Key events for the week 14-18 April

UPCOMING EVENTS:

- Monday: New Zealand Services PMI, NY Fed Consumer Inflation Expectations.

- Tuesday: RBA Meeting Minutes, UK Employment Report, German ZEW, Canada CPI.

- Wednesday: Japan Tankan, China Industrial Production and Retail Sales, UK CPI, US Retail Sales, US Industrial Production and Capacity Utilisation, BoC Policy Announcement, US NAHB Housing Market Index, Fed Chair Powell.

- Thursday: New Zealand Q1 CPI, Australia Employment report, ECB Policy Announcement, US Housing Starts and Building Permits, US Jobless Claims.

- Friday: Japan CPI (Good Friday Holiday)

Tuesday

The UK Unemployment Rate is expected to remain unchanged at 4.4%. The Average Earnings are expected at 5.7% vs. 5.8% prior, while the Ex-Bonus Earnings are seen at 6.0% vs. 5.9% prior. The data is unlikely to influence market expectations as the focus remains on the tariff negotiations and the US-China developments. The market is currently pricing 76 bps of easing by year-end with an 85% probability of a 25 bps cut at the upcoming meeting.

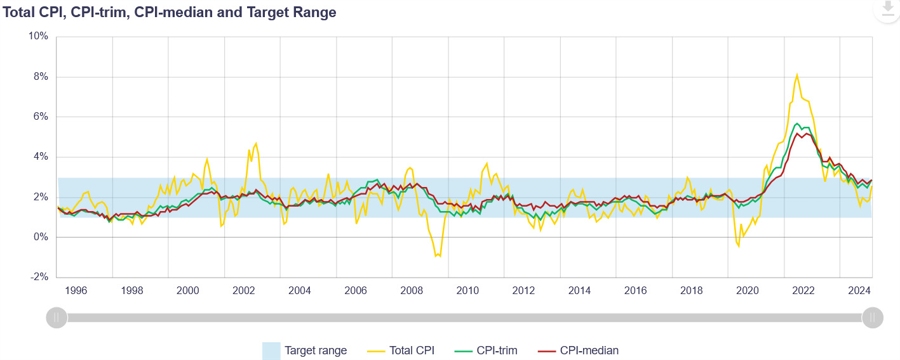

The Canadian CPI Y/Y is expected at 2.6% vs. 2.6% prior, while the M/M reading is seen at 0.6% vs. 1.1% prior. The Trimmed-Mean CPI Y/Y is expected at 3.0% vs. 2.9% prior, while the Median CPI Y/Y is seen at 3.0% vs. 2.9% prior.

Inflation has been moving higher recently after the aggressive BoC easing and the tariffs are expected to keep inflation higher while weighing on growth. The market sees 36 bps of easing by year-end with a 61% probability that the central bank will hold rates unchanged this week.

Wednesday

The UK CPI Y/Y is expected at 2.7% vs. 2.8% prior, while the M/M reading is seen at 0.4% vs. 0.4% prior. The Core CPI Y/Y is expected at 3.5% vs. 3.5% prior, while Services CPI Y/Y is seen at 4.9% vs. 5.0% prior.

Again, the data this month is unlikely to influence market’s expectations that much as the focus remains on tariff negotiations. The market is currently pricing 76 bps of easing by year-end with an 85% probability of a 25 bps cut at the upcoming meeting.

The US Retail Sales M/M is expected at 1.4% vs. 0.2% prior, while the ex-Autos figure is seen at 0.4% vs. 0.3% prior. The focus will be on the Control Group figure which is expected at 0.6% vs. 1.0% prior.

Consumer spending has been stable in the past months which is something you would expect given the positive real wage growth and resilient labour market. More recently though, we’ve been seeing some marked easing in consumer sentiment due to the ongoing trade wars which could weigh on spending going forward.

The BoC is expected to keep rates unchanged at 2.75%. As a reminder, the BoC cut interest rates by 25 basis points to 2.75% as expected at the last meeting amid concerns over weaker growth ahead due to the trade uncertainty and US tariffs. The central bank emphasized a cautious approach to future decisions, balancing the upward pressure on inflation against the downward pressure on weaker demand. The market expects just one last cut by year-end.

Thursday

The New Zealand Q1 CPI Y/Y is expected at 2.3% vs. 2.2% prior, while the Q/Q figures is seen at 0.7 vs. 0.5% prior. The market sees 103 bps of easing by year-end with a 72% probability of a 50 bps cut at the upcoming meeting. All these market expectations about interest rates were influenced by the global market rout following Trump’s aggressive tariffs. That’s where the focus is now. A reversal or easing in the trade war would diminish the aggressive rate cuts expectations.

The Australian Employment report is expected to show 35K jobs added in March vs. -52.8K in February, and the Unemployment Rate to tick higher to 4.2% vs. 4.1% prior. The US trade war and the global market selloff pushed the market to expect 107 bps of easing by year-end with a 40% probability of a 50 bps cut at the upcoming meeting.

The ECB is expected to cut by 25 bps bringing the deposit rate to 2.25%. The market then expects at least two more rate cuts by year-end. Interest rates expectations have been shaped by the ongoing trade war and the recent 90-days pause for reciprocal tariffs helped to alleviate the aggressive pricing. Again, it’s all about the trade war now as the data remains old news.

The US Jobless Claims continue to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

Initial Claims remain inside the 200K-260K range created since 2022, while Continuing Claims hover around cycle highs.

This week Initial Claims are expected at 226K vs. 223K prior, while there’s no consensus for Continuing Claims at the time of writing although the prior release saw a decrease to 1850K vs. 1893K prior.

Friday

The Japanese Core CPI is expected at 3.2% vs. 3.0% prior. Given the global market rout and aggressive risk off sentiment, traders scaled back their rate hikes expectations and they now see the BoJ remaining on hold for the rest of the year. Of course, this is all connected to the trade war so an easing and positive developments on that front should increase the expectations for a rate hike by year-end.