BoC Governor Macklem: We have to be flexible and adaptable

Bank of Canada (BoC) Governor Tiff Macklem addressed the central bank’s policy outlook and answered questions from the media after the BoC paused its easing cycle in April.

BoC press conference key highlights

- The US policy could move back and forth.

- We considered the impact of US tariffs.

- What happens with inflation hinges on tariffs developments.

- Forecasting inflation has become more difficult.

- There is a lot of uncertainty. We're navigating carefully.

- We decided to leave the policy rate unchanged while looking at how US tariffs develop.

- We are just as worried by inflation being above 2% as it being below 2%.

- Use of the word "decisively" is not a code word for anything.

- We have to be flexible and adaptable.

- We are not giving further forward guidance because of current elevated uncertainty.

- It's premature to read anything structural into what we're seeing in the markets.

- Canadian financial institutions are well capitalised, and have some room to absorb volatility.

- There are ample forecasts regarding the range of outcomes from US tariffs.

- We did consider two options: hold rates, or cut by 25 bps.

This section below was published at 13:45 GMT to cover the Bank of Canada's policy announcements and the initial market reaction.

On Wednesday, the Bank of Canada (BoC) maintained its policy rate at 2.75%, a move that matched widespread market expectations.

BoC policy statement key highlights

- Monetary olicy report does not provide economic forecasts, cites uncertainty generated by US tariffs.

- Releases two scenarios on what could happen; first scenario envisages most tariffs being negotiated away, second scenario sees long-lasting global trade war.

- In the first scenario, Canadian and global growth weaken temporarily; Canadian inflation falls to 1.5% for a year, then returns to 2% target.

- Second scenario sees sharp global slowdown and increase in inflation; Canada enters significant recession, inflation rises above 3% in mid-2026 before returning to 2% target.

- Says in both scenarios, nominal neutral interest rate is estimated to be in midpoint of a 2.25% to 3.25% range.

- Says many other scenarios are possible.

- Annualized Q1 gdp seen at 1.8% (vs 2.0% in jan).

- Bank estimates that Q1 2025 output gap was between -1.0% and 0%.

Market reaction

The Canadian Dollar (CAD) gathers traction and drags USD/CAD to the area of daily troughs below the 1.3900 support, in a context of widespread weakness in the Greenback prior to the speech by Chief Powell.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.78% | -0.22% | -0.57% | -0.51% | -0.76% | -0.23% | -1.19% | |

| EUR | 0.78% | 0.60% | 0.23% | 0.26% | 0.26% | 0.57% | -0.41% | |

| GBP | 0.22% | -0.60% | -0.36% | -0.32% | -0.33% | -0.02% | -0.95% | |

| JPY | 0.57% | -0.23% | 0.36% | 0.06% | 0.12% | 0.39% | -0.67% | |

| CAD | 0.51% | -0.26% | 0.32% | -0.06% | 0.04% | 0.29% | -0.61% | |

| AUD | 0.76% | -0.26% | 0.33% | -0.12% | -0.04% | 0.28% | -0.62% | |

| NZD | 0.23% | -0.57% | 0.02% | -0.39% | -0.29% | -0.28% | -0.92% | |

| CHF | 1.19% | 0.41% | 0.95% | 0.67% | 0.61% | 0.62% | 0.92% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

This section below was published as a preview of the Bank of Canada's (BoC) monetary policy announcements at 09:00 GMT.

- Bank of Canada (BoC) is expected to keep its policy rate unchanged.

- The Canadian Dollar has been persistently appreciating vs. the US Dollar.

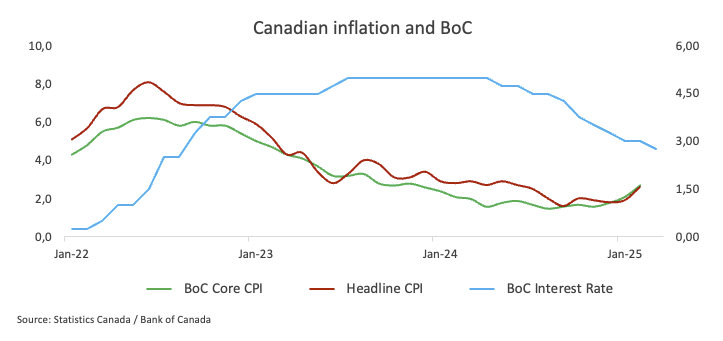

- Headline inflation in Canada returned to above the BoC’s target.

- Governor Macklem’s press conference is seen focusing on US tariffs.

All the attention is expected to be on the Bank of Canada (BoC) this Wednesday, as market experts widely anticipate the central bank to maintain its interest rate at 2.75%, halting seven consecutive interest rate cuts.

At the same time, the Canadian Dollar (CAD) has been gathering momentum in the last couple of weeks, appreciating the 1.3840 region vs. the US Dollar (USD) from monthly lows around the 1.4400 zone.

Since United States (US) President Trump returned to the Oval office in January, it has been all about his trade policies, in particular those regarding tariffs. This specific subject is predicted to dominate the BoC’s event, including comments from Governor Tiff Macklem as well as questions from the media.

The Bank of Canada is strategising a pause in its easing cycle for April as mounting global uncertainties—largely driven by the White House's erratic approach to tariffs—force a rethink of trade policies. This backdrop of unpredictability suggests that a cautious tone will likely define both the BoC’s statement and Governor Macklem's follow-up press conference this week.

At his most recent news conference on March 20, Governor Macklem explained that the ambiguity surrounding the impact of US tariffs had compelled the bank to adjust its monetary policy, making it less forward-looking than usual. He stressed that despite these challenges, there was no doubt about the bank's unwavering commitment to maintaining low inflation.

In addition, from the central bank’s Business Outlook Survey published on April 7, Canadian firms and consumers are now bracing for a much higher risk of recession in the coming year, as US President Trump's tariffs and potential retaliatory measures fuel widespread uncertainty. According to the survey, many companies have paused their investment and hiring plans, with employment expectations now lower than at any point during the pandemic.

The BoC noted that businesses no longer anticipate a slowdown in rising input prices—a notable shift from recent trends—suggesting that inflationary pressures are likely to intensify. In fact, inflation in Canada surged to an eight-month high of 2.6% in February. The survey revealed that 65% of firms expect their costs to climb if tariffs become more widespread, leading 40% of respondents to plan an increase in their selling prices.

Previewing the BoC’s interest rate decision, analysts at TD Securities noted: "We look for the BoC to pause at 2.75% in April as it waits for more clarity around tariff impacts before easing further. Governor Macklem hinted the Bank would be less forward-looking in his March 20th speech, and with the economy showing more strength over January/February, that should be enough for a move back to the sidelines. Look for a cautious tone to the policy statement with more emphasis on tariff risks as the Bank reaffirms its commitment to price stability.”

When will the BoC release its monetary policy decision and how could it affect USD/CAD?

The Bank of Canada is scheduled to reveal its policy decision on Wednesday at 13:45 GMT, followed by Governor Tiff Macklem’s press conference at 14:30 GMT.

Although major surprises are not anticipated, market watchers believe the central bank's message will continue to focus on the implications of US tariffs for the Canadian economy—a sentiment that could also influence currency movements.

Senior Analyst Pablo Piovano from FXStreet highlighted that “USD/CAD has recently broken below its key 200-day Simple Moving Average (SMA) at 1.3995, which could open the taps for extra weakness in the short-term horizon”.

“If the Canadian Dollar extends its recovery, USD/CAD is likely to revisit its 2025 floor at 1.3838 (April 11), closely followed by the November 2024 trough at 1.3817, and ahead of the September 2024 low at 1.3418 (September 25)”, Piovano added.

Piovano notes that “on the upside, the pair should encounter initial resistance at its April peak at 1.4414 (April 1), prior to the March top at 1.4542 (March 4). The breakout of the latter could put a potential test of the 2025 high of 1.4792 (February 3) back on the radar”.

“Currently, spot is trading in oversold conditions as per the Relative Strength Index (RSI), thus, a technical bounce should not be ruled out. However, the ongoing bearish trend could gather extra strength as well, as suggested by the Average Directional Index (ADX) near the 25 level”, Piovano concludes.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.