Cyprus Regulator Suspends Conotoxia Ltd’s Investment License Over Compliance Gaps

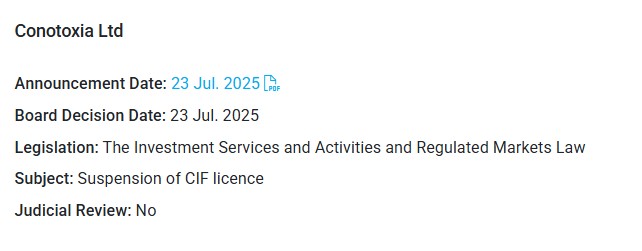

The Cyprus Securities and Exchange Commission (CySEC) has suspended the Cyprus Investment Firm (CIF) license of Conotoxia Ltd, citing concerns about the company’s compliance with legal and regulatory requirements.

The suspension follows suspicions that Conotoxia failed to meet key governance, shareholder suitability, and organizational standards under the Cyprus investment law.

CySEC’s decision, announced today (Tuesday), stops Conotoxia from conducting investment services, entering new business transactions, or advertising as a licensed provider.

Reasons Behind the Suspension

CySEC identified several violations involving failure to comply with the conditions required for CIF authorisation, notably regarding the composition and control of Conotoxia’s board of directors, the suitability of shareholders, and organizational safeguards for client protection.

Related: Cinkciarz.pl Chief Accountant Arrested in Alleged $25M Fintech Fraud Case

At the time of this publication, Financemagnates.com has confirmed that the websites of both Cinkciarz.pl, a Polish online currency exchange brand owned by Conotoxia Holding Group, and Conotoxia Ltd., its Cyprus-based subsidiary, are offline.

During the suspension, Conotoxia cannot offer or carry out any investment services or accept new clients. The firm is also barred from promoting itself as an investment services provider.

This move aligns with CySEC’s broader enforcement strategy to ensure that Cyprus-based financial firms comply strictly with governance and operational rules.

Regulatory Context

Conotoxia now faces a one-month deadline to implement necessary changes to address the regulatory breaches. Failure to resolve issues could result in the permanent withdrawal of the authorisation.

CySEC’s action sends a clear message to investment firms operating in Cyprus: robust compliance with legal and organizational standards is mandatory. Firms that neglect these requirements risk suspension, which disrupts business continuity and erodes client trust.

Investors and market participants should monitor regulatory announcements closely and exercise caution when dealing with CIFs under CySEC scrutiny. The intense regulatory environment within Cyprus underscores the importance of transparency and governance in maintaining market confidence.

Read more: Cinkciarz.pl Loses Dispute with KNF, Accuses Court of Protecting “Civil Service Caste” in Poland

Last month, Polish authorities arrested Cinkciarz.pl's chief accountant concerning an alleged fraud scheme that prosecutors claim cost customers over 112 million zloty ($25 million).

This development followed the Warsaw Administrative Court's recent dismissal of an appeal by Conotoxia sp. z o.o., a Cinkciarz.pl subsidiary, against the Polish Financial Supervision Authority's (KNF) decision to revoke its payment services license.

In February, Cinkciarz.pl announced the closure of its Polish branch. This announcement coincided with the temporary suspension of operations by the company following an investigation by Polish prosecutors over complaints from approximately 1,200 fintech clients.