Why Is Bitcoin Going Up? Robert Kiyosaki Predicts BTC Price Could Hit $1 Million by 2035

Renowned author Robert Kiyosaki forecasts Bitcoin (BTC) price could skyrocket to $1 million by 2035, driven by an ongoing economic crash and surging U.S. debt. As of today (Saturday), 19 April, 2025, Bitcoin’s price is up 1%, trading above $85,000 , according to CoinMarketCap. Despite macroeconomic fears, ETF inflows and bullish sentiment are pushing BTC higher.

In this article, we dive into Kiyosaki’s bold prediction, explore the forces driving Bitcoin’s 2025 rally, and answer the critical question: Why is Bitcoin going up today and high how BTC price can go in the long run?

Why Is Bitcoin Going Up Today? BTC Price Back Above 2 Key EMAs

As of April 19, 2025, Bitcoin (BTC) is priced at approximately $85,419 , a 1% increase compared to the previous close and 0,9% over the past 24 hours. The total market capitalization currently stands at nearly $1.7 trillion, with a daily trading volume of $12.4 billion.

However, Robert Kiyosaki, co-author of Rich Dad Poor Dad, believes Bitcoin’s potential is far greater, projecting a staggering $1 million valuation by 2035.

Why Will Bitcoin Surge? Kiyosaki’s $1 Million Prediction

In a tweet posted on April 19, 2025, Kiyosaki warned of a “Greater Depression” fueled by record-high U.S. debt, rising unemployment, and collapsing 401(k)s. He reiterated advice from his books, including Rich Dad Poor Dad and Rich Dad’s Prophecy, urging investors to buy Bitcoin, gold, and silver to weather the crisis.

“I strongly believe, by 2035, that one Bitcoin will be over $1 million dollars,” Kiyosaki tweeted, citing the current economic crash as a historic wealth-building opportunity.

MAKES ME SAD: In 2025 credit card debt is at all time highs. US debt is at all time highs. Unemployment is rising. 401 k’s are losing. Pensions are being stolen. USA may be heading for a GREATER DEPRESSION.

— Robert Kiyosaki (@theRealKiyosaki) April 18, 2025

I get sad because as I stated in an earlier X….Tweet….I warned…

Here’s why his prediction is resonating:

- Economic Collapse as a Catalyst: Kiyosaki points to soaring U.S. credit card debt, national debt, and pension losses, signaling a “giant crash.” Historically, economic crises drive demand for scarce assets like Bitcoin, which has a fixed supply of 21 million coins.

- Safe-Haven Appeal: With traditional markets faltering, Kiyosaki sees Bitcoin as “digital gold.” Analyst Lyn Alden notes Bitcoin’s 83% correlation with global liquidity, making it a hedge against fiat devaluation.

- Historical Precedent: Bitcoin surged 600% after the 2020 halving and 150% in 2023’s recovery. The April 2024 halving, reducing mining rewards to 3.125 BTC, continues to tighten supply, setting the stage for a bull run.

- Market Sentiment: Despite macro fears, buy-side liquidity on exchanges like Binance remains strong, with large investors moving BTC to cold storage.

What’s Driving Bitcoin’s 2025 Rally?

Bitcoin’s current uptrend isn’t just speculative. Several factors are fueling its momentum:

- ETF Inflows: Bitcoin ETFs have attracted $60 billion in 2025, with retail investors driving 75% of flows. Bernstein analysts project $70 billion more by year-end, potentially pushing BTC to $150,000.

- Liquidity Surge: The U.S. Treasury’s drawdown of its General Account (TGA) to $340 billion has injected $510 billion into markets since February 2025, per analyst Tomas on Markets. Projected liquidity of $6.5 trillion by Q4 could lift speculative assets.

- Post-Halving Dynamics: The 2024 halving continues to constrict supply, mirroring cycles that sparked massive rallies in 2016 and 2020.

- Easing Macro Pressures: Recent tariff exemptions have lowered U.S. Treasury yields, reducing headwinds for risk assets like Bitcoin.

- Monetary policy: President Donald Trump’s didn’t hesitate to attack Federal Reserve Chair Jerome Powell, hinting at firing him for “delaying” interest rate cuts

“In my assessment, Bitcoin crossing the $84,000 threshold was not just a reaction to Trump’s pressure on Powell; it’s the culmination of months of rising uncertainty in traditional markets,” commented Rania Gule, Senior Market Analyst at XS.com. “High interest rates, industrial slowdown, trade tensions, and geopolitical conflicts are all pushing capital toward havens detached from government influence. Here, Bitcoin emerges not as a speculative asset, as it was previously labelled, but as a serious hedge in the eyes of major institutions.”

You may also like: Will Bitcoin Reach $100K Again? Latest BTC Price Prediction for 2025 Says Yes

How High Can Bitcoin Go? Technical Analysis

Bitcoin’s price action shows a consolidation phase since March 2025, trading between $87,400 resistance and $78,000 support. The 50-day and 200-day exponential moving averages (EMAs) have converged near current price leveles, signaling a potential breakout.

My technical analysis indicates that BTC/USD is currently testing the 50 and 200 EMA levels. If the pair manages to break above them decisively—something that hasn’t happened in many months—it could generate a strong signal for potential upward movement.

“Bitcoin's implied volatility is trending below 50 which is a historically low level and price is at the low end of the channel established since November,” said Paul Howard, Director at Wincent. “Given the turmoil in the macro markets, the last month hasn't brought BTC price down below 74k (pre November 2024 levels), and the regulatory environment is a lot friendlier. It would seem likely we see price appreciation rather than a gap lower.”

“There needs to be a catalyst however and that might not come for several months and in my view will be driven from further policy changes in the US notably regards to taxation, payments and regulations (specifically on stablecoins).”

Bullish Case: A break above $86,000 could target:

- $90,000–$92,000 (late 2024 lows)

- $100,000 (psychological level)

- $108,000 (December 2024 all-time high)

- $150,000 (potential Q4 2025 target, per Bernstein)

Bearish Case: A drop below $78,000 could test:

- $74,500 (April 2025 lows)

- $68,000 (July 2024 highs)

- $66,000 (October 2024 lows)

Support and Resistance Levels:

Support Levels | Description | Resistance Levels | Description |

$78,000 | Lower consolidation boundary, tested in March 2025 | $87,400 | Upper consolidation boundary, March 2025 highs |

$74,500 | April 2025 lows | $90,000–$92,000 | Resistance from late 2024 lows |

$68,000 | July 2024 highs | $100,000 | Psychological barrier |

$66,000 | October 2024 lows | $108,000 | December 2024 all-time high |

Bitcoin Price Predictions for 2025 and Beyond

Kiyosaki’s $1 million by 2035 is ambitious, but other analysts offer nearer-term forecasts:

Source | 2025 Price Prediction | Key Drivers |

Robert Kiyosaki | $1M (by 2035) | Economic crash, safe-haven demand, supply scarcity |

Kathie Wood | $1M (by 2030) | |

Bernstein | $150,000 | ETF inflows, halving effects |

Bitfinex | $145,000–$180,000 | Historical cycles, liquidity correlation |

Standard Chartered | $200,000 | Institutional adoption, BTC reserve potential |

Others also liked: How High Can Bitcoin Go? This Expert Predicts BTC Price Jump to $137,000

Risks to the Bitcoin Price Rally

Kiyosaki’s $1 million call assumes a prolonged crisis, but risks could derail Bitcoin’s ascent:

- Debt Ceiling Resolution: An early debt ceiling deal could slow TGA drawdowns, capping liquidity at $6.3 trillion, per Tomas.

- Geopolitical Tensions: Escalating global conflicts could favor gold over Bitcoin

- Technical Hurdles: Failure to break the 200-day EMA could trap BTC below $90,000, delaying bullish momentum.

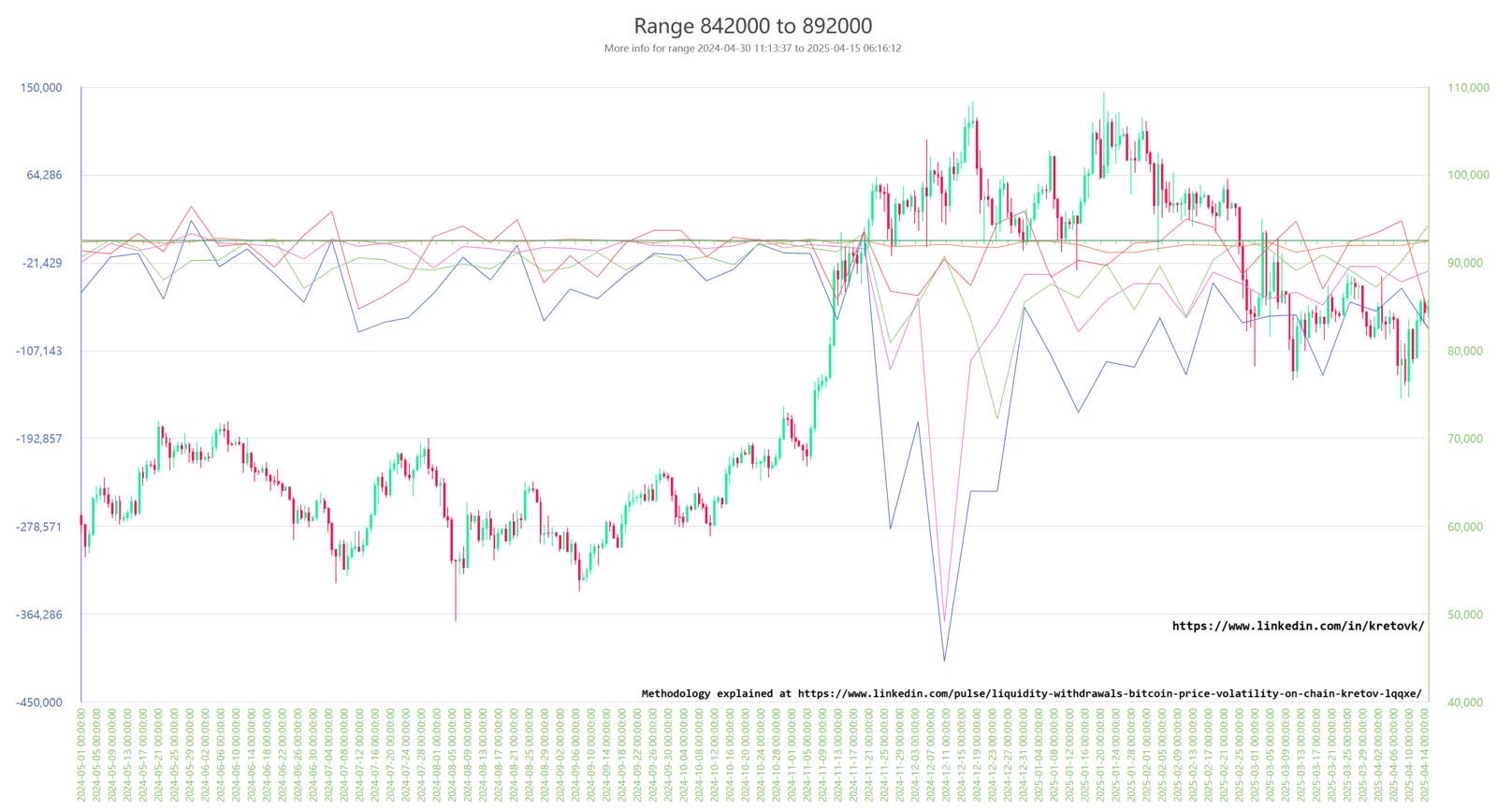

Moreover, Dr. Kirill Kretov, Senior Automation Expert at CoinPanel, offers a more cautious outlook. In a recent statement, Kretov warns that the bullish narrative may overlook critical macroeconomic and market dynamics, casting doubt on a clean breakout to six-figure prices in 2025.

“We are in a phase of deep macro uncertainty marked by geopolitical tension, fragile global markets, and a strong risk-off sentiment,” Kretov explains. He argues that Bitcoin is behaving more like a speculative asset than the “digital gold” Kiyosaki champions. In this climate, traditional safe-haven assets like gold are regaining prominence, potentially siphoning demand from BTC.

Kretov’s analysis delves deeper into market mechanics. He points to “orchestrated” patterns: fear-driven sell-offs followed by quiet accumulation by well-capitalized players. On-chain data reinforces this view, showing a surge in large Bitcoin outflows (100+ BTC) from exchange wallets since November 2024, indicating strategic accumulation by whales.

Meanwhile, smaller transactions (<10 BTC) remain stagnant, reflecting retail investors’ hesitation. “This divergence highlights a market dominated by consolidation at the top, while smaller participants sit idle,” Kretov notes.

Volatility, thin liquidity, and weak retail sentiment further complicate the outlook. Kretov suggests that modest price moves can trigger exaggerated swings, making Bitcoin vulnerable to manipulation. “A collapse to $10,000 is improbable without a systemic crisis, but a breakout to $150,000 seems unlikely without first purging speculative excess,” he says. Instead of a hype-driven rally, Kretov predicts the next bull run may follow a deep correction that clears out “dead weight” from retail speculators.

FAQ: Bitcoin Price Outlook

How High Will Bitcoin Go in 2025?

Analysts project $145,000–$200,000 by Q4 2025, driven by ETFs and liquidity. Kiyosaki’s $1 million by 2035 assumes a decade-long crisis but aligns with BTC’s historical 50%–600% post-halving gains.

Should I Buy Bitcoin Now?

Dips near $80,000–$82,000 offer better entry points, given historical rebounds. Kiyosaki urges action: “Those who wait in fear may be the biggest losers.”

How Much Will Bitcoin Be Worth by 2025?

By year-end 2025, forecasts range from $145,000 (Bitfinex) to $200,000 (Standard Chartered), with Bernstein citing $150,000 as achievable. Liquidity surges ($6.5 trillion projected) and ETF flows ($70 billion expected) are key drivers. However, tariff risks or a debt ceiling resolution could cap gains, making $120,000–$150,000 a realistic target.

What Is the Realistic Bitcoin Price in 2030?

Predicting 2030 is challenging, but assuming continued adoption and liquidity trends, Bitcoin could range from $300,000 to $500,000. This accounts for historical cycle growth (e.g., 600% post-2020 halving), institutional uptake, and potential U.S. BTC reserves. Kiyosaki’s $1 million by 2035 implies a 2030 price of $400,000–$600,000 if growth accelerates during economic turmoil. Geopolitical risks or regulatory shifts could lower this to $200,000.

Will Bitcoin Reach $10 Million?

A $10 million Bitcoin price is highly unlikely, even by 2035. Kiyosaki’s $1 million forecast assumes a “Greater Depression” and massive fiat devaluation, but $10 million would require unprecedented hyperinflation or global adoption far beyond current trends. For perspective, $10 million per BTC implies a $200 trillion market cap—over twice the current U.S. GDP. While bullish, this exceeds realistic scenarios.

What Will Bitcoin Be Worth in 5 Years’ Time?

By April 2030, Bitcoin could realistically trade between $250,000 and $500,000, driven by post-2028 halving dynamics, ETF growth, and corporate adoption. Lyn Alden’s liquidity correlation suggests BTC could benefit from $7 trillion+ in global liquidity by 2030. Kiyosaki’s $1 million by 2035 implies a 2030 price closer to $400,000, but macro risks like trade wars could limit it to $200,000.