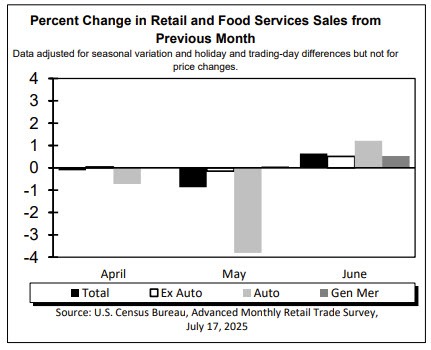

US retail sales for June 0.6% versus 0.1% estimate

- Prior month -0.9%

- Retail sales for June 0.6% versus 0.1% estimate

- Retail sales ex autos 0.5% vs 0.3% estimate. Prior month revised to -0.2% from -0.3%.

- Retail sales ex gas/autos 0.6% vs -0.1% last month.Prior month revised to 0.0% from -0.1%

- Retail sales control group 0.5% versus 0.3% estimate. Prior month revised lower to 0.2% from 0.4%

- Retail sales YoY 3.5% vs 3.29% last month

The data is better than expected. The control group was better than expectations but the prior month was revised lower.

The control group in U.S. retail sales refers to a specific subset of retail categories that feeds directly into GDP calculations for consumer spending. Its significance lies in its role as a cleaner measure of core consumption trends, excluding volatile components.

Of note is that retail sales are not adjusted for inflation. As a result, looking at some of the components like clothing up 0.9%, furniture and for home furnishings up 0.7%, could be impacted by higher prices from tariffs. Of course electronics and points stores did decline, so there is some ambiguity with that idea.

A look at some of the components from the report.

🔹 June vs May 2025 – Top Gainers (Seasonally Adjusted)

| Category | June 2025 | May 2025 | Change |

|---|---|---|---|

| Nonstore retailers (e-commerce) | $122.813B | $121.316B | ▲ +1.2% |

| Building material & garden supply | $40.120B | $39.772B | ▲ +0.9% |

| Motor vehicle & parts dealers | $138.053B | $136.780B | ▲ +0.9% |

| Clothing & clothing accessories | $26.342B | $26.097B | ▲ +0.9% |

| General merchandise stores (total) | $77.250B | $76.746B | ▲ +0.7% |

| Furniture & home furnishings | $11.543B | $11.467B | ▲ +0.7% |

| Food & beverage stores | $84.322B | $83.856B | ▲ +0.6% |

🔻 Mild Declines

| Category | June 2025 | May 2025 | Change |

|---|---|---|---|

| Health & personal care | $38.843B | $39.033B | ▼ -0.5% |

| Electronics & appliance stores | $7.626B | $7.646B | ▼ -0.3% |

| Department stores (subset of GM) | $3.202B | $3.227B | ▼ -0.8% |

| Gasoline stations | $50.291B | $50.300B | Flat ▼ -0.02% |

🟢 Summary Takeaway

June retail sales rose +0.6% MoM, led by strong performances in e-commerce, autos, building materials, and clothing.

The control group (core retail) showed broad-based gains, suggesting solid momentum in GDP-related consumption.

Weakness was narrowly focused in health-related, electronics, and department store segments.