What are the main events for today?

In the European session, we have quite a few economic releases coming up including the Spanish Preliminary CPI, the German Flash Q2 GDP, the Italian Advance Q2 GDP and the Eurozone Flash Q2 GDP. None of them is likely to change anything for the ECB at this point as they continue to wait for more data and are already starting to mention that they will need strong reasons to cut rates further.

The ECB is likely done with its easing cycle already and if the data continues to improve in the next months, we might even see rate hikes in 2026 (barring an exogenous negative shock).

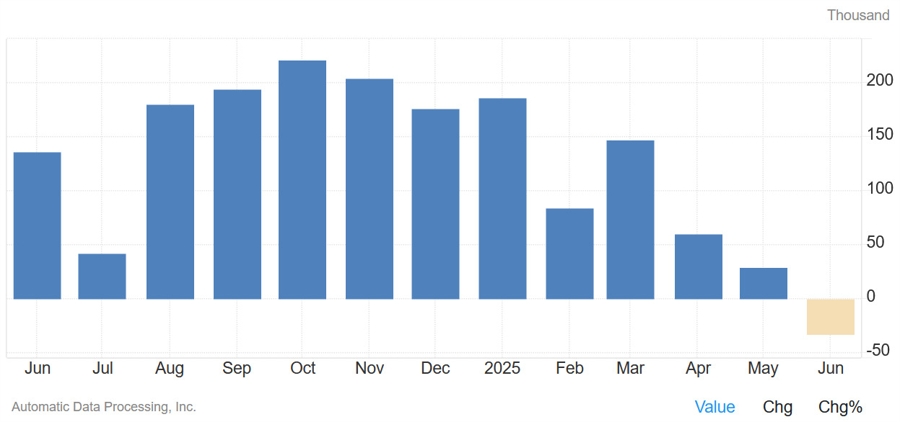

In the American session, in terms of data releases we have the US ADP and the US Q2 Advance GDP coming up. The US ADP is expected at 75K vs -33K last month. The surprising negative print last month triggered some dovish repricing in rates expectations. The US NFP, of course, came out better than expected the day after. The ADP continues to be a market moving release but it's also a poor labour market indicator. Jobless Claims are fine and the NFP will likely be fine too this Friday. It's how much good it's going to be that is the question in my opinion.

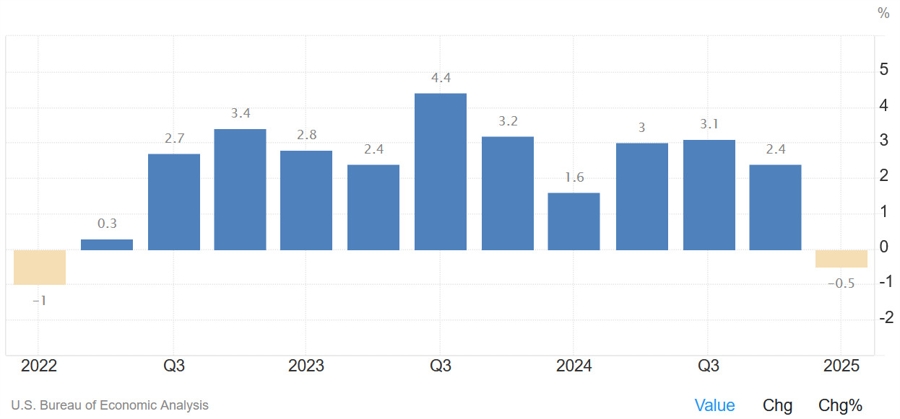

The US Q2 GDP is expected at 2.4% vs -0.5% prior. GDP is a very lagging indicator and the market almost always disregards it because it's already focusing on the next 2-4 quarters. Today might be even more so given that we have the FOMC decision coming a few hours later.

The Bank of Canada is widely expected to keep interest rates unchanged and maintain a neutral stance. The data out of Canada has been good with the employment report surprising to the upside and the underlying inflation figures staying close to the upper bound of their 1-3% target range. The market is pricing just 16 bps of easing by year-end, so another rate cut is still basically a 50/50 chance.

The FOMC is widely expected to keep interest rates unchanged and maintain its neutral stance. We will most likely have one or two dissents coming from Waller and Bowman. Fed Chair Powell might say that they could be in a position to cut rates in September but it will depend on the employment and inflation data. The market is pricing a 67% chance of a cut in September and 95% chance of another cut in December.