Weekly Report: MT5 Surpasses MT4 in Trading Volume; IC Markets Pursues UAE License and More

MT5 overtakes MT4

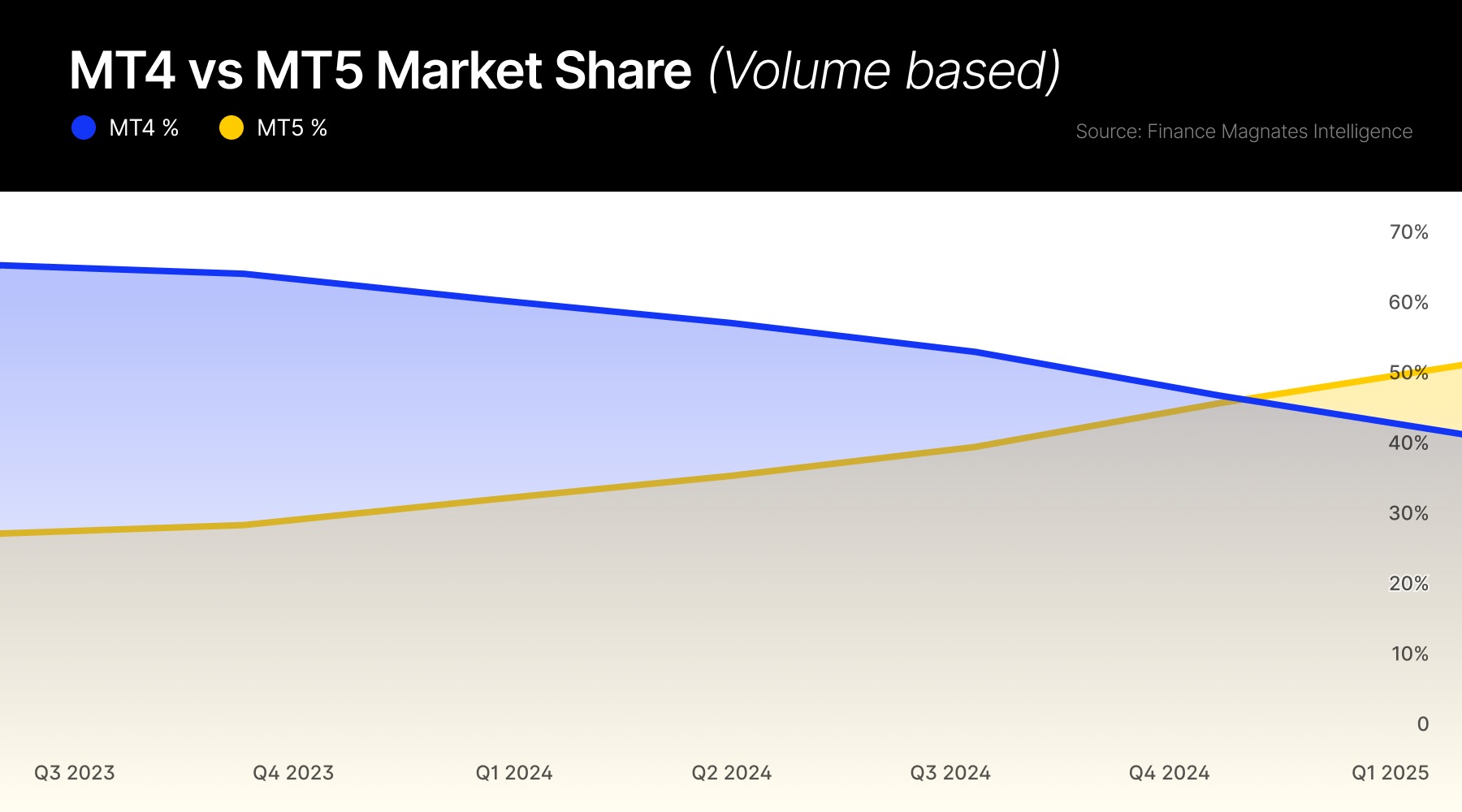

We begin this week’s roundup with a look at our latest report comparing MetaQuotes’ trading platforms, MT4 and MT5, where MT5 has now overtaken MT4 in trading volume.

According to our latest data from the upcoming Finance Magnates' Q1 Intelligence Report, MT5 accounted for 54.2% of the total combined trading volume between MT4 and MT5, while MT4 held a 45.8% share.

Technological upgrades, evolving regulatory standards, and a growing demand for more diverse trading instruments have all fueled its rise.

IC Markets eyes the UAE

Meanwhile, the race to expand into the fast-growing Middle East market is not about to stop. Australia-headquartered broker IC Markets is now considering strengthening its presence in the region by obtaining a licence in the United Arab Emirates.

A report shared with financeMagnates.com revealed that the broker has appointed Jason Hughes as its General Manager for the Middle East. Hughes has previously worked with several brokerage firms, including eToro, Exinity, ADSS, and CMC Markets.

eToro brings Hong Kong stock exchange-listed securities

Israel-based fintech giant eToro is also expanding its offering. The company announced this week that it will add all securities listed on the Hong Kong Stock Exchange (HKEX) to its platform in a phased rollout, expanding investor access to Chinese and Asian markets.

The addition will include all HKEX-listed stocks and exchange-traded products (ETPs), including exchange-traded funds (ETFs) and leveraged and inverse products. Users will also benefit from real-time pricing data provided directly by HKEX.

"By expanding our offering to include more companies listed on HKEX – one of the world's top ten stock exchanges by market capitalization – we are further strengthening our commitment to making global markets accessible to everyone," said Yossi Brandes, VP of Execution Services at eToro.

XTB share buyback program

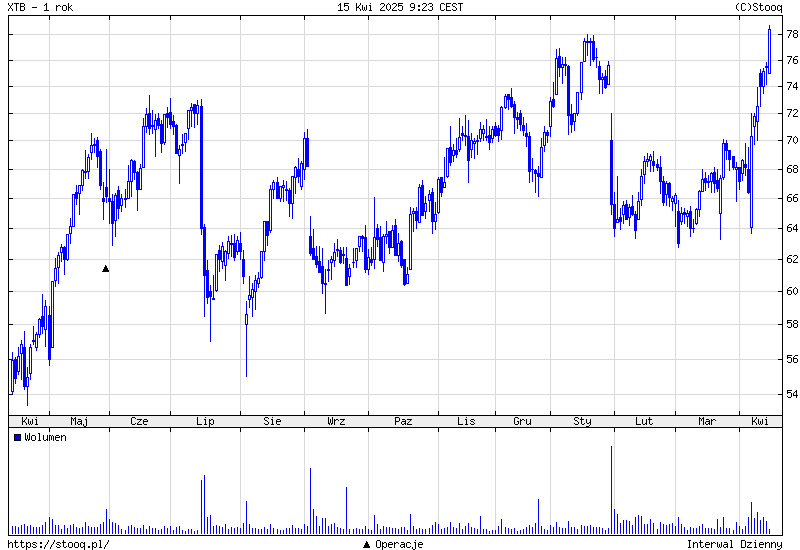

The Polish-based fintech broker XTB (WSE: XTB) is among the few stocks defying the market volatility caused by Trump tariffs, thanks to a share buyback program.

The company's shares jumped to an all-time high on Tuesday, rising more than 4% as investors responded positively to the company's 10 million zlotys share buyback program launched this week.

The Poland-based fintech broker saw its stock price reach 78.74 PLN during morning trading on the Warsaw Stock Exchange (WSE: XTB), surpassing its previous record of 78 PLN set in January.

Also posting positive financial performance, Hantec Markets Limited, the UK subsidiary of the global forex and CFD broker, returned to profitability for the financial year that ended on 31 December 2024. The company posted a profit of £72K for the year, compared to a loss of £55K in 2023.

Forex and CFD trading in Poland

The latest data shows rising numbers in the forex trading industry globally. For instance, the number of active Forex traders in Poland increased by 40% last year alone, reaching nearly 117,000 participants.

The number jumped from approximately 83,000 in 2023 to 116,903 in 2024, amid a growing interest in trading despite the well-documented risks.

Miles away, the U.S. retail forex brokers held approximately $527 million in client obligations as of February 2025, according to the Commodity Futures Trading Commission (CFTC) report. The figures represent a 2.9% month-over-month increase from January, when total client funds stood at approximately $512 million.

StoneX buys R.J. O'Brien

Away from the industry outlook, StoneX Group announced plans to acquire R.J. O’Brien & Associates, a US futures brokerage firm. The deal, valued at an estimated $900 million in equity, is expected to close later this year.

StoneX to Acquire @rjobrien, Creating a Global Derivatives Leader

— StoneX Group Inc. (@StoneX_Official) April 14, 2025

Read our full press release: https://t.co/EF6IYQXoAT pic.twitter.com/m8JL4v0WoP

According to the company’s report, under the agreement, R.J. O’Brien’s global operations will be merged into StoneX. The combined business is expected to be a substantial futures commission merchant in the US, with RJO's client accounts currently at 75,000.

FundedNext re-enters US

And after last year's prop trading turmoil involving MetQuotes, some companies are making a comeback. FundedNext, a prop trading firm launched in 2022, has started a new futures prop trading brand available globally, including the US.

However, the company clarified that its legacy CFDs-based prop products will remain unavailable to US clients. FundedNext initially offered its original prop trading services to US residents, but withdrew following the crackdown on MetaQuotes in February 2024.

In our recent analysis, we looked at why prop firms are challenging CFD brokers and whether there will be a takeover or coexistence. One of the interesting questions raised by this acceleration in prop trading revenues is its effect on CFD brokers.

Charles Finkelstein, CEO and founder of Upside Funding, says his firm’s analysis suggests the number of challenges sold is rising by around 30% per annum. “An argument a trader may make when deciding between the two options is that prop firms have rules and CFD brokers do not, which is completely valid,” he says.

Nvidia takes $5.5B tariff hit

As the global market reels from the consequences of Trump's recent tariffs, losses are starting to emerge. Nvidia faces a $5.5 billion hit from the tariffs, which will affect its Nvidia H20 rollout in China.

Inventory was reportedly intended for China, especially the Nvidia H20 chips, which were hyped as the company's bespoke workaround to U.S. export restrictions, has been affected by the new policies.

Crypto Mantra (OM) drops 90%

Mantra’s OM crypto token, a cryptocurrency native to its namesake blockchain supporting real-world asset (RWA) tokenization, plunged. with centralized exchanges and suspected insider dumpers in the spotlight, the token lost over 90% of its value in the shortest time.

Sherpas, OMies, and broader crypto community,

— JP Mullin (🕉, 🏘️) (@jp_mullin888) April 13, 2025

First off, the team and I greatly appreciate the support that we have received over the past several hours, which we believe is a testament to the strong support MANTRA has among its investors and community.

We have determined that…

Just one day after a devastating crash wiped out billions in value, the OM token staged a dramatic rebound, surging nearly 50%. In response to mounting accusations and comparisons with the collapsed Terra LUNA, Mantra co-founder JP Mullin had to issue a statement assuring investors that the project remained operational.