How High Can XRP Go? Experts Predict 500% XRP Price Jump by 2028

XRP, the native token of Ripple’s XRP Ledger, is stealing the spotlight in 2025. After surging 600% from November 2024 to January 2025, it’s now consolidating around $2 Yet, a blockbuster prediction from Standard Chartered (Stan Chart) has reignited excitement: XRP could hit $12.50 by 2028, a 500%+ leap from today’s levels.

Even more audacious, the bank sees XRP overtaking Ethereum’s (ETH) market cap, potentially becoming the second-largest non-stablecoin crypto behind Bitcoin (BTC).

But how realistic is this forecast? What’s fueling XRP’s potential ascent, and what risks lie ahead? In this in-depth guide, we’ll unpack Standard Chartered’s bullish outlook, analyze the market dynamics propelling XRP, and provide actionable insights.

From regulatory wins to technical signals, here’s everything you need to know about XRP’s trajectory in 2025 and why the XRP price is going up.

Why Will XRP Surge? Standard Chartered’s $12.50 Prediction

Geoffrey Kendrick, Standard Chartered’s Global Head of Digital Assets Research, laid out a multi-year roadmap for XRP that’s turning heads. In a recent report from this week, Kendrick projects:

- 2025: $5.50, over 200% jump from $2.

- 2026: $8.00, up 44% year-over-year.

- 2027: $10.40, nearing double-digit territory.

- 2028: $12.50, a 500% rise from today, with XRP potentially flipping Ethereum’s market cap.

- 2029: A slight dip to $12.25, stabilizing at lofty levels.

You may also like: How Low Can Bitcoin Go? This Expert Predicts BTC Price Drop to $10,000

Kendrick’s optimism isn’t blind hype—it’s grounded in three pivotal drivers: regulatory clarity, cross-border payment utility and tokenization and ETF potential.

- Regulatory Clarity: Ripple’s legal saga with the U.S. Securities and Exchange Commission (SEC) took a decisive turn in 2025 when the SEC dropped its appeal. “This was expected after Trump’s crypto-friendly administration took hold,” Kendrick noted. A clearer regulatory path removes a long-standing overhang, boosting investor confidence.

- Cross-Border Payment Utility: XRP’s core strength lies in facilitating fast, low-cost international transactions. Kendrick compares its role to stablecoins, citing their 50% annual transaction volume growth. “XRP’s blockchain is a payments chain,” he said, projecting similar adoption curves. Ripple’s partnerships with institutions like Santander and SBI Holdings reinforce this edge.

- Tokenization and ETF Potential: Ripple is diving into asset tokenization, including U.S. Treasury bill funds and its stablecoin, RLUSD. Kendrick also anticipates SEC approval for a spot XRP ETF by Q3 2025, potentially unlocking $4–8 billion in inflows within the first year. “This would legitimize XRP for institutional and retail investors,” he added.

XRP to hit $5.5 by '25 & $12.5 by '28? 🚀💸 Standard Chartered thinks so, citing Ripple's cross-border payments strength 💰 pic.twitter.com/xRJkjdpdPw

— Halvings.org (@Halvings_org) April 10, 2025

However, Kendrick acknowledges hurdles. XRP’s developer ecosystem lags behind Ethereum’s, and its low-fee model may cap value capture. Still, he believes these are outweighed by XRP’s real-world utility and market tailwinds.

XRP Price Is Up Today

As of Saturday, April 12, 2025, one XRP is trading at $2.05 on the Bitstamp exchange, reflecting a 0.16% increase since the start of the session. This continues the upward momentum from Friday, when the token surged by nearly 3%.

Over the past 24 hours, XRP has gained approximately 3%, pushing its market capitalization to nearly $120 billion. The daily trading volume exceeds $3 billion.

Why Is XRP Going Up? The 5 Main ReasonsssWhy Is

XRP’s potential isn’t just about one bank’s forecast. A confluence of factors is setting the stage for a breakout, offering retail investors a compelling case to watch closely:

1. Regulatory Tailwinds

The SEC’s decision to pause its Ripple appeal, combined with President Trump’s pro-crypto policies, has shifted sentiment. Trump’s proposed strategic crypto reserve—though initially excluding XRP—signals broader market support that could lift all boats.

2. Institutional Adoption

Ripple’s XRP Ledger is gaining traction for cross-border remittances. Banks in Japan, Latin America, and the Middle East are testing XRP for liquidity provisioning via RippleNet’s On-Demand Liquidity (ODL) service.

3. ETF Hype

The U.S. launch of a leveraged XRP ETF in 2025, while not a spot product, sparked buzz. Bloomberg’s Eric Balchunas called it a sign “nature is healing” for crypto’s bold predictions. A spot ETF approval could drive billions in inflows, mirroring Bitcoin’s ETF-fueled rally in 2024.

4. Tokenization Ambitions

Ripple’s push into tokenized assets—like Treasury bills and RLUSD—positions XRP as a backbone for next-gen finance. Kendrick sees the XRP Ledger evolving into a “tokenization chain,” amplifying its utility beyond payments.

5. Market Resilience

Despite a 7.4% drop in 24 hours amid Trump’s tariff-induced selloff, XRP’s $1.75 support held firm.

"Honestly, it’s hard to justify XRP rallying nearly 4x since November while Ethereum, a technically superior and far more widely adopted platform, has dropped almost 40% in the same timeframe," Dr. Kirill Kretov at CoinPanel commented for FinanceMagnates.com. "I'm starting to think ETH underperformance and XRP overperformance are more connected than they seem."

How High Can XRP Go? Technical Analysis and Historical Context

Standard Chartered’s $12.50 call implies a market cap nearing $700 billion—nearly seven times XRP’s current $100 billion. Is this feasible? Let’s break it down with technicals and history.

Technical Analysis

Based on my technical analysis, XRP’s price chart reveals a bearish regression channel forming since the January 2025 highs, characterized by lower highs and lower lows. The lower boundary of this channel was tested earlier this month, providing a foundation for XRP’s recent bounce. The upper boundary currently sits near $2.52, which I view as the short-term upside target for the token.

Additionally, I’ve mapped out a grid of support and resistance levels. The key support zone lies at the February and April 2025 lows around $1.77, reinforced by the psychological $2.00 level tested in December 2024, as well as significant activity between late February and early March 2025.

On the resistance side, the first hurdle is at $2.59, aligning with the upper edge of the bearish regression channel and local highs from mid-March 2025. The next resistance zone spans $2.87–$2.99, defined by peaks from December 2024 and March 2025. The ultimate resistance is at $3.40, marking this year’s high.

Support and Resistance Levels

Type | Price Level | Description |

Support | $1.77 | February and April 2025 lows, a critical base for recent price action. |

Support | $2.00 | Psychological level, tested in December 2024, with activity in Feb–Mar 2025. |

Resistance | $2.52 | Upper boundary of the bearish regression channel, short-term upside target. |

Resistance | $2.59 | Mid-March 2025 local highs, near the channel’s upper edge. |

Resistance | $2.87–$2.99 | Zone defined by December 2024 and March 2025 peaks. |

Resistance | $3.40 | 2025 yearly high, the ultimate ceiling for bullish momentum. |

Historical Context

XRP’s past offers perspective:

- 2017–2018: XRP soared 36,000% to $3.40, driven by crypto mania, before crashing 80%.

- 2024–2025: A 580% rally from $0.50 to $3.00 post-Trump’s election shows XRP’s volatility. A 500% jump to $12.50 is bold but not unprecedented if adoption scales.

What Could Derail XRP’s Rally? Risks to Watch

No forecast is bulletproof. Here are the key risks for retail investors to monitor:

- Macroeconomic Turbulence: Trump’s tariffs—potentially 60% on Chinese imports—are spooking markets. A global trade slowdown could sap crypto liquidity, capping XRP’s upside.

- Regulatory Reversal: While Trump’s administration leans pro-crypto, a policy shift or SEC crackdown could stall ETF approvals, denting sentiment.

- Competition: Stablecoins like USDT and SWIFT’s blockchain experiments threaten XRP’s payment niche. If banks pivot to alternatives, demand could wane.

- Technical Weakness: A break below $1.75 could trigger a slide to $1.30, per Martinez’s bearish scenario. Retail investors should set stop-losses to manage downside.

- Developer Ecosystem: Kendrick flags XRP’s smaller dev community as a bottleneck. Ethereum’s robust ecosystem could keep it ahead unless Ripple scales innovation.

Why XRP Might Outshine Expectations

Despite risks, XRP’s fundamentals paint a rosy picture. Here’s why bulls are doubling down:

- Supply Dynamics: XRP’s 57 billion circulating supply (of 100 billion total) limits dilution compared to inflationary tokens. A $12.50 price implies strong demand, not token bloat.

- Institutional Backing: Firms like Grayscale and Bitwise are filing for XRP ETFs, signaling confidence.

- Global Reach: Ripple’s 70+ country footprint, from Japan to the UAE, gives XRP a head start in emerging markets.

- Historical Resilience: XRP weathered a multi-year SEC lawsuit and still hit $3.00 in 2025. Its ability to rebound is unmatched.

XRP Price Predictions 2025–2028

The bank’s Geoffrey Kendrick emphasizes the XRP Ledger’s potential to evolve into a tokenization hub, projecting a market cap that could rival Ethereum’s. This trajectory assumes robust institutional adoption and sustained global demand for efficient payment solutions, though it acknowledges risks like a smaller developer ecosystem.

Source | 2025 | 2026 | 2027 | 2028 | Key Drivers |

Standard Chartered | $5.50 | $8.00 | $10.40 | $12.50 | ETF inflows, regulatory clarity, payment utility |

CoinPedia | $5.81 | $8.60 | - | - | RippleNet growth, banking adoption |

Changelly | $2.05 | - | - | $7.10 | Conservative macro outlook, market volatility |

Egrag Crypto | $17.00 | - | - | - | Technical patterns, $3.40 breakout |

CoinPedia aligns closely with Standard Chartered for 2025, predicting $5.81, and edges slightly higher to $8.60 by 2026. Their analysis focuses on RippleNet’s expanding footprint in banking, particularly in Asia and Latin America, where institutions are leveraging XRP for liquidity.

Changelly takes a more conservative stance, projecting $2.05 for 2025 and $7.10 by 2028. This restrained outlook accounts for potential volatility from global trade tensions and a slower pace of institutional uptake.

Egrag Crypto delivers the boldest call, forecasting a staggering $17.00 by 2025. This technical-driven prediction stems from chart patterns, notably a future breakout above $3.40, which Egrag sees as a launchpad for exponential gains.

Others also liked: Will XRP Go Up? New Price Forecasts Show If XRP Can Reach $100

How Thin Markets Could Amplify XRP’s Next Move

Kretov from CoinPanel also broke down the trading dynamics that could make XRP a volatile standout in today’s crypto landscape.

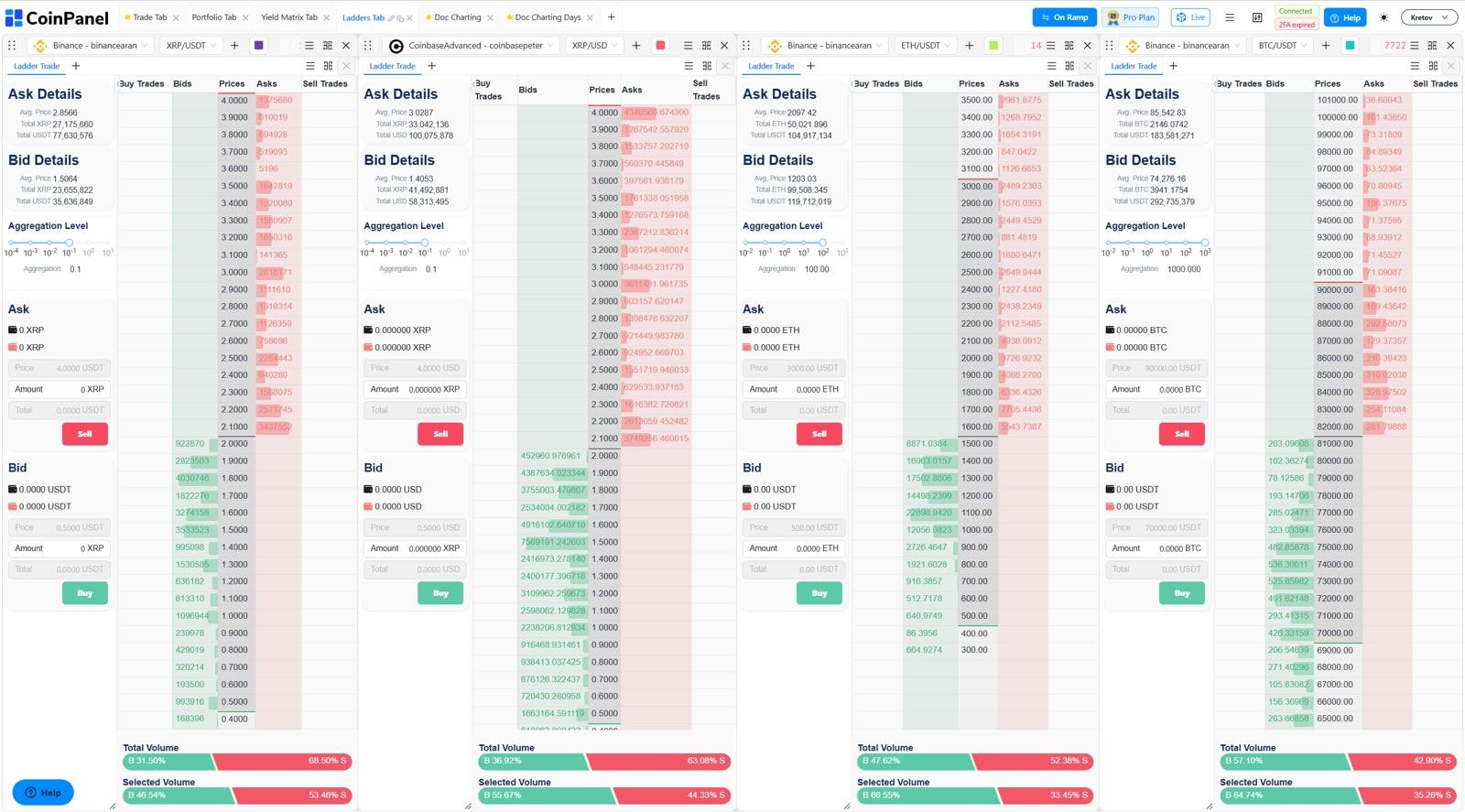

“In thin markets, miracles are always possible, especially when large players are involved,” Kretov explains. “But charts only show the consequences of decisions, not the decisions themselves.” To get to the heart of XRP’s potential, he analyzed the order books for XRP/USDT on Binance and XRP/USD on Coinbase, asking a simple question: What would it take to double XRP’s price, say, from $2 to $4?

The numbers are striking. “On Binance, you’d need roughly $77.6 million to clear the sell side and reach $4, about 27 million XRP in the book,” Kretov notes. “On Coinbase, it’s a bit thicker—around $100 million for the same 2x move, or 33 million XRP.” While these figures sound hefty, they pale in comparison to other major cryptocurrencies. For perspective, doubling Ethereum’s price would also require about $100 million, but ETH benefits from deep liquidity across decentralized exchanges and DeFi platforms. Bitcoin? A mere 10% upward move on Binance’s BTC/USDT pair would demand nearly $200 million in market orders.

This disparity highlights XRP’s unique position. “This illustrates how much easier it is to move altcoin prices like XRP than it is with BTC or ETH,” Kretov says. In illiquid conditions, a single whale—or even a well-timed event—could trigger a dramatic repricing. A $100 million buy, for instance, could jolt XRP’s price, spark headlines, and inflate its perceived market cap, even if the surge isn’t sustainable. However, Kretov warns of the ripple effects: “A purchase that large would cause slippage, arbitrage across exchanges, and attract fresh liquidity, so the effect wouldn’t be permanent.”

XRP Price Prediction: FAQ

How High Can XRP Go by 2028?

Standard Chartered’s $12.50 target implies a 592% rise from $1.80, driven by ETF approvals and payment adoption. “XRP’s market cap could hit $700 billion,” Kendrick says. More conservative estimates, like Changelly’s $7.10, reflect macro risks. A $5–$15 range feels balanced.

What If I Bought $100 of XRP Today?

At $1.80, $100 buys 55.56 XRP. If it hits $12.50 by 2028, that’s $694—a 594% return. Even at $5.50 (2025), it’s $305. But a drop to $1.30 could shrink it to $72. Diversify to manage risk.

Is XRP a Good Investment in 2025?

XRP’s utility, ETF buzz, and regulatory wins make it compelling. With $1.75 support holding, $100–$500 entries suit risk-tolerant investors. Watch tariffs and technicals before jumping in.

Can XRP Really Flip Ethereum?

Kendrick’s claim hinges on XRP’s market cap ($100 billion) surpassing Ethereum’s ($183 billion) by 2028. “XRP’s payment focus gives it an edge over Ethereum’s broader scope,” he argues. Skeptics point to Ethereum’s developer moat, but XRP’s momentum is undeniable.

Is XRP the Future of Payments?

With RippleNet processing $1 billion monthly, XRP’s speed (3–5 seconds) and low fees ($0.0002) rival SWIFT.

Stay ahead of the crypto curve! Dive into the latest XRP market insights and expert analysis on FinanceMagnates.com.