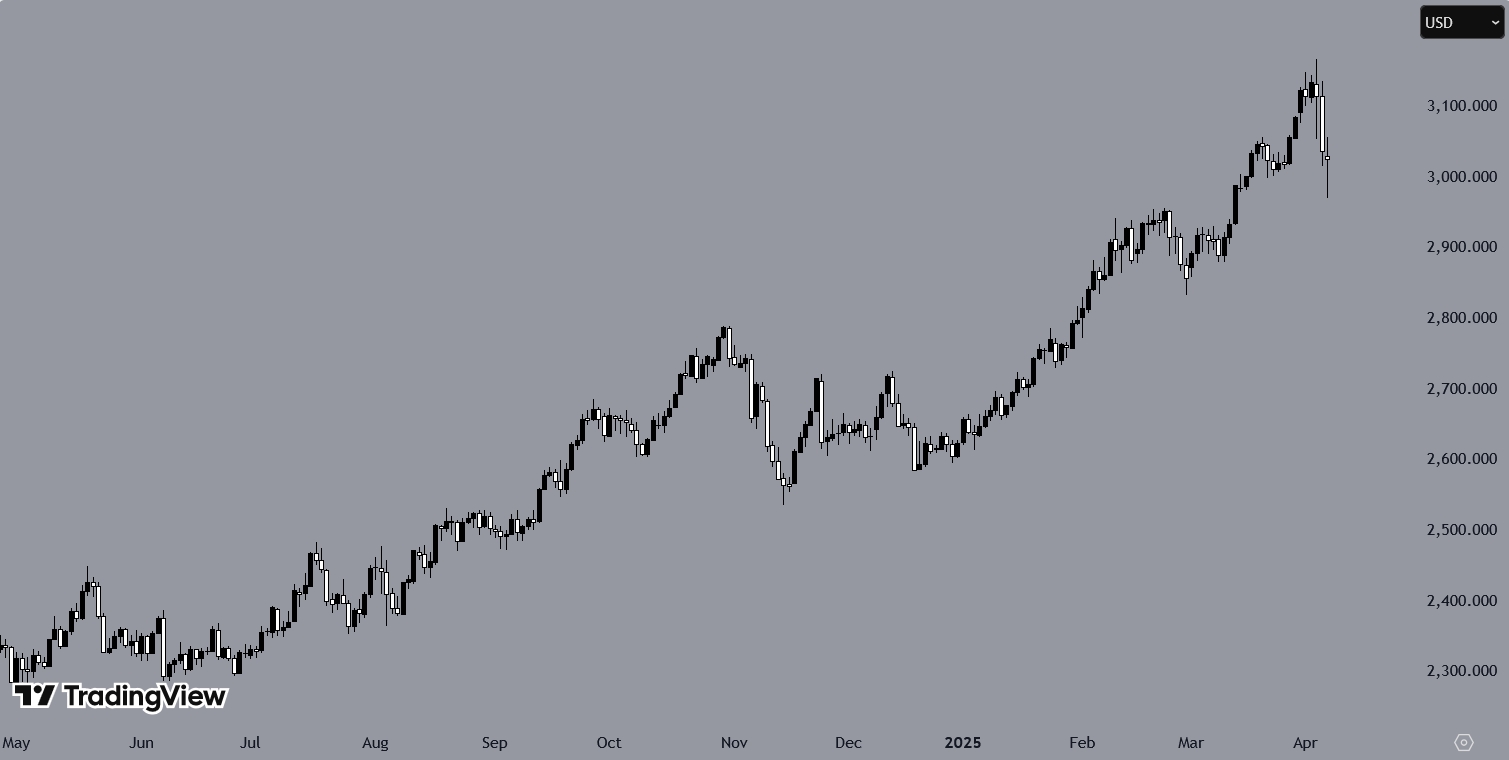

Gold Falls Below $3000 as Trump's Tariffs Trigger Global Selloff

Gold prices continued to fall on Monday (today), puzzling investors who typically view the metal as a safe-haven asset during times of crisis. Spot gold dipped below $3000, marking its third consecutive session of losses.

The decline follows a more than 3% drop on Friday, when US President Donald Trump’s broad tariff measures triggered widespread market turmoil. Nearly $6 trillion in value was wiped from US stocks last week, amplifying concerns about a looming global recession.

Tariff Fears Spark Gold Liquidation Wave

Despite mounting fears of an economic downturn, investors appear to be liquidating gold holdings. Analysts attribute the move to profit-taking and margin calls across other asset classes, forcing some investors to sell gold to cover broader losses.

Trump’s 10% blanket tariff on imports is now in effect, with steeper levies for several countries expected later this week. The escalating trade war has fuelled volatility in financial markets and added pressure on policymakers.

Federal Reserve Chair Jerome Powell warned that the tariffs could heighten inflation risks and slow economic growth, underlining the complex challenge facing the US economy.

BREAKING:

— Current Report (@Currentreport1) April 3, 2025

Gold price hits $3200, a record high after US President Trump announced aggressive reciprocal tariffs, sparking fears of a full-blown global trade war and prompting investors to seek safe-haven assets. pic.twitter.com/Xt49mz57ZL

You may find it interesting at FinanceMagnates.com : Trump’s Tariffs, Global Market Chaos: Is This the New Black Monday?

Gold Forecast Faces Uncertainty After Recent Decline

Jeffrey Gundlach, CEO and Chief Investment Officer of DoubleLine Capital, recently projected that gold prices could reach $4,000 per ounce. Speaking during an investor call, he highlighted the metal’s strong upward momentum, which began around the $1,800 level and saw gold surpass the $3,000 mark for the first time.

Gold’s going to reach $4,000, recession probability at 60%, says Gundlachhttps://t.co/40sYZ8PmZh

— David Lee (@DavidLe76335983) March 16, 2025

Gundlach pointed to sustained central bank buying as a key driver, framing gold as a store of value amid financial system uncertainty.

However, market conditions have shifted. The recent broad-based selloff has pressured gold prices, pushing them to $2,975. This reversal has raised questions about the near-term path for gold and whether Gundlach’s $4,000 target remains achievable under current market stress.