this will provide access to traditionally restricted investments and could enable future decentralized finance applications. Shares of Robinhood have risen 170% since the start of the year. The stock was recently down 1.7% at $104.88 on Tuesday.

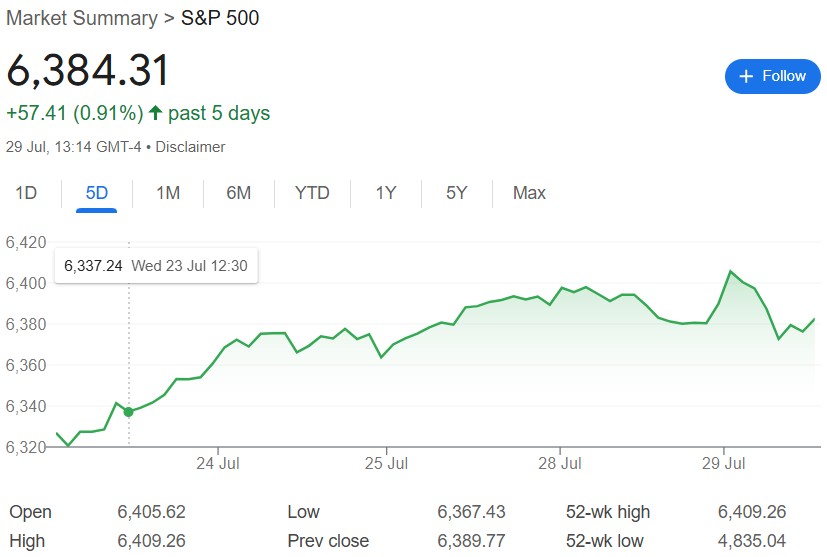

Wall Street began the week with optimism, pushing the S&P 500 and Nasdaq 100 to new all-time highs, as investors welcomed progress on key trade fronts. But that momentum faded by the close, with the Dow ending slightly lower and broader indexes giving back early gains as Treasury markets stirred investor unease.

Trade Deals Fuel Early Market Gains

According to Barchart, Markets climbed Monday following news that the United States and the European Union reached a trade agreement. Under the deal, most EU exports will face a 15% tariff—substantially less than the 50% rate previously threatened by President Trump.

That development, coupled with a report from the South China Morning Post suggesting the US and China are set to extend their tariff truce for another 90 days, resulted in early optimism across equity markets.

Read more: This Bitcoin Price Prediction Suggests BTC Will Hit $200K in 2025

The Nasdaq 100 rose 0.36%, outperforming major indexes, while the S&P 500 eked out a modest 0.02% gain. The Dow Jones Industrial Average dipped 0.14%.

Bond Market Pressures Weigh on Equities

The rally lost steam in the afternoon after a weak $70 billion auction of 5-year Treasury notes pushed bond yields higher. That prompted a wave of long liquidation in equities, especially as rising yields typically dampen the appeal of riskier assets like stocks.

The bond market also reacted to the US Treasury’s revised borrowing estimate for the third quarter, which jumped to $1.01 trillion—nearly double its April forecast. Investors now anticipate a surge in government debt supply, potentially increasing upward pressure on yields. Amid the trade-driven swings, markets also responded to positive economic data.