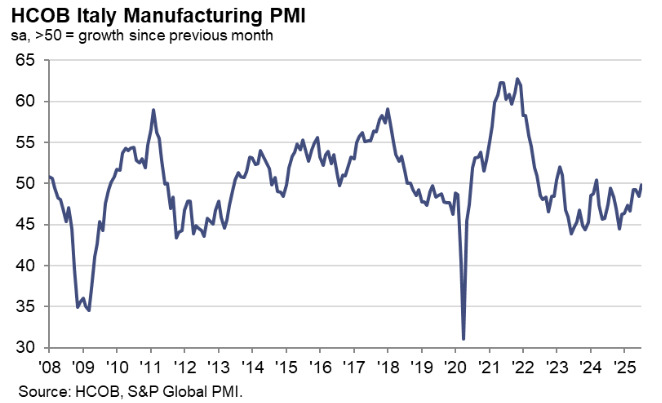

Italy July manufacturing PMI 49.8 vs 49.0 expected

- Prior was 48.4

Key findings:

- Softer declines in output and new orders

- Input stocks rise for the first time in nearly three years

- Prices back in inflation territory

Comment:

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“Italy’s manufacturing sector showed tentative signs of stabilisation in July, with the HCOB PMI rising to 49.8 from 48.4 in June. Although the headline index remained just below the 50.0 threshold that separates growth from contraction, the softer declines in output and new orders suggest that the worst of the recent downturn may be behind us. Notably, the investment goods segment registered an improvement in business conditions, bucking the broader trend of decline.

“In July, Italian manufacturers began rebuilding input inventories for the first time in nearly three years – a development that may reflect a shift in sentiment. While firms reported that part of this stock accumulation was driven by supply chain concerns and lower order numbers, it also coincided with a marked improvement in business confidence. With optimism among manufacturers rising to levels above the long-run average, some firms may be positioning themselves for a potential recovery in demand later in the year. In past cycles, such inventory rebuilding often signalled that the downturn is nearing its bottom.

“Overall, July’s data suggest that Italy’s manufacturing sector may be approaching a turning point. The recent EU–US trade agreement has prevented a sharp escalation in tensions and provides a welcome dose of planning certainty for Italian exporters. However, while the deal replaces the threatened 30 percent tariff with a reduced 15 percent duty on selected industrial goods, this rate remains substantial and continues to put Italian firms at a competitive disadvantage in the US market. How long this agreement will hold remains uncertain – especially given the volatility of recent US trade policy and the possibility that the terms could shift again.”