XRP Hits $2 as Trump Announces 90-Day Tariff Suspension on Trading Partners

President Donald Trump announced a temporary suspension of tariffs on many US trading partners while increasing tariffs on Chinese imports. The decision came less than 24 hours after new tariffs had triggered a global market decline.

The White House confirmed that tariffs on countries willing to negotiate would be paused for 90 days. During this period, the US aims to strike new trade deals.

Following the announcement, XRP saw a sharp increase, climbing over 10%. The cryptocurrency reached a three-day high of $2.09235, regaining the $2 psychological level.

XRP Price Rebounds Following Tariff Suspension

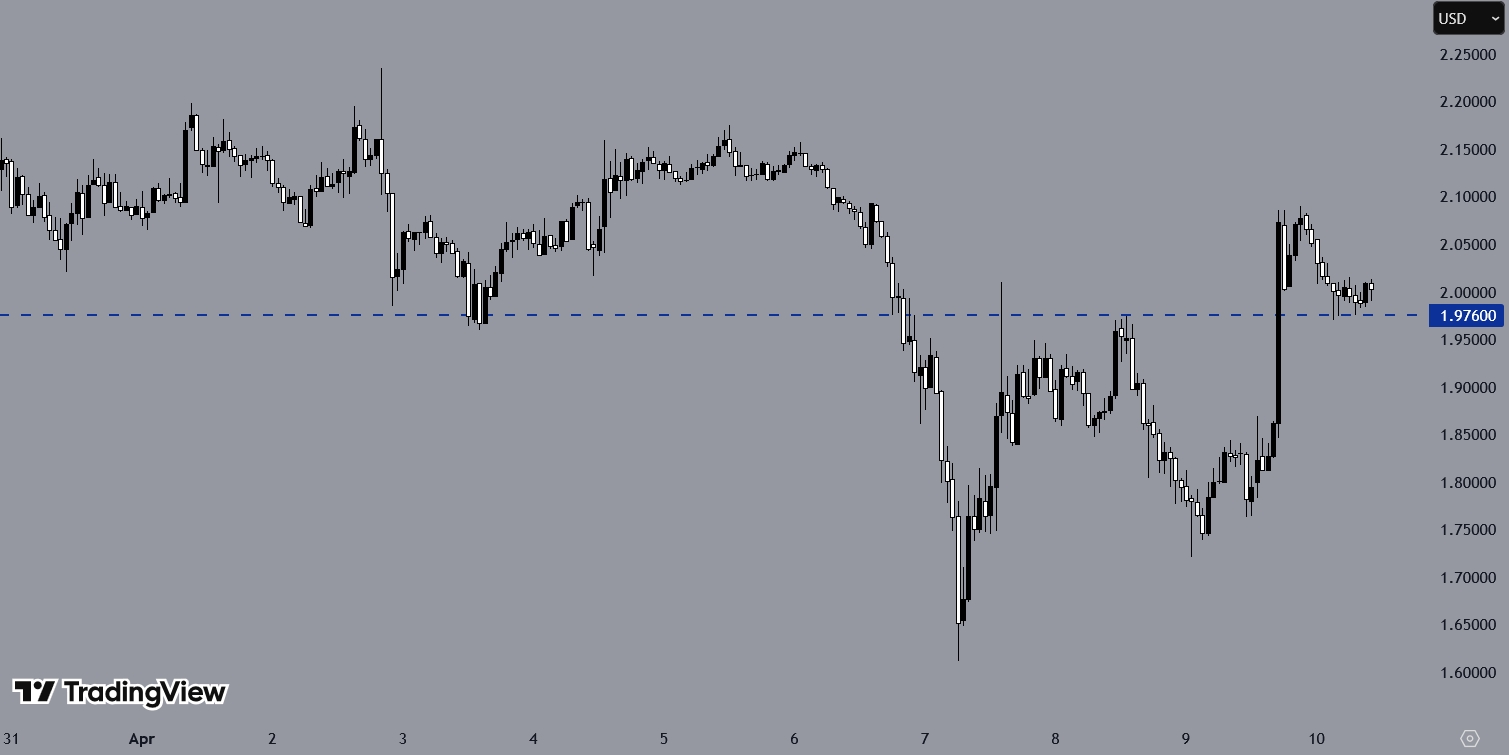

The XRPUSD H1 chart indicates that the price was initially below 1.97600 and trending downward. However, it found support at 1.74300 and made a strong bullish move. As it rose, the price breached the 1.97600 level and traded above it for some time. This level could act as support, potentially attracting intraday buyers to go long above it.

Conversely, if the price breaks the support, it may move downward again. However, the tariff suspension could discourage sellers from taking short positions.

You may want to read at financemagnates.com: Is XRP Going Up as Trump’s Tariffs Raise Talk of Global Financial Shift?

Ripple Acquires Hidden Road for $1.25 Billion

Meanwhile, Ripple has acquired Hidden Road for $1.25 billion, a move that could enhance its position in the crypto market and support potential growth for XRP. The acquisition makes Ripple the first crypto company to own and operate a global, multi-asset prime broker.

Today, Ripple announced it is acquiring Hidden Road for $1.25B– becoming the first crypto company to own and operate a global, multi-asset prime broker. Together, Ripple and Hidden Road are bringing the promise of digital assets to institutional customers at scale, bridging…

— Ripple (@Ripple) April 8, 2025

Hidden Road provides services such as clearing, prime brokerage, and financing across foreign exchange, digital assets, derivatives, swaps, and fixed income.

The acquisition is intended to support the next phase of growth in the crypto industry by providing infrastructure for institutional adoption. Prime brokers are seen as essential for bridging traditional finance and decentralized finance.