HSBC Faces Double Trouble: Money Laundering Probe Meets Profit Plunge

HSBC's Swiss private banking division is under investigation by law enforcement in Switzerland and France over suspected money laundering activities, the British banking giant disclosed Wednesday alongside its quarterly earnings that fell short of analyst expectations.

HSBC Swiss Unit Faces Money Laundering Probe by Two Countries

The probe centers on what HSBC describes as “two historical banking relationships” that caught the attention of authorities. While the bank said the investigations remain in early stages, it cautioned that any eventual penalties or sanctions could pack a serious financial punch.

HSBC didn't sugarcoat the potential consequences. The bank told investors it's “not practicable” to predict how this will play out, but warned the impact “could be significant.” That kind of language typically signals lawyers are preparing for substantial costs down the road.

Q2 Results Miss as Buyback Softens Blow

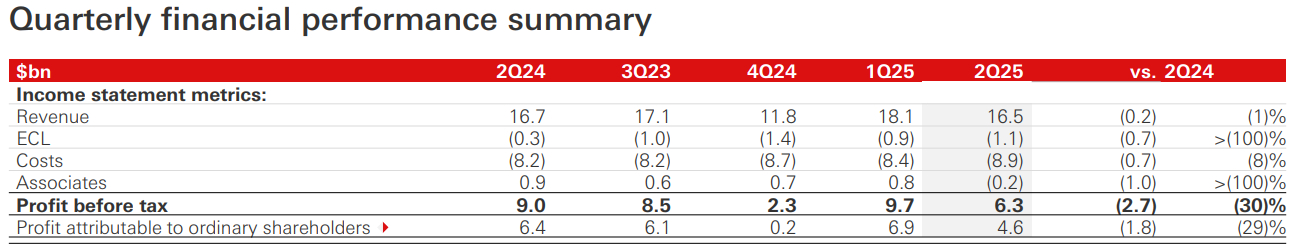

The money laundering disclosure came as HSBC delivered mixed second-quarter results that fell short of analyst expectations. Europe's largest bank reported profit before tax of $6.3 billion for the three months ending June, down 29% from the same period last year and missing the consensus estimate of $6.99 billion.

Revenue also disappointed, coming in at $16.5 billion against expectations of $16.67 billion. The shortfall stemmed partly from impairment charges related to a Chinese bank and lost income from businesses the lender sold off in the first half of 2024.

To cushion the disappointment, HSBC announced a $3 billion share buyback program, though it wasn't enough to prevent Hong Kong-listed shares from sliding 3.82% at the close. Operating expenses jumped 10% year-over-year, driven by restructuring costs and increased technology investments.

CEO Georges Elhedery acknowledged the challenging environment, pointing to “structural challenges” facing the global economy. He specifically called out broad-based tariffs and fiscal vulnerabilities as sources of uncertainty that are complicating inflation and interest rate outlooks.

“Even before tariffs take effect, trade disruptions are reshaping the economic landscape,” Elhedery said. The bank warned that while direct tariff impacts on revenue should be modest, broader macroeconomic deterioration could push its return on tangible equity below its mid-teens target range.

Regulatory Heat Already Building

This isn't HSBC's first rodeo with Swiss money laundering concerns. Last year, Switzerland's financial watchdog FINMA delivered a stinging rebuke of the bank's compliance practices.

The regulator found HSBC's private bank had botched basic due diligence on high-risk accounts belonging to politically exposed persons—essentially politicians, government officials, and their associates who pose higher corruption risks. The violations involved more than $300 million in transactions spanning 2002 to 2015.

FINMA didn't pull punches in its assessment. The regulator said HSBC “failed to carry out an adequate check of either the origins, purpose or background of the assets involved” and couldn't properly document transactions to prove they were legitimate.

The Swiss penalty came with strings attached. HSBC had to conduct a comprehensive review of its anti-money laundering systems and freeze new business with politically exposed clients until the cleanup was complete.

Related: HSBC Australia Faces ASIC Lawsuit over Alleged $23 Million Scam Losses

Broader Industry Scrutiny

HSBC's troubles reflect a wider crackdown on financial crime compliance across the banking sector. UK regulators alone have imposed over £250 million in anti-money laundering fines since early 2024, with compliance experts expecting the penalty parade to continue.

Recent research suggests the problems run deep. A survey of UK bank compliance officers found that 82% admit they don't always properly verify new individual customers, while only 6% run daily checks on existing clients.

The investigation puts fresh pressure on HSBC as it tries to rebuild its reputation following years of regulatory troubles. The bank has faced repeated sanctions and fines across multiple jurisdictions for compliance failures, making this latest probe particularly unwelcome news for management and shareholders.