Bitcoin Correction, Fed Policy, and “Weimar Lite”: Analyst Warns of Volatile Decade

Bitcoin’s recent price drop is seen as a healthy market reset, driven by seasonal trends and broader market weakness. Institutional demand is expected to support the next rally, while U.S. monetary policy could lead to a “Weimar Lite” decade, marked by currency weakness, rising inequality, and high asset prices.

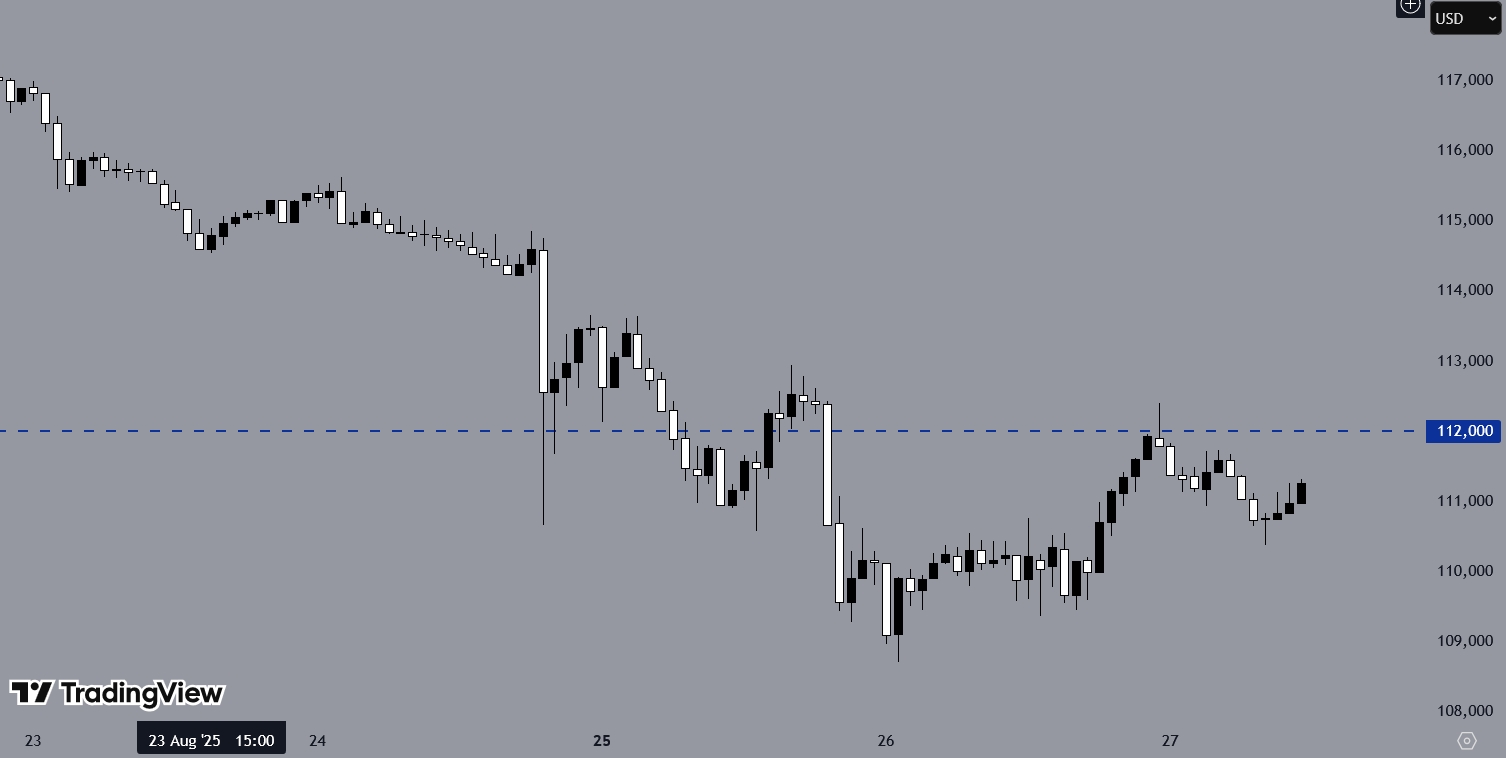

BTCUSD, after showing bearish pressure on the H1 chart, found intraday support and began moving upward. The 112K level has acted as resistance, causing a prior rejection. At the time of writing, the cryptocurrency has established support and is once again approaching the resistance level. can I use it as the opening

Bitcoin Correction Signals “Weimar Lite” Risks

Financial analyst John Pompiano has outlined his views on Bitcoin, U.S. monetary policy, and the long-term direction of the economy in a recent podcast interview. His analysis focused on the current correction in Bitcoin prices, expectations of Federal Reserve policy shifts, and what he described as a “Weimar Lite” decade for the United States.

Bitcoin Price Reset

Bitcoin has fallen from its recent highs. Pompiano linked the decline to two forces. The first is seasonality. September has been the only month in which Bitcoin has consistently posted negative returns. The second is weakness across broader markets. The S&P 500 and other risk assets have also pulled back, which has pressured Bitcoin.

You may find it interesting at FinanceMagnates.com: Bitcoin Bounces; Analyst Predicts BTC Could Reach $170K at Cycle Peak.

He described the decline as a healthy reset. A constant upward move, he argued, would fuel leverage and create a sharper downturn later. This correction, in his view, clears excess leverage and builds a base for a future rally. He still projects Bitcoin could reach $150,000 in the current cycle.

Institutional Buying Ahead

Pompiano expects corporate treasuries to play a key role in the next phase of Bitcoin’s rise. He said several companies have signaled intentions to allocate funds to Bitcoin. He believes this could add billions in new demand and attract broader media coverage.

Federal Reserve Policy

Turning to monetary policy, Pompiano interpreted Federal Reserve Chair Jerome Powell’s Jackson Hole comments as a sign that rate cuts will begin in September. He said the central bank is under heavy pressure to ease policy.

Pompiano disagreed with the Fed’s stated reasoning that the labor market is weakening. He argued that productivity gains from artificial intelligence and digital systems are not captured in traditional employment data. In his view, this makes the economy stronger than official statistics suggest.

“Weimar Lite” Outlook

For the long term, Pompiano predicted a period he called “Weimar Lite.” He said rate cuts and continued monetary expansion will weaken the currency, widen wealth inequality, drive up asset prices, and make housing less affordable. While not expecting full hyperinflation, he warned of significant distortions across markets.

Bitcoin as a Hedge

Pompiano framed Bitcoin as a hedge in this scenario. With a fixed supply, he described it as the asset most responsive to global money supply growth. He believes this makes Bitcoin a key protection against currency debasement in the coming decade.

If lower, this is the best support on Bitcoin.

— BitcoinHyper (@BitcoinHypers) August 21, 2025

Most will probably get scared: https://t.co/ogEFY1qo9A pic.twitter.com/CTZZXLHSXp

Bitcoin Faces Bearish Pressure, Analysts Warn

Crypto analyst BitcoinHyper outlined a potential bearish scenario for Bitcoin after a recent 10% drop and a brief rebound from daily support. Breaches of key weekly and horizontal supports signal a downtrend across 1-hour, 2-hour, and 4-hour charts.

BitcoinHyper sees a possible short-term rally to around $119,000, which could trigger a short squeeze, followed by a deeper correction toward $108,000, while a more severe scenario could push prices near $18,000. Oversold indicators suggest a temporary rebound, but the overall trend remains negative, prompting cautious long positions with tight stop-losses and selling into strength.

Separately, Ryan Lee, Chief Analyst at Bitget, expects Bitcoin to trade between $112,000 and $118,000 amid profit-taking and cautious sentiment. He noted that higher leverage in futures markets may increase volatility, while macroeconomic factors, including Federal Reserve decisions, could affect price direction. The market reflects a balance between rebound opportunities and potential further corrections.