Trade Nation Revenue Jumps to £21.7M in 2024, Ends Year in Profit

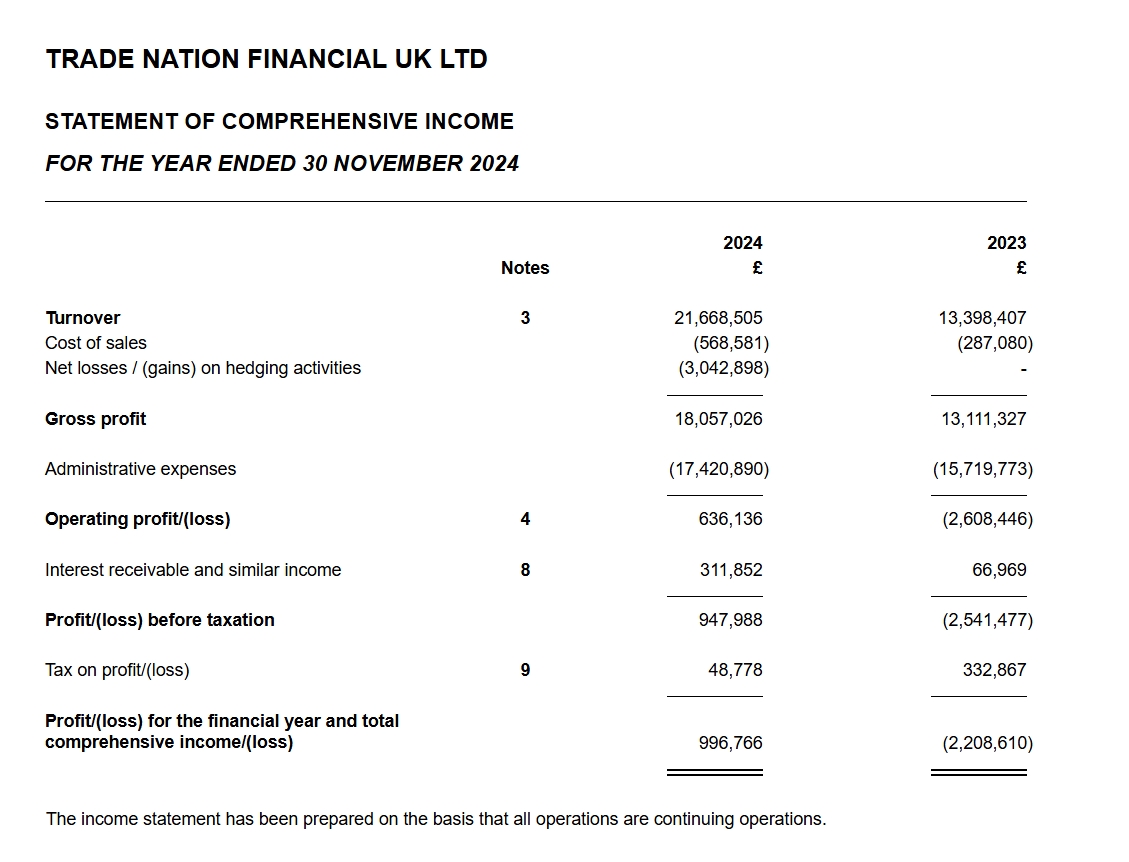

Trade Nation, a provider of spread betting and contracts for difference, has reported a return to profitability in its UK operations. The firm posted a net profit of £996,766 for the financial year ending 30 November 2024. This marks a sharp contrast to the previous year’s net loss of £2.2 million.

Revenue and Profitability Improve

The company’s revenue increased to £21.7 million in 2024, up from £13.4 million the year before. Gross profit also rose to £18.1 million, despite sales and hedging-related costs. In comparison, gross profit in 2023 stood at £13.1 million.

Operating profit came in at £636,136, a notable improvement from the operating loss of £2.6 million recorded in the previous year. The tax charge fell to £48,778 from £332,867 in 2023, contributing further to the improved bottom line.

You may find it interesting at FinanceMagnates.com: Trade Nation Caps Off 2022 with 300% Profit Growth in the UK.

Key Factors Behind the Results

Several factors contributed to the financial turnaround. Administrative expenses were kept in check, allowing the company to benefit from the higher revenue base. Interest income also rose sharply, reaching £311,852—more than four times higher than the previous year’s figure. Additionally, the absence of hedging losses, which had totalled £3 million in 2023, helped boost the results.

In its filing, the company stated: “The company’s ultimate shareholder continues to support and invest globally in the Trade Nation client experience, delivering bespoke content and high levels of service. The group continues to review the number of regulatory licences and intends to further extend its global coverage, expanding opportunities for increased marketing, customer acquisition and higher revenues. The company’s results post year end have been favourable to budget, with the Directors’ continued focus on achieving the financial objectives.”