US Forex Brokers Hold Over $500 Million in Client Funds, CFTC Data Shows

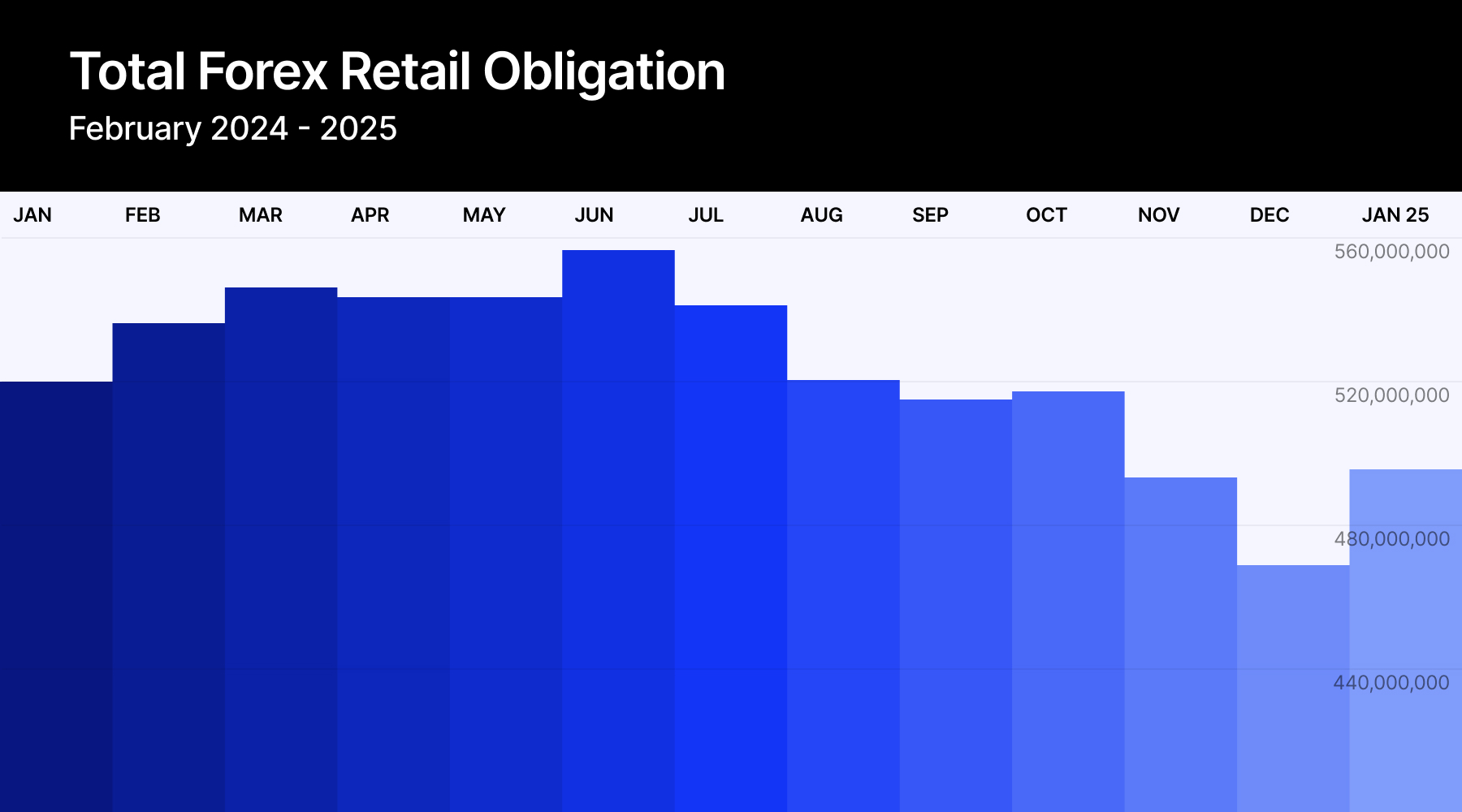

U.S. retail forex brokers held approximately $527 million in client obligations as of February 2025, according to the latest regulatory data from the Commodity Futures Trading Commission (CFTC).

U.S. Forex Brokers See Client Funds Rise to $527 Million in February

The February 2025 figures represent a 2.9% month-over-month increase from January, when total client funds stood at approximately $512 million. However, the data shows a 2.9% year-over-year decline compared to February 2024.

The U.S. retail forex market remains highly concentrated, with the top three brokers controlling over 85% of client funds. This concentration reflects the significant regulatory barriers to entry in the U.S. market, including the $20 million minimum capital requirement for forex dealers.

Six Brokers Control Entire US Retail Forex Market

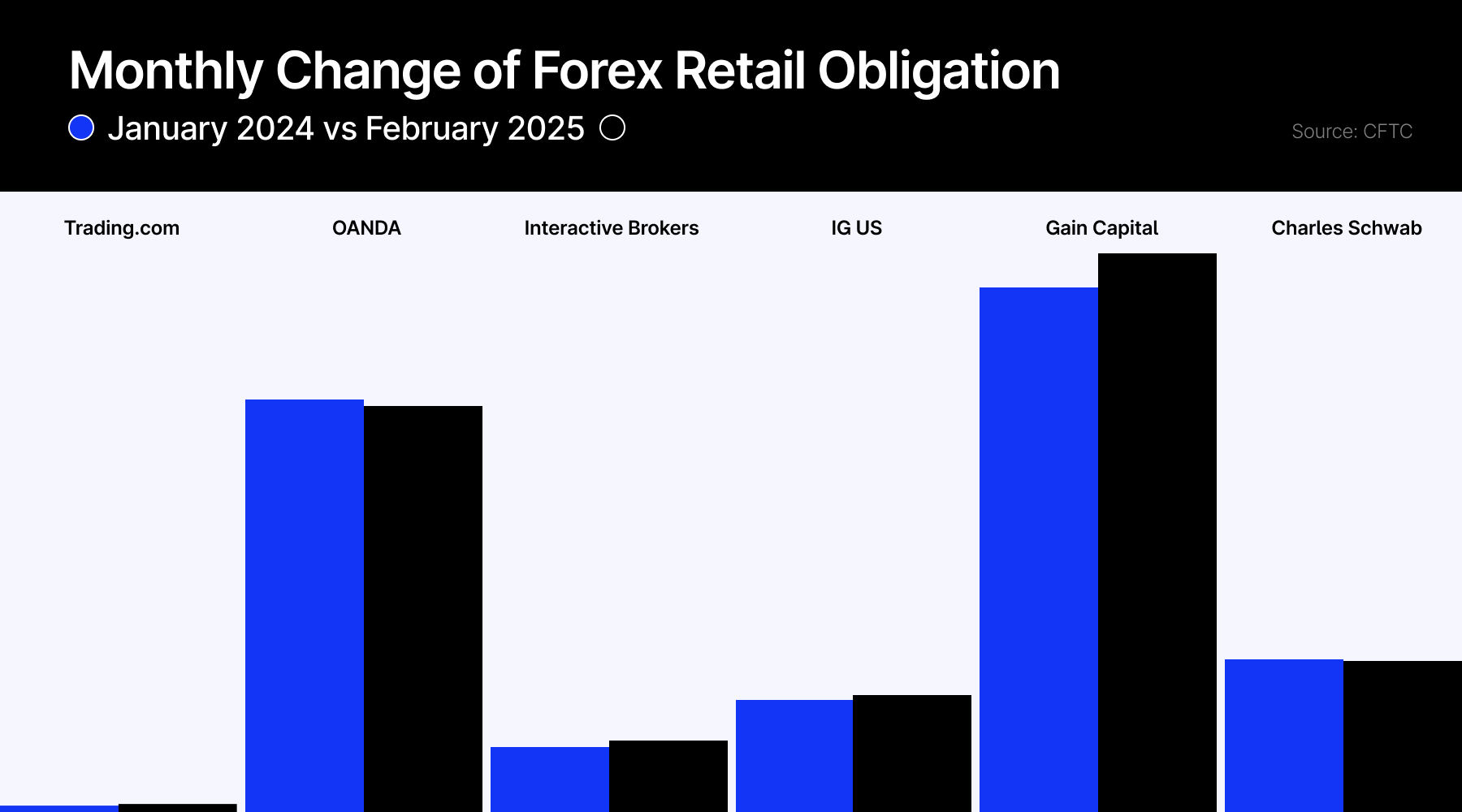

Six registered retail foreign exchange dealers (RFEDs) currently dominate the U.S. forex market: Gain Capital, Oanda, Charles Schwab, IG US, Interactive Brokers, and Trading.com.

Gain Capital maintained its position as the market leader, holding $225 million in client funds as of February 2025, representing approximately 42.7% of the total market. This marks a 6% increase from January 2025 and a 7% year-over-year growth compared to February 2024.

Oanda remains the second-largest forex broker with $163.2 million in client obligations, though this represents a 1.5% decrease from January. Charles Schwab holds the third position with approximately $61 million in client funds.

Smaller Players and Market Volatility

The data reveals significant volatility for some smaller market participants. IG US reported $46.7 million in client funds, showing a 3% monthly increase but a substantial 23.8% year-over-year decline. Interactive Brokers experienced the most significant monthly growth among major brokers, with client funds increasing 9.5% to $28.6 million.

Trading.com, while maintaining the smallest market share among the six registered dealers, demonstrated the strongest percentage growth. The broker reported $2.5 million in client funds, a 9.2% increase from January and a 36.2% growth compared to February 2024.

Regulatory Compliance

The CFTC requires all registered forex dealers to maintain substantial capital reserves to protect client funds. According to the regulatory filing, all six brokers currently meet or exceed the minimum capital requirements established by the commission.

The monthly data is compiled from financial reports submitted by registered futures commission merchants (FCMs) and retail foreign exchange dealers to the CFTC.